FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

am.500.

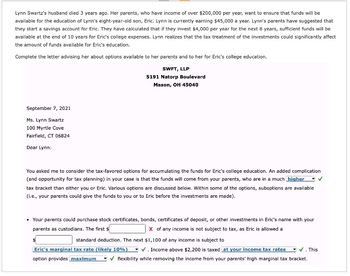

Transcribed Image Text:Lynn Swartz's husband died 3 years ago. Her parents, who have income of over $200,000 per year, want to ensure that funds will be

available for the education of Lynn's eight-year-old son, Eric. Lynn is currently earning $45,000 a year. Lynn's parents have suggested that

they start a savings account for Eric. They have calculated that if they invest $4,000 per year for the next 8 years, sufficient funds will be

available at the end of 10 years for Eric's college expenses. Lynn realizes that the tax treatment of the investments could significantly affect

the amount of funds available for Eric's education.

Complete the letter advising her about options available to her parents and to her for Eric's college education.

SWFT, LLP

5191 Natorp Boulevard

Mason, OH 45040

September 7, 2021

Ms. Lynn Swartz

100 Myrtle Cove

Fairfield, CT 06824

Dear Lynn:

You asked me to consider the tax-favored options for accumulating the funds for Eric's college education. An added complication

(and opportunity for tax planning) in your case is that the funds will come from your parents, who are in a much higher

tax bracket than either you or Eric. Various options are discussed below. Within some of the options, suboptions are available

(i.e., your parents could give the funds to you or to Eric before the investments are made).

• Your parents could purchase stock certificates, bonds, certificates of deposit, or other investments in Eric's name with your

parents as custodians. The first $

Xof any income is not subject to tax, as Eric is allowed a

standard deduction. The next $1,100 of any income is subject to

Eric's marginal tax rate (likely 10%)

option provides maximum

✓. Income above $2,200 is taxed at your income tax rates ✓ ✓. This

flexibility while removing the income from your parents' high marginal tax bracket.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- E10.15arrow_forwardHansen Corporation. a C Corporation (mot a manufacturer) reports the following items in income and expenses for 2021 Gross Revenue $900,000 Dividend Received from 30% owned Corp 200,000 LTCG 30,000 STCL 12000 City of Lee's Summit Bond Interest 10000 COGS 375000 Administrative Expenses 325000 Charitable Contribution 60,000 Compute Hansen's C Corp Taxable income?arrow_forward12-10arrow_forward

- The answer is 1,130.55arrow_forwardNow, assume that the state of the limit order book is as follows just before the call of CBA's opening call auction: Buy Quantity Price $8.08 $8.01 $7.99 $7.96 $7.91 $7.87 $7.84 $7.82 0 0 0 a. $7.96 O b. $8.01 O c. Other O d. $7.99 e. $7.91 1800 800 1100 1900 800 Sell Quantity 1600 1800 1200 0 0 0 0 If no more orders are entered, the call price would be:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education