Concept explainers

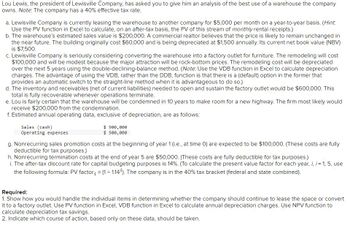

Lou Lewis, the president of Lewisville Company has asked you to give him an analysis of the best use of a warehouse the company owns. The company has a 40% effective tax rate. a. Lewisville Company is currently leasing the warehouse to another company for $5,000 per month on a year-to-year basis. b. The warehouse's estimated sales value is $200,000. A commercial realtor believes that the price is likely to remain unchanged in the near future. The building originally cost $60,000 and is being

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Please help me with c. Thanks!arrow_forwardRaiders Restaurant is considering the purchase of a $10,000,000 flat-top grill. The grill has an economic life of 6 years and will be fully depreciated using the straight-line method. The grill is expected to produce 600,000 tacos per year for the next 6 years, each taco costing $4 to make and priced at $11. Assume the discount rate is 12% and the tax rate is 21%. The restaurant expects the market value of the grill to be $0, 6 years from now. Calculate the book value of the grill at the end of year 3. (Round to 2 decimals)arrow_forwardRaiders Restaurant is considering the purchase of a $10,000,000 flat - top grill. The grill has an economic life of 6 years and will be fully depreciated using the straight-line method. The grill is expected to produce 600,000 tacos per year for the next 6 years, each taco costing $4 to make and priced at $11. Assume the discount rate is 12% and the tax rate is 21 %. The restaurant expects the market value of the grill to be $0, 6 years from now. Calculate the net present value for the project.arrow_forward

- You are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,360,000; rents are estimated at $174,080 during the first year and are expected to grow at 2.5 percent per year thereafter. Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 6 percent interest for 30 years (total annual payments will be monthly payments × 12). The property is expected to appreciate in value at 3 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor’s expected before-tax internal rate of return on equity invested (BTIRR)? d.…arrow_forwardYou are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,430,000; rents are estimated at $183,040 during the first year and are expected to grow at 2.5 percent per year thereafter. Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 8 percent interest for 30 years (total annual payments will be monthly payments × 12). The property is expected to appreciate in value at 4 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor’s expected before-tax internal rate of return on equity invested (BTIRR)? d. What…arrow_forwardBottoms Up Diaper Service is considering the purchase of a new industrial washer. It can purchase the washer for $7,200 and sell its old washer for $2,500. The new washer will last for 6 years and save $1,700 a year in expenses. The opportunity cost of capital is 15%, and the firm’s tax rate is 21%. a. If the firm uses straight-line depreciation over a 6-year life, what are the cash flows of the project in years 0 to 6? The new washer will have zero salvage value after 6 years, and the old washer is fully depreciated. (Negative amounts should be indicated by a minus sign.) b. What is project NPV? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. What is NPV if the firm investment is entitled to immediate 100% bonus depreciation? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education