FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Lui, Montavo, and Johnson plan to liquidate their Premium Pool and Spa business. They have always shared

| Premium Pool and Spa Balance Sheet June 30, 2020 |

||||||

| Assets | ||||||

| Cash | $ | 84,250 | ||||

| Machinery | $ | 626,750 | ||||

| Less: |

156,000 | 470,750 | ||||

| Total assets | $ | 555,000 | ||||

| Liabilities | ||||||

| Accounts payable | $ | 159,600 | ||||

| Equity | ||||||

| Jim Lui | $ | 78,200 | ||||

| Kent Montavo, capital | 202,800 | |||||

| Dave Johnson, capital | 114,400 | |||||

| Total equity | 395,400 | |||||

| Total liabilities and equity | $ | 555,000 | ||||

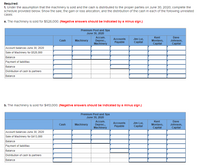

Transcribed Image Text:Requlred:

1. Under the assumption that the machinery is sold and the cash is distributed to the proper parties on June 30, 2020, complete the

schedule provided below. Show the sale, the gain or loss allocation, and the distribution of the cash in each of the following unrelated

cases:

a. The machinery is sold for $526,000. (Negatlve answers should be Indicated by a mlnus slgn.)

Premium Pool and Spa

June 30, 2020

Accum.

Deprec.,

Machinery

Kent

Dave

Jim Lui,

Сapital

Accounts

Cash

Machinery

Montavo,

Сapital

Johnson,

Capital

Payable

Account balances June 30, 2020

Sale of Machinery for $526,000

Balance

Payment of liabilities

Balance

Distribution of cash to partners

Balance

b. The machinery Is sold for $413,000. (Negative answers should be Indicated by a mlnus slgn.)

Premium Pool and Spa

June 30, 2020

Accum.

Kent

Dave

Accounts

Jim Lui,

Cash

Machinery

Deprec.,

Machinery

Montavo,

Capital

Johnson,

Сapital

Payable

Capital

Account balances June 30, 2020

Sale of Machinery for $413,000

Balance

Payment of liabilities

Balance

Distribution of cash to partners

Balance

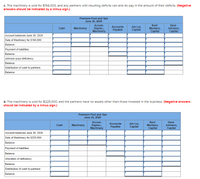

Transcribed Image Text:c. The machinery Is sold for $194,000, and any partners with resulting deficits can and do pay in the amount of their deficits. (Negatlve

answers should be Indicated by a minus sign.)

Premium Pool and Spa

June 30, 2020

Accum.

Kent

Dave

Accounts

Payable

Jim Lui,

Сaptal

Cash

Machinery

Deprec.,

Machinery

Montavo,

Сapital

Johnson,

Capital

Account balances June 30, 2020

Sale of Machinery for $194,000

Balance

Payment of liabilities

Balance

Johnson pays deficiency

Balance

Distribution of cash to partners

Balance

d. The machinery is sold for $225,000, and the partners have no assets other than those Invested In the business. (Negative answers

should be Indicated by a mlnus slgn.)

Premium Pool and Spa

June 30, 2020

Accum.

Accounts

Payable

Jim Lui,

Сapital

Kent

Montavo,

Capital

Dave

Johnson,

Cash

Machinery

Deprec.,

Machinery

Сapital

Account balances June 30, 2020

Sale of Machinery for $225,000

Balance

Payment of liabilities

Balance

Allocation of deficiency

Balance

Distribution of cash to partners

Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Amelia’s business goes bankrupt this year. To close her business, Amelia starts by selling off her business assets. Below are the asset disposition transactions: Assets Purchased Date Cost Sold date Sold price Delivery car 5/1/23 30k 12/31/23 25k Furniture 3/20/20 40k 12/31/23 20k Equipment 4/1/20 110k 12/31/23 100k Land 1/1/22 150k 12/31/23 180k Assume there is no Section 179 and bonus depreciation. Use MACRS only for depreciation. Show detailed calculation and explanation a) Calculate total accumulated depreciation of each asset until the sold date (12/31/23). b) Calculate the adjusted basis for each asset c) Calculate the gain/loss for each asset d) Point out the exact character of gain/loss for each asset gain/loss (ex: Ordinary, pure 1231, 1245, 1250, etc.) e) Calculate the Net 1231 Gain/Loss Hint: Be aware of 1245 Depreciation recapture and 1231 lookback rules Hint: Review textbook chapter on this. In the year of disposition, under half-year convention, only ½ of MACRS…arrow_forwardJag and rope Co., merged all the assets and liabilities. The company details as follows, Furniture OMR 40,000 & 50,000. Land OMR 60,000 & 40,000. Building OMR 100,000 & 50,000. Vechicle OMR 20,000 & 10,000 and Account payable OMR 40,000 & 60,000. How much value to get after the amalgamate. Select one: a. OMR 370,000 b. OMR 220,000 c. OMR 270,000 d. OMR 180,000arrow_forwardAarrow_forward

- need help please provide correct answerarrow_forwardJonathan has the following separate casualties during the year: Decrease in FairMarket Value AdjustedBasis InsuranceReimbursement HoldingPeriod Business furniture $4,000 $5,000 $ 0 3 years Business machinery 15,000 14,000 10,000 3 years The furniture was completely destroyed while the machinery was partially destroyed. Jonathan also sold business land for a Section 1231 gain of $10,000. Calculate the amount and nature of Jonathan's gains and losses as a result of these casualties. Amount of Gain or Loss Gain or Loss Business furniture $fill in the blank 1 Business machinery $fill in the blank 3 Since both result in a casualty , the losses are from Section 1231 treatment and are treated as losses.arrow_forwardOn August 1 of year 0, Dirksen purchased a machine for $23,750 to use in its business. On December 4 of year 0, Dirksen sold the machine for $21,500. Use MACRS Table. Note: Loss amounts should be indicated by a minus sign. Do not round percentages used for calculations. Round other intermediate computations to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable. b. Dirksen depreciated the machinery using MACRS (seven-year recovery period). What are the amount and character of the gain or loss Dirksen will recognize on the sale if the machine is sold on January 15 of year 1 instead?arrow_forward

- Charles Turner Construction Incorporated is a creditor of ABC Company. Turner constructed the office building in which ABC has its headquarters. At the time the building was constructed, Turner attached a lien on the building as security for the $80,000 note which Turner accepted. Now, ABC Company has filed for bankruptcy and it is estimated that the building has a net realizable value of $70,000. Turner’s status is: Fully Secured Partially Secured Unsecured A. Yes No Yes B. No No Yes C. No Yes No D. No Yes Yes E. Yes No Noarrow_forwardDynamo Manufacturing paid cash to acquire the assets of an existing company. Among the assets acquired were the following items.Patent with 4 remaining years of legal life $32,200Goodwill 43,700Dynamo’s financial condition just prior to the acquisition of these assets is shown in the following statements model.Balance Sheet Income StatementAssets= Liabilities +Stockholders’Equity Revenue − Expenses = Net IncomeStatementof CashCash Flows + Patent + Goodwill92,000 + NA + NA = NA + 92,000 NA − NA = NA NARequireda. Compute the annual amortization expense for these items.b. Show the acquisition of the intangible assets and the related amortization expense for Year 1 in a horizontal statements model.c. Prepare the journal entries to record the acquisition of the intangible assets and the related amortization for yeararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education