FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

1 question. Had to upload 2 pictures because of the length. Thanks

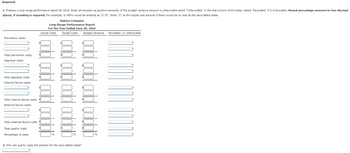

Transcribed Image Text:Required:

1. Prepare a long-range performance report for 20x5. Enter all answers as positive amounts. If the budget variance amount is unfavorable select "Unfavorable" in the last column of the table. Select "Favorable" if it is favorable. Round percentage answers to two decimal

places, if rounding is required. For example, 5.789% would be entered as "5.79". Enter "0" as the target cost amount if there would be no cost at the zero-defect state.

Prevention costs:

Total prevention costs

Appraisal costs:

Total appraisal costs

Internal failure costs:

Total internal failure costs

External failure costs:

Total external failure costs

Total quality costs

Percentage of sales

Nabors Company

Long-Range Performance Report

For the Year Ended June 30, 20x5

Actual Costs

colblood

gold

Target Costs

gold god odd

2. Why are quality costs still present for the zero-defect state?

Budget Variance

golol gold goldl godbl

Favorable; or Unfavorable

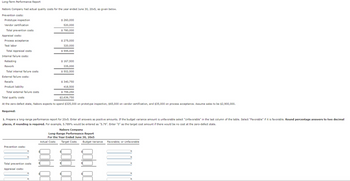

Transcribed Image Text:Long-Term Performance Report

Nabors Company had actual quality costs for the year ended June 30, 20x5, as given below.

Prevention costs:

Prototype inspection

Vendor certification

Total prevention costs

Appraisal costs:

Process acceptance

Test labor

Total Appraisal costs

Internal failure costs:

Retesting

Rework

Total internal failure costs

External failure costs:

Recalls

Product liability

Total external failure costs

111

Prevention costs:

$ 260,000

Total prevention costs

Appraisal costs:

520,000

$ 780,000

$ 275,000

320,000

$ 595,000

$167,500

335,000

$ 502,500

Total quality costs

At the zero-defect state, Nabors expects to spend $325,000 on prototype inspection, $65,000 on vendor certification, and $35,000 on process acceptance. Assume sales to be $2,900,000.

Required:

$340,750

418,500

$ 759,250

$2,636,750

1. Prepare a long-range performance report for 20x5. Enter all answers as positive amounts. If the budget variance amount is unfavorable select "Unfavorable" in the last column of the table. Select "Favorable" if it is favorable. Round percentage answers to two decimal

places, if rounding is required. For example, 5.789% would be entered as "5.79". Enter "0" as the target cost amount if there would be no cost at the zero-defect state.

Nabors Company

Long-Range Performance Report

For the Year Ended June 30, 20x5

Actual Costs Target Costs Budget Variance Favorable; or Unfavorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- K Use the figure for the question(s) below. Zoom: 1d 5d 1m 3m 6m YTD 1y 5y 10y Man Dec 2007 Mur Jan 2008 2007 m OA. May 2008 OB. February 2008 O C. March 2008 O D. April 2008 Feb 2008 Dec 03, 2007 Mar 2008 - Jun 04, 2008 -3.21 (-16.55%) Apr 2008 2008 May 2008 470 27 20 18 19 14 3 The above screen shot from Google Finance shows the price history of Progenics, a pharmaceutical company. In the time period shown, Progenics released information that an intravenously-administered formulation of their leading product had failed in a Phase III clinical trial. In which of the months shown in the price history is this most likely to have occurred? 10arrow_forwardI need help answer questions 3-5 and and why or why not the company should move forward with this endeavorarrow_forwardNeed answer to age group column: Use the filter tabs on columns F or G to find the certain groups??? Please show up and workarrow_forward

- annswer for practice 2 please ??????arrow_forwardu Online Cour X (78) Whats x M Your AccoL X M Inbox (2,74 X SP2021-AC X Answered: Ek My Home * CengageN X Bartleby Q x + D X A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?inprogress=true FMovies | Watch M. BIO201 Connect 10. M Gmail > YouTube Fourth Homework O eBook Patents 6. MC.12.06 Instructions Chart Of Accounts General Journal 7. MC.12.07 Instructions 8. MCС.12.08 Mystic Pizza Company purchased a patent from Prime Pizza Plus on January 1, 2019, $72,000. The patent has a remaining legal life of 9 years. 9. МC.12.09 Required: 10. MC.12.10 Prepare the journal entries to record the acquisition and the amortization for 2019, assuming Mystic Pizza amortizes its patents using the 11. RE.12.01.BLANKSHEET straight-line method over the life of the asset. 12. RE.12.02 13. RE.12.03.BLANKSHEET 14. RE.12.04.BLANKSHEET 15. RE.12.05.BLANKSHEET 16. RE.12.06.BLANKSHEET 17. RE.12.07.BLANKSHEET 18. RE.12.08 O V I 12:52arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward

- Your answers are incorrect, there are at least 4 blanks to fill in and you only provided 2 or 3. Also please do not use Excel, please use another way to show your work.arrow_forward7:27 f t < Session[1].docx - Word ✓ Qo 138 - 21 Paragraph O References Mailings Review View Help BLUEBEAM One day you're going to miss my boring texts ## TO Accessibility: Investigate Search Costs to date Estimated costs to complete Progress billings during the year Cash collected during the year hoher webb ng Normal ||| No Spacing Styles Acrobat 2021 $ 980,000 3,020,000 1,000,000 648,000 Go to website O Heading 1 √ Calculate the amount will be reported for accounts receivable on the statement of financial position at December 31, 2022. 3. Accounts Receivable on the Statement of Financial Position at December 31, 2022 for Newton Corp.: Accounts Receivable is calculated as the cumulative billings to date minus the cumulative cash collected: Accounts Receivable at December 31, 2022 = Cumulative Billings- Cumulative Cash Collected Accounts Receivable at December 31, 2022 = ($1,000,000+ $1,000,000) - ($648,000+ $1,280,000) = $2,000,000 - $1,928,000 = $72,000 Therefore, the amount reported…arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education