Question

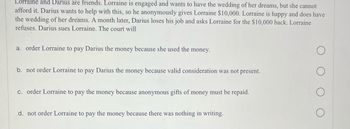

Transcribed Image Text:Lorraine and Darius are friends. Lorraine is engaged and wants to have the wedding of her dreams, but she cannot

afford it. Darius wants to help with this, so he anonymously gives Lorraine $10,000. Lorraine is happy and does have

the wedding of her dreams. A month later, Darius loses his job and asks Lorraine for the $10,000 back. Lorraine

refuses. Darius sues Lorraine. The court will

a. order Lorraine to pay Darius the money because she used the money.

b. not order Lorraine to pay Darius the money because valid consideration was not present.

c. order Lorraine to pay the money because anonymous gifts of money must be repaid.

d. not order Lorraine to pay the money because there was nothing in writing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Jane Smith, age 40, is single and has no dependents. She is employed as a legal secretary by Legal Services, Inc. She owns and operates Typing Services located near the campus of Florida Atlantic University at 1986 Campus Drive, Boca Raton, FL 33434. Jane is a material participant in the business. She is a cash basis taxpayer. Jane lives at 2020 Oakcrest Road, Boca Raton, FL 33431. Jane’s Social Security number is 123-45-6781. Jane indicates that she wants to designate $3 to the Presidential Election Campaign Fund. Jane had health insurance for all months of 2018. During 2018, Jane had the following income and expense items: $100,000 salary from Legal Services, Inc. $20,000 gross receipts from her typing services business. $700 interest income from Third National Bank. $1,000 Christmas bonus from Legal Services, Inc. $60,000 life insurance proceeds on the death of her sister. $5,000 check given to her by her wealthy aunt. $100 won in a bingo game. Expenses connected with the typing…arrow_forwardProfessor Shott buys a Porsche against the wishes of his much more intelligent wife. Professor Shott soon realizes his mistake when he starts to make the car payments. Jane, a very wealthy 17 year old, offers to buy the Porsche and Professor Shott accepts. Now assume that before she turns 18 Jane gets in an accident and badly damages the Porsche causing $20,000 in damage. Assume she originally paid Professor Shott $50,000 for the car. If Jane now seeks to return the damaged car what is the result? Professor Shott must refund Jane his money minus the amount of the damages. Professor Shott does not have to refund Jane anything. Professor Shott can demand it be repaired before giving Jane a refund. Professor Shott must refund Jane 100% of his money even though he damaged the car.arrow_forwardRamona Smith spilled orange juice on her computer two days before her term paper was due. Ramona desperately needed a new laptop, so she went online and found a laptop that fit her needs. She emailed the seller, Effie Frost, expressing her desire to purchase the laptop. Effie ernailed Ramona back and said that she (Effie) would sell Effie's laptop to Ramona for $300. An hour later, Ramona and Effie signed the following agreement: "1, Effie Frost, agree to sell my laptop computer to Ramona Smith for Four Hundred Dollars and zero cents. This is the entirety of the agreement. This agreement supersedes any and all other agreements made by the seller and the buyer." Ramona now claims that she should only pay $300 for the laptop because during that initial email exchange with Effie, Effie told Ramona that $300 was the price of the laptop, and she has the email exchange as evidence of the price quote of $300. What legal concept could be used to enforce the contract for $400? O Condition…arrow_forward

- 9arrow_forwardOlav starts Power Cells to make and sell batteries. Later, Olav contracts with Quinn to invest additional capital in the firm in exchange for 25 percent of the profits. Olav and Quinn are not partners in Power Cells becausearrow_forwardJohn works as an engineer for a technological company, and Maria works as a sales executive for a competitor business. Maria reminded John that her profession contains sensitive information, and she cautions him not to reveal anything he learns from her work to anyone. While attending a conference, John overheard two executives from Maria's company discussing a new product launch. He chooses to buy a modest amount of Maria's company's shares, intending to profit from the predicted increase in the company's stock price following the product launch. John double-checked his company's regulations to ensure that there was no conflict of interest or limitation on the purchase. However, as a result of unanticipated factors, the product introduction was delayed, and the stock price of Maria's company fell instead. Instead of the predicted profit, John's investment resulted in a loss. Question : In the view of conflict of interest of ethics in financial analysis, state the key points of the…arrow_forward

- a WI Thi aw poin loqua yd olM : Jane was tired of living in the jungle with Tarzan and entered into a sales contract to purchase a small house from Tarzan that he had inherited. Tarzan later changed his mind, because he liked Jane swinging in the trees with him. If Jane decides to seek legal assistance to acquire the house, which remedy should she ask for? O Quantum meruit O Promissory estoppel O Specific performance O Legal ejectment dead artarrow_forwardEric and Susan just purchased their first home, which cost $140,000. They purchased a homeowner’s policy to insure the home for $130,000 and personal property for $80,000. They declined any coverage for additional living expenses. The deductible for the policy is $500. Soon after Eric and Susan moved into their new home, a strong windstorm caused damage to their roof. They reported the roof damage to be $19,500. While the roof was under repair, the couple had to live in a nearby hotel for three days. The hotel bill amounted to $420. Assuming the insurance company settles claims using the replacement value method, what amount will the insurance company pay for the damages to the roof?arrow_forwardShawn buys 50 widgets at a store closing sale. He buys the widgets intending to use them around the house. He only uses 25, though, and decides to sell the remaining widgets online. Shawn lives in Colorado. He finds an individual buyer, Victoria, in Italy. Does the CISG apply if there is an issue with this contract? O No, because at least one party must be a merchant. Yes, because the contract does not state that the CISG does not apply. O Yes, because the CISG automatically applies when two signatory country parties enter into a contract. No, because the contract does not state that the CISG applies. O No, because these are two consumers.arrow_forward

- Max and Jack enter into a contract which states: "Jack will paint Max's kitchen blue and Max promises to pay Jack $200 upon completion." Which is an example of an implied condition? That Max will pay Jack upon completion of the painting. That Jack will use blue paint when painting Max's kitchen. That Max will allow Jack access to his kitchen That Max will pay Jack $200.arrow_forwardHernandez's uncle agreed to cosign on a loan , union bank offered to lend hernandez $85,000 at 10.5% simple interest. find the interest and maturity valuearrow_forwardSkip and Jack are the shareholders of the Blue Fish Event Corporation. Skip and Jack regularly put on classy events on or near the beach, so they have a special insurance policy to protect their assets. Business has been slow as fewer large beach weddings are taking place, so Skip and Jack use a large fan to blow down and damage most of their décor assets, some of which were personal assets of Skip and Jack, to collect the insurance benefits. (a) Assuming their acts are proven, will a court allow Skip and Jack to recover the insurance money? (b) Is this a situation where the corporate veil may be pierced? Why or why not? (c) What would it mean for Skip and Jack if the corporate veil is pierced in this situation?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios