FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

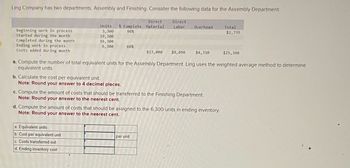

Transcribed Image Text:Ling Company has two departments, Assembly and Finishing. Consider the following data for the Assembly Department

Beginning work in process

Started during the month

Completed during the month

Ending work in process

Costs added during month

Units

3,300

19,300

16,300

6,300

Direct

Direct

% Complete Material Labor Overhead

90%

b. Calculate the cost per equivalent unit.

Note: Round your answer to 4 decimal places.

60%

a. Equivalent units

b. Cost per equivalent unit

c. Costs transferred out

d. Ending inventory cost

$13,000 $8,050 $4,310

a. Compute the number of total equivalent units for the Assembly Department. Ling uses the weighted average method to determine

equivalent units.

c. Compute the amount of costs that should be transferred to the Finishing Department.

Note: Round your answer to the nearest cent.

d. Compute the amount of costs that should be assigned to the 6,300 units in ending inventory.

Note: Round your answer to the nearest cent.

per unit

Total

$2,735

$25,360

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: General Introduction

VIEW Step 2: a. Computation of the number of total equivalent units for the Assemble Department

VIEW Step 3: b. Calculation of the cost per equivalent unit

VIEW Step 4: c. Computation of the amount of costs that should be transferred to Finishing Department

VIEW Step 5: d. Computation of the amount of costs that should be assigned

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected T - accounts of Moore Company are given below for the just completed year: Raw Materials Debit Credit Balance 1/1 33,000 Credits ? question mark Debits 156,000 Balance 12/31 43,000 Manufacturing Overhead Debit Credit Debits 186,200 Credits ? question mark Work in Process Debit Credit Balance 1/1 38,000 Credits 524,000 Direct materials 108,000 Direct labor 204,000 Overhead 214, 200 Balance 12/31 ? question mark Factory Wages Payable Debit Credit Debits 221,000 Balance 1/1 18,000 Credits 216,000 Balance 12/31 13,000 Finished Goods Debit Credit Balance 1/1 58,000 Credits ? question mark Debits? question mark Balance 12/31 87,000 Cost of Goods Sold Debit Credit Debits? question mark Required: What was the cost of raw materials used in production? How much of the materials in (1) above consisted of indirect materials? How much of the factory labor cost is indirect labor? What was the cost of goods manufactured? What was the unadjusted cost of goods sold? Do not include any…arrow_forwardBorchardt Corporation has provided the following data concerning last month's operations. Direct materials Direct labor Manufacturing overhead applied to Work in Process Work in process inventory $169,000 O$235,000 How much is the cost of goods manufactured for the month on the Schedule of Cost of Goods Manufactured? $173,000 O$178.000 Beginning $ 66,000 hs $ 29,000 $ 58,000 $ 82,000 Ending $ 57,000arrow_forward3. The Assembly Department for Bright Company has the following production data for the current month. Beginning Work in Process Units transferred out Ending Work in Process -0- 20,000 10,000 Materials are entered at the beginning of the process. The ending work in process units are 70% complete as to conversion costs. Instructions: Compute the equivalent units of production for (a) materials and (b) conversion costs (2 marks) 4. Tien Group estimates that unit sales will be 20,000 in quarter 1, 24,000 in quarter 2, 27,000 in quarter 3 and 33,000 in quarter 4. Management desires to have an ending finished goods inventory equal to 20% of the next quarter's expected unit sales. Instructions: Prepare a production budget by quarters for the first 6 months of 2020. (*arrow_forward

- Please help me with correct answer thankuarrow_forwardCurrent Attempt in Progress Production costs chargeable to the Sanding Department in July in Monty Company are $41,160 for materials, $14,700 for labor, and $12,740 for manufacturing overhead. Equivalent units of production are 29,400 for materials and 19,600 for conversion costs. Compute the unit costs for materials and conversion costs. (Round answers to 2 decimal places, e.g. 15.25.) Unit costs $ Materials $ Conversion Costsarrow_forwardCarla Vista Manufacturing Inc. provides you with the following data for the month of June:Prime costs were $ 196,000, conversion costs were $140, 500, andtotal manufacturing costs incurred were $265,500. Beginning and ending work in process inventories were equal. Selling and administrative costs were $ 262,100. (a)What were the total costs of direct materials used, direct labour, and manufacturing overhead? Direct material costs$Direct labour costsManufacturing overhead costsarrow_forward

- Sheffield Company had the following department information for the month: Total materials costs Equivalent units of production for materials Total conversion costs Equivalent units of production for conversion costs What is the total manufacturing cost per unit? O $3.20. O $7.90. O $4.70. O $3.63. $47000 10000 $80000 25000arrow_forwardSohar Company had the following department data: Physical Units Work in process, July 1 30,000 Completed and transferred out 135,000 Work in process, July 31 45,000 Materials are added at the beginning of the process. What is the total number of equivalent units for materials in July? Select one: a. 45,000. b. 150,000. c. 210,000. d. None of the answers are correct e. 135,000. Clear my choicearrow_forwarda. Prepare a cost of production report for the Cutting Department. If an amount is zero or a blank, enter in "0". For the cost per equivalent unit computations, round your answers to two decimal places. The Cutting Department of Karachi Carpet Company provides the following data for January. Assume that all materials are added at the beginning of the process. Work in process, January 1, 8,200 units, 65% completed $103,894* *Direct materials (8,200 × $10.2) $83,640 Conversion (8,200 × 65% × $3.8) 20,254 $103,894 Materials added during January from Weaving Department, 126,400 units $1,301,920 Direct labor for January 219,708 Factory overhead for January 268,533 Goods finished during January (includes goods in process, January 1), 127,800 units — Work in process, January 31, 6,800 units, 40% completed — Cost of Production Report-Cutting Department For the Month Ended January 31 Unit Information Units charged to production: Number of…arrow_forward

- Friedman Company has a production process that involves three processes. Units move through the processes in this order: cutting, stamping, and then polishing. The company had the following transactions in November: View the transactions. Prepare the joumal entries for Friedman Company. (Record debits first, then credits. Exclude explanations from journal entries.) 1. Cost of units completed in the Cutting Department, $14,000 Date Nov. 30 Accounts Debit Credit Transactions 1. Cost of units completed in the Cutting Department, $14,000 2. Cost of units completed in the Stamping Department, $28,000 $39,000 3. Cost of units completed in the Polishing Department, 4. Sales on account, $40,000 5. Cost of goods sold is 80% of sales - Xarrow_forwardUsing the following for March, calculate the cost of goods manufactured: Direct materials $29,000 Direct labor $19,000 Manufacturing overhead $27,000 Beginning work in process inventory $10,000 Ending work in process inventory $12,000 The cost of goods manufactured was: $74,000 $86,000 $76,000 $73,000 Show the calculation and work.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education