FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

KSAs: Understand processes and concepts of cost-volume-profit.

How to Calculate unit contribution margin, contribution margin, contribution margin ratio, and operating income?

Transcribed Image Text:Lore Inc

has finished a new virtual reality game, Sailor's

Revenge. Management is now considering its

marketing strategies. The table below is available to

help with the decision. Two managers, Shohreh

Johnson, had the following discussion of ways to

increase the profitability of this new offering:

Antonio: I think we need to think of some way to

increase our profitability. Do you have any ideas?

Shohreh: Well, I think the best strategy would be to

become aggressive on price. If we drop the price from

$80 to $70 per unit and maintain our advertising

budget at $10,000,000, I think we will generate total

sales of 2,000,000 units. This would be twice our

current unit sales expectations.

Antonio: I think that is the wrong way to go. You are

giving up too much on price. Instead, I think we need to

follow an aggressive advertising strategy. If we

increase our advertising by $7,000,000 to a total of

$17,000,000, we should be able to increase sales

volume to 1,400,000 units without any change in price.

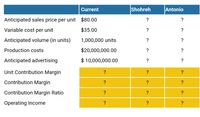

Part 1: Calculate (1) unit contribution margin, (2)

contribution margin, (3) contribution margin ratio, and

(4) operating income for all three options.

Part 2: Which strategy is best and why?

Transcribed Image Text:Current

Shohreh

Antonio

Anticipated sales price per unit $80.00

?

?

Variable cost per unit

$35.00

?

?

Anticipated volume (in units)

1,000,000 units

?

?

Production costs

$20,000,000.00

?

?

Anticipated advertising

$ 10,000,000.00

?

?

Unit Contribution Margin

?

?

?

Contribution Margin

?

?

?

Contribution Margin Ratio

?

?

?

Operating Income

?

?

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which type of income statements, Contribution Format or Traditional Format should be used to identify relevant costs? Please provide explanation for your answer. Then provide an example including two income statements based on absorption and variable costing, respectively, to support your explanation.arrow_forwardDiscuss the components of the Contribution Margin Income Statement, how does management use this in the decision making process?arrow_forwardPlease explain what is meant by the contribution margin. Also, please provide an example of how the contribution margin ratio is calculated and how the unit contribution margin is calculated.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education