FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

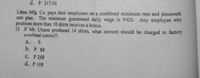

Transcribed Image Text:d. P 217.50

Litton Mfg. Co. pays their employees on a combined minimum rate and piecework

rate plan. The minimum guaranteed daily wage is P420. Any employee who

produces more than 10 shirts receives a bonus.

15 If Mr. Unson produced 14 shirts, what amouht should be charged to factory

overhead control?.

a.. 0

b. P 88

с. Р 268

d.. P 168

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forward8. Mazoon Company motorcycle helmets. the company has enough orders to keep the factory production at 1,000 motorcycle helmets per month. Mazoon's monthly manufacturing cost and other expense data are as follows. specializes in manufacturing Maintenance costs on factory building Factory manager's salary Advertising for helmets Sales commissions 500 3000 7000 2000 Depreciation on factory building Rent on factory equipment Insurance on factory building Raw materials (plastic, polystyrene, etc.) 19000 Utility costs for factory Supplies for general office Wages [or assembly line workers Depreciation on office equipment Miscellaneous materials (glue, thread, 1900 etc.) 600 5000 2000 700 100 43000 400 a) Prepare an answer with the following heading Enter each cost item on your answer sheet totalling the amount in each column. b) Compute the cost to produce 1 helmet Product Costs Cost Item Direct Material Direct Labor Manuf. Overhead Period Costarrow_forwardClay Earth Company sells ceramic pottery at a wholesale price of $ 7.00 per unit. The variable cost of manufacturing is $1.75 per unit. The fixed costs are $5,500 per month. It sold 4, 700 units during this month. Calculate Clay Earth's operating income (loss) for this month. A. $(19,175) B. $(5,500) C. $19, 175 D. $27,400arrow_forward

- 9. What is the total amount of this invoice? Materials: $458.00 7.75% sales tax on materials. 28 hours of labor at $67.50 per hour. 10% discount on labor. 5% discount on materials. $2,171,60 $2,169.82 $2,159.00 Less than the amount in answer C. More than the amount in answer Aarrow_forwardJj.76.arrow_forwardThe following data is available for Sunland Repair Shop for 2022: Repair technicians' wages $380000 Employee benefits 70000 Overhead Total 60000 $72.00. $108.00. $264.00. O $147.00. $510000 The desired profit margin is $45 per labor hour. The material loading charge is 40% of invoice cost. It is estimated that 5000 labor hours will be worked in 2022. In January 2022, Sunland repairs a bicycle that uses parts of $180. Its material loading charge on this repair would bearrow_forward

- Hrs.7 PT corp makes 300 units of A per year. At this level, the cost per unit includes $360 in direct materials, $1,000 in direct labor, $240 in variable overhead, and $900 in fixed overhead. An outside supplier has offered to make all 300 units for $2,100 per unit. If PT accepts this offer, two thirds of the fixed overhead would persist, but would be defrayed by renting out the floor space for $72,000 per year. What is the total fixed costs from the original estimate of production costs per unit? How much of the total fixed costs will persist (including defrayal by renting the space)?arrow_forwardMaestro Co. employs a salesperson whose salary is $2,000 per month. Once the monthly sales exceed $40,000, the salesperson receives the commission of 5% of the sales made. Which of the following Cost Behavior Patterns describe the salesperson’s salary the most? Question 7Select one: a. Variable costs b. Fixed costs c. Semivariable costs d. Step costsarrow_forward41. Account Analysis and Contribution Margin Income Statement. Downhill Company would like to estimate costs associated with its production of bike helmets on a monthly basis. The accounting records indicate the following production costs were incurred last month for 4,000 helmets: Assembly workers’ labor (hourly) $70,000 Factory rent 3,000 Plant manager’s salary 5,000 Supplies 20,000 Factory insurance 12,000 Materials required for production 20,000 Maintenance of production equipment (based on usage) 18,000 Required: 1. Use account analysis to estimate the total fixed cost per month and the variable cost per unit. State your results in the cost equation form Y = f + vX by filling in the dollar amounts for f and v. 2. Estimate total production costs assuming 5,000 helmets will be produced and sold. 3. Prepare a contribution margin income statement assuming 5,000 helmets will be produced, and each helmet will be sold for $70. Fixed selling and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education