FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Do not give answer in image

Transcribed Image Text:May 1

May 1

Investment by Luke

Investment by Lando

Investment by Leia

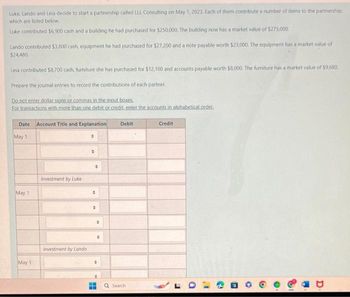

Transcribed Image Text:Luke, Lando and Leia decide to start a partnership called LLL Consulting on May 1, 2023. Each of them contribute a number of items to the partnership,

which are listed below.

Luke contributed $6,900 cash and a building he had purchased for $250,000. The building now has a market value of $275,000.

Lando contributed $3,800 cash, equipment he had purchased for $27.200 and a note payable worth $23,000. The equipment has a market value of

$24,480.

Leia contributed $8,700 cash, furniture she has purchased for $12,100 and accounts payable worth $8,000. The furniture has a market value of $9,680.

Prepare the journal entries to record the contributions of each partner.

Do not enter dollar signs or commas in the input boxes.

For transactions with more than one debit or credit, enter the accounts in alphabetical order.

Date Account Title and Explanation

May 1

May 1

May 11

Investment by Luke

Investment by Lando

→

·

•

:

•

•

0

Debit

Search

Credit

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rand Company produces dry fertilizer. At the beginning of the year, Rand had the following standard cost sheet: Direct materials (8 lbs. @ $1.25) $10.00 Direct labor (0.15 hr. @ $18.00) 2.70 Fixed overhead (0.20 hr. @ $3.00) 0.60 Variable overhead (0.20 hr. @ $1.70) 0.34 Standard cost per unit $13.64 Overhead rates are computed using practical volume, which is 49,000 units. The actual results for the year are as follows: Units produced: 53,000 Direct materials purchased: 408,000 pounds at $1.32 per pound Direct materials used: 406,800 pounds Direct labor: 10,500 hours at $17.95 per hour Fixed overhead: $36,570 Variable overhead: $18,000 MPV=28,560 UNFAV MUV=21,500 FAV LRV=525 FAV LEV=45,900 UNFAV FIXED SPENDING VARIANCE= 7,170 UNFAV FIXED VOLUME VARIANCE= 2,400 FAV VARIABLE SPENDING= 150 UNFAV VARIABLE EFFICIENCY= 4,335 UNFAV Prepare journal entries for the following: The purchase of direct materials The issuance…arrow_forwardHow can forwardrates be used for hedging purposes?arrow_forwardit is still incorrect, please find correct answerarrow_forward

- Hoover Corp., a wholesaler of music equipment, issued $11,200,000 of 20-year, 9% callable bonds on March 1, 20Y2, at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions. Refer to the Chart of Accounts for exact wording of account titles. 20Y2 Mar. 1 Issued the bonds for cash at their face amount. Sept. 1 Paid the interest on the bonds. 20Y4 Sept. 1 Called the bond issue at 102, the rate provided in the bond indenture. (Omit entry for payment of interest.)arrow_forwardPlease answer G part with explanation. Answer was incoorect in previous solutionarrow_forwarddid not fully awnser questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education