Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

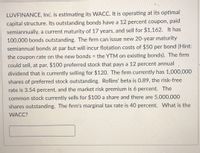

Transcribed Image Text:**LUVFINANCE, Inc. Weighted Average Cost of Capital (WACC) Estimation**

LUVFINANCE, Inc. is currently estimating its Weighted Average Cost of Capital (WACC) while operating at its optimal capital structure. Here are the details of its financial instruments:

1. **Bonds:**

- Coupon Rate: 12%, paid semiannually

- Current Maturity: 17 years

- Current Selling Price: $1,162

- Total Outstanding: 100,000 bonds

- New Bonds: Issuable at 20-year maturity with $50 flotation costs per bond. The coupon rate on new bonds equals the Yield to Maturity (YTM) of existing bonds.

2. **Preferred Stock:**

- Par Value: $100

- Annual Dividend: 12%

- Current Selling Price: $120

- Total Outstanding Shares: 1,000,000

3. **Common Stock:**

- Current Selling Price: $100 per share

- Total Outstanding Shares: 5,000,000

- Beta (β): 0.89

4. **Market Conditions:**

- Risk-Free Rate: 3.54%

- Market Risk Premium: 6%

5. **Tax:**

- Firm’s Marginal Tax Rate: 40%

**Objective:**

The task is to compute the Weighted Average Cost of Capital (WACC) of the company, considering the costs and proportions of each type of capital component mentioned above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A firm is planning on issuing new bonds and equity. The semiannual bonds will have a coupon rate 9% with a maturity of 15 years. The preferred stock pays a dividend of $6. The common stock's current dividend is $2.50 with a growth rate of 7%. The flotation costs on bonds is 5%, 7% on preferred stocks and 10% on common stock. The tax rate is 35%. The current price of the bonds is $975 while the price of the common stock is $53.50 and $55 for the preferred stock. If the growth rate falls to 6%, what is change in the cost of external equity? external equity falls by 8.5% external equity falls by 7% external equity falls by 6.5% external equity falls by 6%arrow_forwardLMN Co.'s bonds, issued 5 years ago, currently sell for $1,100. They have a 9.15% annual coupon rate and a 20-year maturity, a $1,000 par value, and are callable in 10 years at $1,085.00. Assume that no costs other than the call premium would be incurred to call and refund the bonds, and also assume that the yield curve is horizontal, with rates expected to remain at current levels in the future. Under these conditions, what rate of return should an investor expect to earn if he or she purchases these bonds, 5 years after the issue? 8.0861% 8.2277% 8.2251% 8.0915% 7.9829%arrow_forwardThe required rate on this company's debt has now risen to 16 percent. The firm has a bond issue outstanding with 24 years to maturity and a coupon rate of 9.8 percent, with interest being paid semiannually. What is the current yield?arrow_forward

- Harbor Inc. wants to raise $80 million by issuing 10-year zero-coupon bonds at an annual interest rate of 5.4%. What should be the total face value of the bonds (in $ million)?arrow_forwardPetmart recently hired Jim as a consultant to estimate the company’s WACC. Jim has obtained the following information. (1) The firm's noncallable bonds mature in 20 years, have an 8.00% annual coupon, a par value of $1,000, and a market price of $1,050.00. (2) The company’s tax rate is 40%. (3) The risk-free rate is 4.50%, the market risk premium is 5.50%, and the stock’s beta is 1.80. (4) The target capital structure consists of 45% debt and the balance is common equity. The firm uses CAPM to estimate the cost of common stock, and it does not expect to issue any new shares. What is its WACC?arrow_forwardLoran Chalices Inc. hired you as a consultant to estimate the company's WACC. You have obtained the following information. (1) The company's noncallable bonds mature in 20 years, have a coupon rate of 7.00% paid annually, a par value of $1,000, and a current market price of $875. (2) The company's tax rate is 25%. (3) The required rate of return on the company's common stock based on CAPM is 10.3%. (4) The target capital structure consists of 45% debt, with the remainder comprised of common equity. What is its WACC?arrow_forward

- Imagination Dragons Corporation needs to raise funds to finance a plant expansion, and it has decided to issue 20-year zero coupon bonds with a par value of $1,000 each to raise the money. The required return on the bonds will be 8 percent. Assume semiannual compounding periods. a. What will these bonds sell for at issuance? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Using the IRS amortization rule, what interest deduction can the company take on these bonds in the first year? In the last year? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Repeat part (b) using the straight-line method for the interest deduction. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. b. C. Issue price First year interest deduction Last year interest deduction Interest deduction $ $ 208.29 39.58arrow_forward(Cost of debt) Sincere Stationery Corporation needs to raise $500,000 to improve its manufacturing plant. It has decided to issue a $1,000 par value bond with an annual coupon rate of 10 percent with interest paid semiannually and a 10-year maturity. Investors require a rate of return of 9 percent. a. Compute the market value of the bonds. b. How many bonds will the firm have to issue to receive the needed funds? c. What is the firm's after-tax cost of debt if the firm's tax rate is 34 percent?arrow_forwardConsider the case of Badger Corp.: Badger Corp. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $1,220.35. However, Badger Corp. may call the bonds in eight years at a call price of $1,060. What are the YTM and the yield to call (YTC) on Badger Corp.'s bonds? YTM YTC Value If interest rates are expected to remain constant, what is the best estimate of the remaining life left for Badger Corp.'s bonds? 13 years 10 years 5 years 8 years If Badger Corp. issued new bonds today, the coupon rate must be for the bonds have to be issued at par.arrow_forward

- MLK Bank has an asset portfolio that consists of $150 million of 15-year. 7.5 percent annual coupon, $1,000 bands that sell at par e-1. What will be the bonds new prices if market yields change immediately by ± 010 percent? a-2. What will be the new prices if market yields change immediately by = 2.00 percent? b-1. The duration of these bonds is 9.4892 years. What are the predicted bond prices in each of the four cases using the duration rule? b-2. What is the amount of error between the duration prediction and the actual market values? Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B1 Required B2 The duration of these bonds is 9.4892 years. What are the predicted bond prices in each of the four cases using the duration rule? (Do not round intermediate calculations. Enter all answers as positive numbers. Round your answers to decimal places, (ep.32.16)) AL-A 10% AL-0.10% A-20% At-20N Bonds' New Price E 000.00 990 51arrow_forwardAccess Ltd is financing a new investment and was previously unsuccessful to secure a similar interest rate as they had with their previous debt from their local Bank. Given their AAA credit rating, they instead decided to issue 5000 units of a 10-year bond to fund the investment. Coupon rate is set at 8% per annum and will be paid quarterly. The face value of one of the bonds is $1,000. The estimated yield for similar bonds of comparable risk rating is 12% per annum. Determine the market price of the one of the bonds.arrow_forward(Cost of debt) Sincere Stationery Corporation needs to raise $500,000 to improve its manufacturing plant. It has decided to issue a $1,000 par value bond with an annual coupon rate of 14 percent and a maturity of 10 years. The investors require a rate of return of 9 percent. a. Compute the market value of the bonds b. What will the net price be if flotation costs are 10.5 percent of the market price? c. How many bonds will the firm have to issue to receive the needed funds? d. What is the firm's after-tax cost of debt if its average tax rate is 25 percent and its marginal tax rate is 21 percent? e. Rework the problem as follows: Assume a coupon rate of 8 percent. f. What effect does changing the coupon rate have on the firm's after-tax cost of capital? Why is there a change? GUD a. If the bond's annual coupon rate is 14%, what is the market value of the bond? (Round to the nearest cent.) b. What will the net price be if flotation costs are 10.5 percent of the market price? (Round to…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education