Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Plz solve within 30min I vill give definitely upvote and vill give positive feedback thank you sir plz solve

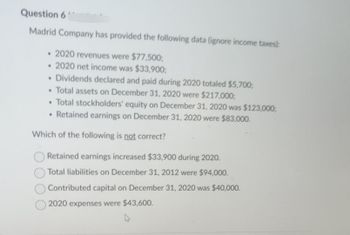

Transcribed Image Text:Question 6

Madrid Company has provided the following data (ignore income taxes):

• 2020 revenues were $77,500;

• 2020 net income was $33,900;

• Dividends declared and paid during 2020 totaled $5,700,

• Total assets on December 31, 2020 were $217,000,

• Total stockholders' equity on December 31, 2020 was $123,000;

• Retained earnings on December 31, 2020 were $83,000.

Which of the following is not correct?

Retained earnings increased $33,900 during 2020.

Total liabilities on December 31, 2012 were $94,000.

Contributed capital on December 31, 2020 was $40,000.

2020 expenses were $43,600.

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- ted with McGraw-Hill CoX O Question 2 - chapter 16- proble X ezto.mheducation.com/ext/map/index.html?_con3Dcon&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-grou chapter 16 - problems i Saved Help Save & Exit Su 2 Lazare Corporation expects an EBIT of $30,800 every year forever. Lazare currently has no debt, and its cost of equity is 14%. The firm can borrow at 9%. (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) a. If the corporate tax rate is 35%, what is the value of the firm? Value of the firm b. What will the value be if the company converts to 50% debt? Value of the firm c. What will the value be if the company converts to 100% debt? Value of the firm Next > %24 %24 %24arrow_forwardAutoSave Off File Home Module ThreeProblem Set Question3 ⚫ Saved to this PC Search Insert Page Layout Formulas Data Review View Automate Help ✗Cut Calibri 12 Α' Α' ab Wrap Text Text Copy ▾ Paste B I U ~A~ Merge & Center $ % 9 +0.00 Format Painter Clipboard √☑ Font Б Alignment √☑ Number Г A1 A B C D E F G H Accent3 Accent4 Accent5 Conditional Format as Formatting Accent6 Comma Comma [0] Table ▾ Styles Katherine Apuzzo KA Comments Share ☐☐ > AutoSum ✓ ĄT பப Fill Insert Delete Format Sort & Find & Add-ins > Clear Filter Select Cells Editing Analyze Data Add-ins J K L M N о P Q R S T U V W X Y ✓ ✓ ✓ fx Function: MAX; Formulas: Subtract; Divide; Cell Referencing 1 Function: MAX; Formulas: Subtract; Divide; Cell Referencing 2 3 BE5.7 - Using Excel to Determine Profitability Given a Constrained Reso 4 PROBLEM 5 Rachel wants to use her knitting skills to make a little extra money so she 6 can enjoy a theatre weekend with her besties. She's got the pattern down 7 for a hat, scarf, and mittens,…arrow_forwardMy Drive - Google Drive X 4 My Drive - Google Drive Front Desk Operations 2020 - Go X + ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress%3Dfalse Tp Netflix 0z TVCC Email P My Math Lab Log In to Canvas X Mathway | Calculus.. N Netflix Cengage Login * Login Readin- Darby Company, operating at full capacity, sold 114,800 units at a price of $108 per unit during the current year. Its income statement is as follows: Sales $12,398,400 Cost of goods sold 4,392,000 Gross profit $8,006,400 Expenses: Selling expenses $2,196,000 Administrative expenses 1,332,000 Total expenses 3,528,000 Income from operations $4,478,400 The division of costs between variable and fixed is as follows: Variable Fixed Cost of goods sold 60% 40% Selling expenses 50% 50% Administrative 30% 70% expenses Management is considering a plant expansion program for the following year that will permit an increase of $972,000 in yearly sales. The expansion will increase fixed costs by…arrow_forward

- MindTap - Cengage Learning CengageNOWv2 | Online teachin x 9 Cengage Learning b Answered: CengageNOWv2| Onli x i v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Ch 13-2 Practice Exercises E Calculator eBook Show Me How Print Item Reporting Stockholders' Equity Using the following accounts and balances, prepare the Stockholders' Equity section of the balance sheet using Method 1 of Exhibit 8. 50,000 shares of common stock authorized, and 2,000 shares have been reacquired. Common Stock, $80 par $3,200,000 Paid-In Capital from Sale of Treasury Stock 64,000 Paid-In Capital in Excess of Par-Common Stock 440,000 Retained Earnings 1,728,000 Treasury Stock 42,000 Stockholders' Equity Paid-In Capital: Common Stock, $80 Par 3,200,000 Excess over par 440,000 Treasury Stock From Sale of Treasury Stock 64,000 Total Paid-in Capital $ 3,704,000 Retained Earnings Total Treasury Stock Total Stockholders' Equity Check My Work 2 more…arrow_forwardI Session 6 L Dashboard x Question 9 X G What is the X Login | bar x M (Alen A ezto.mheducation.com/ext/map/index.html?_con%3con&external_browser%3D0&launchUrl=https%253A%2521 - Z. M MKT 100 (Section 2. H QuickLaunchSSO : Homework Saved Asset W has an expected return of 13.6 percent and a beta of 1.37. If the risk-free rate is 4.62 percent, complete the following table for portfolios of Asset W and a risk-free asset. (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Enter your portfolio expected return answers as a percent rounded to 2 decimal places, e.g.., 32.16. Enter your portfolio beta answers rounded to 3 decimal places, e.g., 32.161.) Portfolio Expected Percentage of Portfolio in Asset W Portfolio Beta Return 0 % % 25 % 50 75 % 100 % 125 % 150 % ......Tarrow_forwardQuestion 3arrow_forward

- AutoSave C. Home Insert Draw Page Layout Formulas Data Review X Times New Roman v 10 A A == Paste B I U v V A > Chapter 15 Build A Model.xlsx Automate General $%9 Read-Only Tell me Conditional Formatting Insert v Format as Table Delete v 00 20 .00 <-→0 Editing Cell Styles v Format View B C D E F G H I 0% 10% 20% 30% 40% 50% 60% 70% 80% 175 65 Xvfx A 66 67 68 69 Additional: using the (hypothetical) free cash flow stream below, calcuate and graph the NPVs (y-axis) against the various 70 Debt/Value Ratios (x-axis) in the space below (similar to Figure 15-8): 71 72 Time 73 FCF 74 0 1 2 3 4 5 -1200500 200000 350000 425000 350000 265000 Debt/Value WACC (from NPV (aka 75 Ratio above table) Firm Value) 76 0% 8.900% 77 10% 8.640% 78 20% 8.488% 79 30% 8.462% 80 40% 8.796% 81 50% 9.520% 82 60% 10.724% 83 70% 12.078% 84 85 86 $1.20 Build a Model + Ready Accessibility: Investigate MAY 6 44 Warrow_forwardsf Your session h X sf Career Opport x x - ( xoqui Birdledon Writi x O Brussels Alrline x myAU Portal N X Fall 2021 Seme X to.mheducation.com/ext/map/index.html?_con%3Dcon&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252F... seno TV erviews (Chapter 8) i Saved Help Save & Exit Which of the following service auditor reports provide evidence about the operating effectiveness of controls? Multiple Choice Type 1 report. Type 2 report. Comprehensive report. IT report. Next %24 < Prev 6. 9 jo Finacial Accounting... Finacial Account....pdf Finacial Account...pdf Finacial Account..pdf MacBook Airarrow_forward4Homework: Project Analysis As X 9 Question 2 - Homework: Projec X %3D heducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252F... O * O Project Analysis Assignment i 1 Saved Help Save & Exit Submit Check my work A project currently generates sales of $18 million, variable costs equal 60% of sales, and fixed costs are $3.6 million. The firm's tax rate is 35%. Assume all sales and expenses are cash items. a. What are the effects on cash flow, if sales increase from $18 million to $19.8 million? (Input the amount as positive value. Enter your answer in dollars not in millions.) Cash flow increases by $ 47,000 b. What are the effects on cash flow, if variable costs increase to 70% of sales? (Input the amount as positive value. Enter your answer in dollars not in millions.) decreases | by s 2$ 117,000 Cash flowarrow_forward

- al Acco X M Question 4 - Comprehensive Pr + heducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252F ve Problem 5 i Saved Required information [The following information applies to the questions displayed below.] Jasper Company, a machine tooling firm, has several plants. One plant, located in Saint Cloud, Minnesota, uses a job order costing system for its batch production processes. The Saint Cloud plant has two departments through which most jobs pass. Plantwide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $250,000. During the past year, actual plantwide overhead was $242,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the Saint Cloud plant for the past year are as follows: Budgeted department overhead (excludes plantwide overhead) Actual…arrow_forwardACCTUZ Chapterz Miini Case Microsolt Word AaBbCcD AaBbCcD AaBbC AaBbCc AABI AaBbCcl AaBbCcD AaBbCcC IT Normal T No Spaci. Heading 1 Heading 2 Subtle Em... Title Subtitle Emphasis Styles Ehapter 22 Mini Case When math is required, to receive full credit- SHOW YOUR MATH, otherwise you will not receive credit (even if the answer is correct). You must submit your answer on a word document or spreadsheet. Hand written responses are not acceptable and will not receive credit. Submit on Blackboard, if submitted via email or another source you will not receive credit. If submitted late (after the due date and time) you will not receive credit. Sweet Suites, Inc. operates a hotel property that has 300 rooms. On average, 80% of Sweet Suites, Inc., rooms are occupied on weekday, and 40% are occupied during the weekend. The managerhas asked you to developa budget forthe housekeeping and restaurant staff forweekdays and weekends. You have determined that the housekeeping staff requires 30 minutes…arrow_forwardPlease solve max please in 15-22 minutes and no reject thank u. Im needed please no rejectarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education