FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

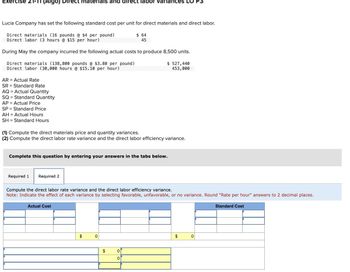

Transcribed Image Text:Exercise 21-11 (Algo) Direct materials and direct labor variances LO

Lucia Company has set the following standard cost per unit for direct materials and direct labor.

Direct materials (16 pounds @ $4 per pound)

Direct labor (3 hours @ $15 per hour)

$ 64

45

During May the company incurred the following actual costs to produce 8,500 units.

Direct materials (138,800 pounds @ $3.80 per pound)

Direct labor (30,000 hours @ $15.10 per hour)

AR Actual Rate

SR

Standard Rate

AQ Actual Quantity

SQ

AP

SP

Standard Quantity

Actual Price

Standard Price

AH Actual Hours

SH

Standard Hours

$ 527,440

453,000

(1) Compute the direct materials price and quantity variances.

(2) Compute the direct labor rate variance and the direct labor efficiency variance.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Compute the direct labor rate variance and the direct labor efficiency variance.

Note: Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Round "Rate per hour" answers to 2 decimal places.

Actual Cost

$

0

$

0

0

$

0

Standard Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Miguez Corporation makes a product with the following standard costs: Direct materials Direct labor Variable overhead Standard Quantity or Hours 4.0 liters 0.7 hours 0.7 hours Standard Price or Rate $ 8.70 per liter $ 39.00 per hour $ 3.70 per hour Standard Cost Per Unit $ 34.80 $ 27.30 $ 2.59 The company budgeted for production of 4,300 units in September, but actual production was 4,200 units. The company used 7,140 liters of direct material and 1,850 direct labor-hours to produce this output. The company purchased 7,500 liters of the direct material at $8.90 per liter. The actual direct labor rate was $41.10 per hour and the actual variable overhead rate was $3.60 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The variable overhead rate variance for September is: Multiple Choice О $294 F О О о $185 U $185 F $294 Uarrow_forwardThe standard factory overhead rate is $10 per direct labor hour ($8 for variable factory overhead and $2 for fixed factory overhead) based on 100% of normal capacity of 30,000 direct labor hours. The standard cost and the actual cost of factory overhead for the production of 5,000 units during May were as follows: Line Item Description Amount Standard: 25,000 hours at $10 $250,000 Actual: Variable factory overhead $202,500 Fixed factory overhead 60,000 The variable factory overhead controllable variance isarrow_forwardMilar Corporation makes a product with the following standard costs Standard Quantity Standard Price on or Hours 6.5 pounds Direct materials Direct labor Nariable overhead Rate. $ 6.00 per pound $25.00 per hour $11.50 per hour 0.8 hours 0.8 hours In January the company produced 3,360 units using 13.440 pounds of the direct material and 2.808 direct labor-hours, During the month, the company purchased 16,900 pounds of the direct material at a cost of $14,200. The actual direct labor cost was S69,795 and the actual Varlable overhead cost Was $30,940. The company applies variable overhead on the basis of direct iabor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor rate variance for January is Multiple Choice $405 F $405 U Windows Update S2.595U Countdown to goodnes... We're all set to do the restart you scheduled. Mc Graw Hill Prev 24 of 36 Nexflm Type here to search |耳 59 F Mostly cloudy 8:34 AM 10/21/2021 DELL F1 F2 F3 F4 F5 F6 F7…arrow_forward

- Doogan Corporation makes a product with the following standard costs: Standard Quantity or Standard Price or Hours Rate Direct materials Direct labor Variable overhead 9.0 grams e.4 hours $ 3.60 per gram $36.00 per hour $ 8.60 per hour e.4 hours The company produced 6,800 units in January using 40.910 grams of direct material and 2.540 direct labor-hours. During the month, the company purchased 46,000 grams of the direct material at $3.30 per gram. The actual direct labor rate was $35.30 per hour and the actual varlable overhead rate was $8.40 per hour. The company applies varlable overhead on the basis of direct labor-hours. The direct materials purchases varlance is computed when the materials are purchased. The varlable overhead rate varlance for January is:arrow_forwardgue Corporation uses a standard cost system. The following information was provided for the period that just ended: Actual price per kilogram $3.00 Actual kilograms of material used 31,000 Actual hourly labor rate $18.20 Actual hours of production 4,900 labor hours Standard price per kilogram $2.80 Standard kilograms per completed unit 6 kilograms Standard hourly labor rate $18.00 Standard time per completed unit 1 hr. Actual total factory overhead $34,900 Actual fixed factory overhead $18,000 Standard fixed factory overhead rate $1.20 per labor hour Standard variable factory overhead rate $3.80 per labor hour Maximum plant capacity 15,000 hours Units completed during the period 5,000 The direct labor cost variance is _____.arrow_forwardRahularrow_forward

- A company's standard cost system requires 7,000 direct labor hours per month jg. qtler taproduce 3,500 units of handbags. The management has set 2 standard of using 4.3 yards of direct materials per unit of handbag. Information regarding standard costs is mentioned below: Particulars Total standard direct materials cost Total standard direct labor cost Total standard variable manufacturing overhead (based on direct labor-hours) Amount $54,250 $42,000 $18,200 During November, the company produced 3,600 wits of handbags using 6 960 direct labor hours. Actual cots recordad isthe month of Novemb are ss allows:arrow_forwardSedona Company set the following standard costs for one unit of its product for this year. Direct material (15 pounds $3.40 per pound) Direct labor (10 hours e S9.70 per DLH) Veriable overhead (10 hours $4.90 per DLH) Fied overhead (10 hours $2. 00 per DLH) Standard cost per unit $ 51.00 97.00 49.00 20.00 $ 217.00 The $6.90 ($4.90 - $2.00) total overhead rate per direct labor hour (DLH) is based on a predicted activity level of 41,300 units, which is 70% of the factory's capacity of 59,000 units per month. The following monthly flexible budget information Is avallable. Operat ing Levels (K of capacity) 65% 30, 350 383,500 Flexible Budget Budgeted production (units) Rudgeted direct labor (standard hours) Budgeted overhead Varlable overhead Fised overhead Total avertead 41, 300 413,000 75% 44, 250 442, 500 $1,879,150 826,000 $ 2,023, 700 826, 000 $ 2,849, 700 $2,168, 250 126, e00 $ 2,994, 250 $ 2,705, 150 During the current month, the company operated at 65% of capacity, direct labor of…arrow_forward2. Blue Hose Company employees a standard cost system for product costing. The standard cost of the product is the following: Raw Materials 2 lbs per unit at $6 per lbLabor 4 hours per unit at $12 per hour Actual direct material cost was $418,000 for 76,000 lbs of material used to manufacture 30,400 units in November. All materials purchased were used in November. Workers were paid $1,510,000 for 125,000 hours of work. Compute the price/rate, quantity/efficiency and flexible spending variances for direct materials and direct labor. Please label all variances. For the price and quantity/efficiency variances, explain what happened and then give a possible explanation as to why it happened. Please Answer With A Step By Step Solutionarrow_forward

- accarrow_forwardThe following data relates to Potawatomi Corporation's operations for the month. Potawatomi produced 8,500 units and the normal monthly capacity is 20,000 direct labor hours. Direct Material: Standard (5 lbs. @ $2.10/lb.) Actual (39,000 lbs. @ $2.20/lb.) Standard Unit Costs Total Actual Costs $10.50 $85,800 Direct Labor: Standard (2 hrs. @ $12/hr.) $24.00 Actual (18,000 hrs. @ $11.90/hr.) $214,200 Variable Overhead: Standard (2 hrs. @ $4.00/hr.) $8.00 Actual $69,700 Total $42.50 $369,700 Use fork diagrams to calculate the following variances: b. Materials efficiency variance a. Materials price variance C. Labor rate variance e. Variable overhead spending variance f. Variable overhead efficiency variance d. Labor efficiency variancearrow_forwardMax Company has developed the following standards for one of its products: Direct materials 15 pounds ´ £16 per poundDirect labour 4 hours ´ £24 per hourVariable overhead 4 hours ´ £14 per hour The following activities occurred during the month of October: Materials purchased 10,000 pounds costing £170,000Materials used 7,200 poundsUnits produced 500 unitsDirect labour 2,300 hours at £23.60 per hourActual variable overhead £30,000 The company records materials price variances at the time of purchase. Refer to Figure 17-1. Max's variable standard cost per unit would bearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education