FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

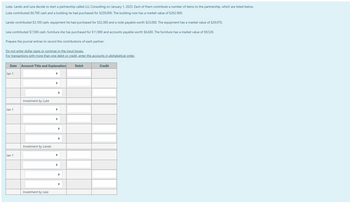

Transcribed Image Text:Luke, Lando and Leia decide to start a partnership called LLL Consulting on January 1, 2023. Each of them contribute a number of items to the partnership, which are listed below.

Luke contributed $6,700 cash and a building he had purchased for $239,000. The building now has a market value of $262,900.

Lando contributed $3,100 cash, equipment he had purchased for $32,300 and a note payable worth $23,000. The equipment has a market value of $29,070.

Leia contributed $7,500 cash, furniture she has purchased for $11,900 and accounts payable worth $6,600. The furniture has a market value of $9,520.

Prepare the journal entries to record the contributions of each partner.

Do not enter dollar signs or commas in the input boxes.

For transactions with more than one debit or credit, enter the accounts in alphabetical order.

Date Account Title and Explanation

Jan 1

Jan 1

Jan 1

Investment by Luke

Investment by Lando

Investment by Leia

+

♦

→

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Roberto and Sangeeta have been in partnership for many years sharing profits and losses in the ratio 3:2. They decide to dissolve the partnership on 31 August 2021. Their summarized statement of financial position at that date was as follows: The following information is also available: Furniture and equipment were sold for $690,000. Roberto took over one of the vehicles at an agreed value of $90,000; the other was sold for $120,000. The firm paid $148,000 in full settlement of accounts payable Inventory realized $210,000. Accounts receivable were settled after allowing a 10% discount Dissolution expenses amounted to $4,000 Required: Prepare the following accounts: a. Realization b. Bank c. Capital accounts d. State two reasons why a partnership might be disolvedarrow_forwardJennifer DeVine and Stanley Farrin decide to organize the ALL-Star partnership. DeVine invests $25,000 cash, and Farrin contributes $20,000 cash and equipment having a book value of $5,500. Prepare the entry to record Farrin’s and DeVine’s investment in the partnership, assuming the Ferrin’s equipment has a fair market value of $9,000arrow_forwardSue and Andrew form SA general partnership. Each person receives an equal interest in the newly created partnership. Sue contributes $16,000 of cash and land with an FMV of $61,000. Her basis in the land is $26,000. Andrew contributes equipment with an FMV of $18,000 and a building with an FMV of $39,000. His basis in the equipment is $14,000, and his basis in the building is $26,000. How much gain must the SA general partnership recognize on the transfer of these assets from Sue and Andrew?arrow_forward

- Shawna Kearn and Todd White are forming a partnership to develop a theme park near Bay City, Florida. Kearn contributes cash of $1,000,000 and land with a current market value of $13,500,000. When Kearn purchased the land in 2013, its cost was $7,500,000. The partnership will assume Kearn's $3,000,000 note payable on the land. White contributes cash of $3,000,000 and equipment with a current market value of Requirements 1. Journalize the partnership's receipt of assets and liabilities from Kearn and from White. 2. Compute the partnership's total assets, total liabilities, and total partners' equity immediately after organizing.arrow_forwardSteve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O’Donnell, a local merchant, to contribute the capital to form a partnership. On January 1, 2019, O’Donnell invests a building worth $74,000 and equipment valued at $44,000 as well as $32,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances. To entice O’Donnell to join this partnership, Reese draws up the following profit and loss agreement: O’Donnell will be credited annually with interest equal to 10 percent of the beginning capital balance for the year.O’Donnell will also have added to his capital account 10 percent of partnership income each year (without regard for the preceding interest figure) or $6,000, whichever is larger. All remaining income is credited to Reese.Neither partner is allowed to withdraw funds from the partnership during 2019.…arrow_forwardManjiarrow_forward

- Can you make a solution for these? The right answer for Rod and Sol is 420,000. Thanks!arrow_forwardDewwy, Screwum, and Howe are forming a partnership. Dewwy is transferring $93,000 of personal cash to the partnership. Screwum owns land worth $27,000 and a small building worth $205,000, which she transfers to the partnership. Howe transfers to the partnership cash of $19,000, accounts receivable of $47,700 and equipment worth $35,000. The partnership expects to collect $45,000 of the accounts receivable. Cash 93000 Dewwy Capital 93000 Equipment 27000 Building 205000 Screwum Capital 232000 Cash 19000 Accounts Recievable 47700 Equipment 35000 Doubtful 2700 Howe Capital 99000 What amount would be reported as total owners’ equity immediately after the investments? I would have expected $99,000 since this was agreed upon. What did I miss in the reading?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education