Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

q 24 thank you

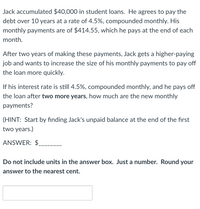

Transcribed Image Text:Jack accumulated $40,000 in student loans. He agrees to pay the

debt over 10 years at a rate of 4.5%, compounded monthly. His

monthly payments are of $414.55, which he pays at the end of each

month.

After two years of making these payments, Jack gets a higher-paying

job and wants to increase the size of his monthly payments to pay off

the loan more quickly.

If his interest rate is still 4.5%, compounded monthly, and he pays off

the loan after two more years, how much are the new monthly

payments?

(HINT: Start by finding Jack's unpaid balance at the end of the first

two years.)

ANSWER: $

Do not include units in the answer box. Just a number. Round your

answer to the nearest cent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Homework F21 Question 10 of 20 0/1 View Policies Show Attempt History Current Attempt in Progress X Net income will be understated when ending inventory is understated. Understating ending inventory will overstate O assets. O cost of goods sold. O net income. O owner's equity. eTextbook and Media Attempts: 1of 2 used Submit Answer Save for Later 回可可 % & 4 5 6 e C b n m !!!arrow_forwardLenci Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During May, the company budgeted for 5,100 units, but its actual level of activity was 5,050 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for May: Data used in budgeting: Revenue Direct labor Direct materials Manufacturing overhead Selling and administrative expenses Total expenses Actual results for May: Revenue Direct labor Direct materials Fixed element per month $0 $0 0 41,500 22,700 $ 64,200 $ 197,810 $ 28,565 $ 80,265 $ 47,905 $ 22,680 Manufacturing overhead Selling and administrative expenses The spending variance for manufacturing overhead in May would be closest to: Variable element per unit $ 39.60 $ 5.50 15.70 1.30 0.20 $ 22.70arrow_forwardMay 2024 บ M Tu W Th F 8 29 30 1 2 3 5 6 7 8 9 10 12 13 15 14 16 17 19 20 21 22 23 24 26 27 28 29 30 31 Su June 2024 M Tu W Th F Seth 6-3 1-2 2.3 Brendyn 9-6 34 mod 194 v lifiv T T F 7479 139 ..... Saturday, May 11 Friday, May 24 Saturday, May 25 Sunday, May 26 Monday, May 27arrow_forward

- UTF 8 Ch x Book 4 xisx Bb Signature E UTF-8Lece Connect p.mheducation.com/ext/map/indexhtml?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fperustatecollege.blackboard.com%252Fwebapps%252Fportal%2= Question 2 B Chapter 7E x 8 BUS 214 14 x Ques Chapters 7-9) 6 Saved Help Brian May, quitarist for Queen, does not know how to price his signature Antique Cherry Special that cost him £290 to make, He knows he wants 80% markup on cost. What price should Brian May ask for the guitar? Price aw -> %23 %24 4. 5 6. 2. 3. t y. e r karrow_forward1arrow_forwardNonearrow_forward

- x M Question 6-QUIZ- CH 18-C X Gran Project 6 education.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%252Fw... Saved Help Exercises 18-41 (Algo) Allocation of Central Costs; Profit Centers [LO 18-3] Woodland Hotels Incorporated operates four resorts in the heavily wooded areas of northern California. The resorts are named after the predominant trees at the resort: Pine Valley, Oak Glen, Mimosa, and Birch Glen. Woodland allocates its central office costs to each of the four resorts according to the annual revenue the resort generates. For the current year, the central office costs (000s omitted) were as follows: Front office personnel (desk, clerks, etc.) Administrative and executive salaries Interest on resort purchase Advertising Housekeeping Depreciation on reservations computer Room maintenance Carpet-cleaning contract Contract to repaint rooms $ 12,100 5,700 4,700 600 3,700 80 1,210 50 570 $ 28,710 Revenue (000s) Pine Valley $ 9,150…arrow_forwardUnit 1 question 16arrow_forwardPlz answer fast i give up vote without plagiarism pleasearrow_forward

- Multiple Choice $26.75 $12.80 $30.05 $24.50arrow_forwardLignin is a basic component of almost any plant that grows, so it is one of the most abundant organic compounds in the world. Almost anything derived from oil can be made out of lignin. The question is "can we do it cost-effectively and consistently?" A startup company has developed a process to derive plastics, carbon fiber and other advanced materials from lignin. The cash flow diagram for this process is shown below (in $ millions). If the company's hurdle rate (MARR) is 20% per year, is this a profitable undertaking? Click the icon to view the diagram for cash flows. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 20 per year. The present worth of the venture is $ million. (Round to two decimal places.)arrow_forward11 Determine the difference between the present value of a $10,000 twenty-year annuity earning 10% interest compounded annually versus a $10,000 twenty-year growing annuity earning 10% interest compounded annually and having a 3% annuity growth rate.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education