Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

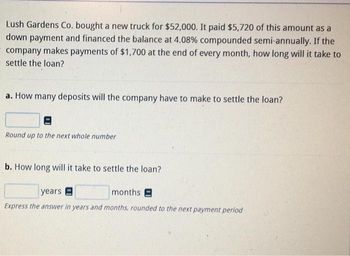

Transcribed Image Text:Lush Gardens Co. bought a new truck for $52,000. It paid $5,720 of this amount as a

down payment and financed the balance at 4.08% compounded semi-annually. If the

company makes payments of $1,700 at the end of every month, how long will it take to

settle the loan?

a. How many deposits will the company have to make to settle the loan?

Round up to the next whole number

b. How long will it take to settle the loan?

years

months E

Express the answer in years and months, rounded to the next payment period

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A manufacturer needs to borrow money to purchase a building. The purchase price of thebuilding is $1.5 million, and the company will put $300,000 in cash down at closing. If thecompany can borrow the difference from its bank at 4.85% for 20 years, what will the monthlyprincipal and interest payment of the loan be? Create an amortization schedule also. Solved in excelarrow_forwardSouth Penn Tracking is financing a new truck with a loan of $10,000 to be repaid in 5 annual end-of-year installments of $2,504.56. What annual interest rate is the company paying?arrow_forwardCompany A is contemplating on borrowing $500,000 to start a business. Credit union 1 has offered to loan the company the money at an interest rate of 14% compounded continuously. Credit union 2 has offered the money with the stipulation that the company repays it by making monthly payments of $120,000 for 5 years. From which credit union should the company borrow the money?arrow_forward

- An firm borrowed $159,000 to remodel their office. The load was to be paid back in equal monthly payments over 30 years at 5% interest, compounded monthly. After 7 years, the firm wants to pay off the loan. What is the remaining balance that must be paid off? Express your answer in $ to the nearest $1,000.arrow_forwardLush Gardens Co. bought a new truck for $56,000. It paid $6,160 of this amount as a down payment and financed the balance at 4.47% compounded semi-annually. If the company makes payments of $1,800 at the end of every month, how long will it take to settle the loan? Express the answer in years and months, rounded to the next payment period You plan to save money for a down payment of $32,000 to purchase an apartment. You can only afford to save $6,000 at the end of every 6 months into an account that earns interest at 5.50% compounded monthly. How long will it take you to save the planned amount? Express the answers in years and months, rounded to the next payment periodarrow_forwardComplete the problems below. 1. A company will need $40,000 in four years for a new addition. To meet the goal, the company will deposit money into an account paying 6% annual interest, compounded monthly. How much should the company deposit each month in order to be able to pay for the addition? Looking at a couple of scenarios to compare to the initial investment (above): a. Exactly 20 months after the company begins their investment (above), they receive a payment from a settled lawsuit of $2000 that they immediately deposit into the account. If they continue, uninterrupted, with their monthly deposits, will the company be able to afford to add a skylight to the addition if the change order (the amount added to the original cost of $40,000) is $3000? If yes, how much, if any would be left over? If no, how much more money will they need? b. Suppose that instead of depositing the money monthly for five years, they decide to finance the addition (the original $40,000) for four years at…arrow_forward

- Hazelnut just bought a new cracker. To pay for the cracker, the company took out a loan that requires Hazelnut to pay the bank a special payment of $8,162.00 in 5 months and also pay the bank regular payments. The first regular payment is expected to be $1,225.00 in 1 month and all subsequent regular payments are expected to increase by 0.20 percent per month forever. The interest rate on the loan is 0.73 percent per month. What was the price of the cracker? O $231,132.08 (plus or minus 3 dollars) O $239,002.58 (plus or minus 3 dollars) O $175,678.72 (plus or minus 3 dollars) O $1,540,000.00 (plus or minus 3 dollars) O none of the answers are within 3 dollars of the correct answerarrow_forwardc) Consider this question: XYZ Company can borrow money at an interest rate of 10% (that's their Cost of Capital). They have an opportunity to invest in a project that will generate returns (Free Cash Flows) over the next three years. One year from now, the project will generate $80,000 in FCF, two years from now the project will generate $90,000 in FCF, and three years from now the project will generate $100,000 in FCF. The project will require an investment of $230,000. Is it worth doing? Time 1 year from now 2 years from now 3 years from now Free Cash Flow $ $ Cost of Capital 10% 80,000 90,000 100,000arrow_forwardAn open loan of $17,000 was taken out today where payments (deposits) and withdrawals can be made freely with a loan rate of 2.8% compounded semi-annually. To reduce the balance of the loan, $1030 was paid 12 months from today, and $5730 was paid 16 months from today. What is the final outstanding balance of the loan 24 months from today (8 months after the last payment)? State your final answer in dollars ($) with two decimals.arrow_forward

- Lush Gardens Co. bought a new truck for $52,000. It paid $4,680 of this amount as a down payment and financed the balance at 3.98% compounded semi-annually. If the company makes payments of $2,000 at the end of every month, how long will it take to settle the loan? years months Express the answer in years and months, rounded to the next payment periodarrow_forwardCranes Limited took a loan of $ 450,000 at 4% compounded monthly from its bank to train its employees on new safety measures. If it made semi annual payments to amortize the loan in 4 years, construct the amortization table.arrow_forwardGeneral Computers Inc. purchased a computer server for $54,000. It paid 40.00% of the value as a down payment and received a loan for the balance at 4.50% compounded semi-annually. It made payments of $2,800.81 at the end of every quarter to settle the loan. a. How many payments are required to settle the loan? 0 payments Round up to the next payment b. Fill in the partial amortization schedule for the loan, rounding your answers to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education