FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hello question is attached, thanks.

Transcribed Image Text:**Maglie Company Cost Allocation Analysis**

Maglie Company manufactures two types of video game consoles: handheld and home. The handheld consoles are smaller and more affordable than the home consoles. The company recently started producing the home model, and since then, profits have been declining. Management suspects that the current accounting system does not accurately allocate costs to products, especially as sales of the new home consoles rise.

Management has tasked you with investigating the cost allocation issue. Overhead is currently assigned to products based on their direct labor costs. Data from last year show that manufacturing overhead was $1,440,000 for the production of 28,000 handheld consoles and 10,000 home consoles. Direct labor and materials costs were as follows:

| | Handheld | Home | Total |

|---------------|---------------|---------------|---------------|

| Direct labor | $1,160,400 | $439,600 | $1,600,000 |

| Materials | $750,000 | $684,000 | $1,434,000 |

Management has identified three cost drivers for overhead costs. These drivers and associated costs for last year are detailed below:

| Cost Driver | Costs Assigned | Activity Level |

|---------------------------|----------------|-----------------------------|

| | | Handheld | Home | Total |

| Number of production runs | $660,000 | 40 | 10 | 50 |

| Quality tests performed | 594,000 | 12 | 18 | 30 |

| Shipping orders processed | 186,000 | 100 | 50 | 150 |

| **Total overhead** | **$1,440,000** | | | |

This information will assist in evaluating the discrepancies in cost allocation between the two product lines and help optimize financial strategies for improved profitability.

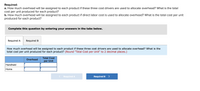

Transcribed Image Text:**Cost Allocation Exercise**

**Objective:**

Determine the overhead assigned to each product using different allocation methods and calculate the total cost per unit.

**Required:**

a. How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total cost per unit produced for each product?

b. How much overhead will be assigned to each product if direct labor cost is used to allocate overhead? What is the total cost per unit produced for each product?

**Instructions:**

Complete the questions by entering your answers in the tabs below.

**Tabs:**

- Required A

- Required B

**Table: Overhead and Total Cost Per Unit**

- Two products are listed: Handheld and Home.

- Required information: Overhead and Total Cost per Unit for each product.

**Guidance:**

For the calculations, make sure to round the "Total Cost per Unit" to 2 decimal places as specified.

Use the tab navigation to complete each part of the exercise.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education