FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

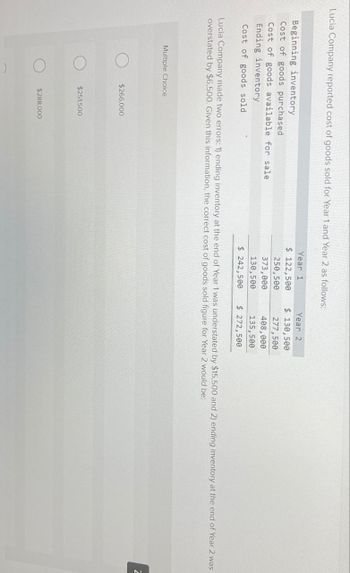

Transcribed Image Text:Lucia Company reported cost of goods sold for Year 1 and Year 2 as follows:

Beginning inventory

Cost of goods purchased

Cost of goods available for sale

Ending inventory

Cost of goods sold

Year 1

Year 2

$ 122,500

$ 130,500

250,500

277,500

373,000

408,000

130,500

135,500

$ 242,500

$ 272,500

Lucia Company made two errors: 1) ending inventory at the end of Year 1 was understated by $15,500 and 2) ending inventory at the end of Year 2 was

overstated by $6,500. Given this information, the correct cost of goods sold figure for Year 2 would be:

Multiple Choice

$266,000

$251,500

$288,000

Z

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- BI 420 $200 Sold 150 $401 Pur. 250 $205 Sold 275 $421 Pur. 200 $215 Sold 260 $441 EI 185 PB10. LO 10.3Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for B76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for Weighted Average.arrow_forwardFle LUIL Iset Omlat Ticip 10 B I U S A 田 Arial f Cost of Goods Sold3= U Y H. K L M A B C. 43 UFO 44 45 Date Item Quantity Cost Per Unit Total 46 47 Ending Inventory Income Statement Sales Cost of Goods Sold Gross Profit Operating Expenses $1.400.00 Gross Profit %=== Net Income AVERAGE COST 70 71 Average Cost Per Unit= Cost of Goods Sold=: Ending Inventory 74 77 Income Statement Sales Cost of Goods Sold Gross Profit Operating Expenses Net Income $1,400.00 Gross Profit %= Sheet1 Sheet2 Sheet3arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Don't provide answers in image formatarrow_forwardPeriodic Inventory System Company A $ 520,000 Company B Beginning inventory + Net Purchases 327,000 TOTAL GOODS AVAILABLE TO SELL 685,000 750,000 (Ending Inventory) 290,000 Cost of Goods Sold $ 615,000 For Company A determine Net Purchases and Cost of Goods Sold. For Company B determine Beginning Inventory and Ending Inventory. Company A: Net purchases 4 and Cost of goods sold type your answer. Company B: Beginning inventory type your answer... and Ending inventory type your answer.arrow_forward15arrow_forward

- Beg Inv @ cost $11,160 Net Additional markups $600 Sales $94,056 Purchases @ retail $92,400 Freight-in $840 Beg Inv @ retail $18,000 Purchases @ cost $54,600 Net markdowns $1,144 4. Which retail inventory method excludes markups but includes markdowns in calculating the cost ratio? (LIFO Retail Method, Average Cost Method, LCM Conventional Method or none of these) Thank you Brendaarrow_forwardPlease help with questionarrow_forwardkauskarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education