FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

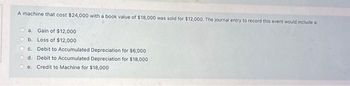

Transcribed Image Text:A machine that cost $24,000 with a book value of $18,000 was sold for $12,000. The journal entry to record this event would include a

a. Gain of $12,000

b. Loss of $12,000

c. Debit to Accumulated Depreciation for $6,000

d. Debit to Accumulated Depreciation for $18,000

e. Credit to Machine for $18,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 15. A company encountered $196,000 of depreciation on factory equipment. What is the journal entry to record this transaction? A. Dr. Depreciation expense B. Dr. MOH C. Dr. Depreciation expenses D. Dr. WIP $196,000 Cr. Accumulated depreciation Dr. Accumulated depreciation $196,000 $196,000 Dr. MOH $196,000 Cr. Accumulated depreciation $196,000 $196,000 $196,000 $196,000arrow_forwardNew Office Equipment List price: $60,000; terms: 2/10, n/30; paid within the discount period. Transportation-in: $1,500. Installation: $2,500. Cost to repair damage during unloading: $650. Routine maintenance cost after eight months: $350. determine the amount of cost to be capitalized in the asset account office equipment: ?arrow_forwardOriginal Cost POST. ... Accumulated Depreciation for Previous Years DATE DESCRIPTION REF. DEBIT CREDIT ... Book Value, Beginning Year 4 1 20xx ... Salvage Value 2 2. ... Revised Remaining Depreciation Cost 3 ... 4 Revised Useful Life 15 YEARS Revised Depreciation, Total Revised Depreciation, Per Year ...arrow_forward

- Recognizing $3,500 of actual manufacturing equipment depreciation is an asset __________ transaction.arrow_forwardMACRS Depreciation Rate Year 0 20.00% OA. $19,104 OB. $11,520 OC. $1,896 OD. $9,480 Year 1 32.00% Year 2 19.20% Year 3 Year 4 11.52% 11.52% Year 5 5.76% A bakery invests $40,000 in a light delivery truck. This was depreciated using the five-year MACRS schedule shown above. If the company sold it immediately after the end of year 2 for $21,000, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 20%?arrow_forwardTurp and Tyne Distillery sold a still with a cost of $19,000 and accumulated depreciation of $9,000 for $8,000 cash. This transaction would be reported as a........... a. An operating activity b. An investing activity c. A financial activity d. None of the abovearrow_forward

- Question Description The original cost of a machine was $60,000. After $45,000 of depreciation was recorded, the machine was traded in on a new machine of like purpose priced at $75,000. A $10,500 trade-in allowance was received on the old machine and the balance of $64,500 was paid in cash. Prepare the general journal entry to record this trade-in.arrow_forwardANSWER AND SHOW WORK IN EXCEL ATTACHED IS QUESTIONarrow_forwardSubject - account Please help mearrow_forward

- A 4 Estimated Residual: 5 Estimated Life in years: 6 Estimated Life in hours: 7 Actual Hours: 8 Year 1 Year 2 9 10 11 12 14 15 16 17 18 19 Year 3 Year 4 20 21 22 23 $ B 10,000 Year 1 2 Prepare the following Straight Line depreciation schedule by using the excel SLN FUNCTION (fx) to calculate the 13 Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. W|N 3 4 1200 4 360 270 350 220 с D SULLIVAN RANCH CORPORATION Depreciation Schedule-Straight Line Method End of year amounts Depreciation Expense E Accumulated Depreciation LL Book Value Farrow_forwardA company sold a machine that originally cost $250,000 for $120,000 when accumulated depreciation on the machine was $100,000. The gain or loss recorded on the sale of this machine is:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education