Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

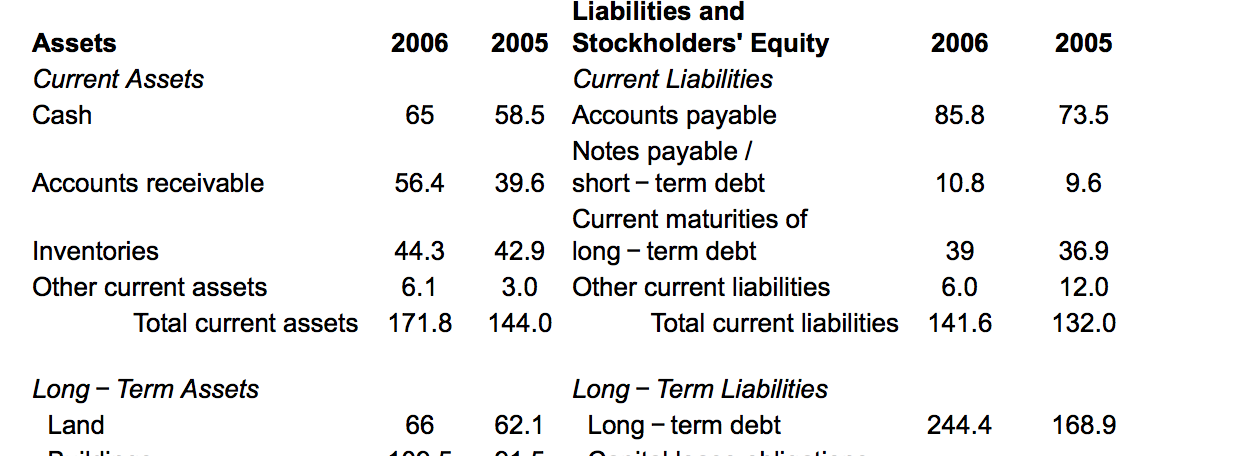

Transcribed Image Text:Liabilities and

2005 Stockholders' Equity

Assets

2006

2006

2005

Current Assets

Current Liabilities

58.5 Accounts payable

Notes payable /

39.6 short – term debt

Cash

65

85.8

73.5

Accounts receivable

56.4

10.8

9.6

Current maturities of

long - term debt

Other current liabilities

Total current liabilities

Inventories

44.3

42.9

39

36.9

Other current assets

6.1

3.0

6.0

12.0

171.8

144.0

Total current assets

141.6

132.0

Long - Term Liabilities

Long - term debt

Long - Term Assets

66

62.1

Land

244.4

168.9

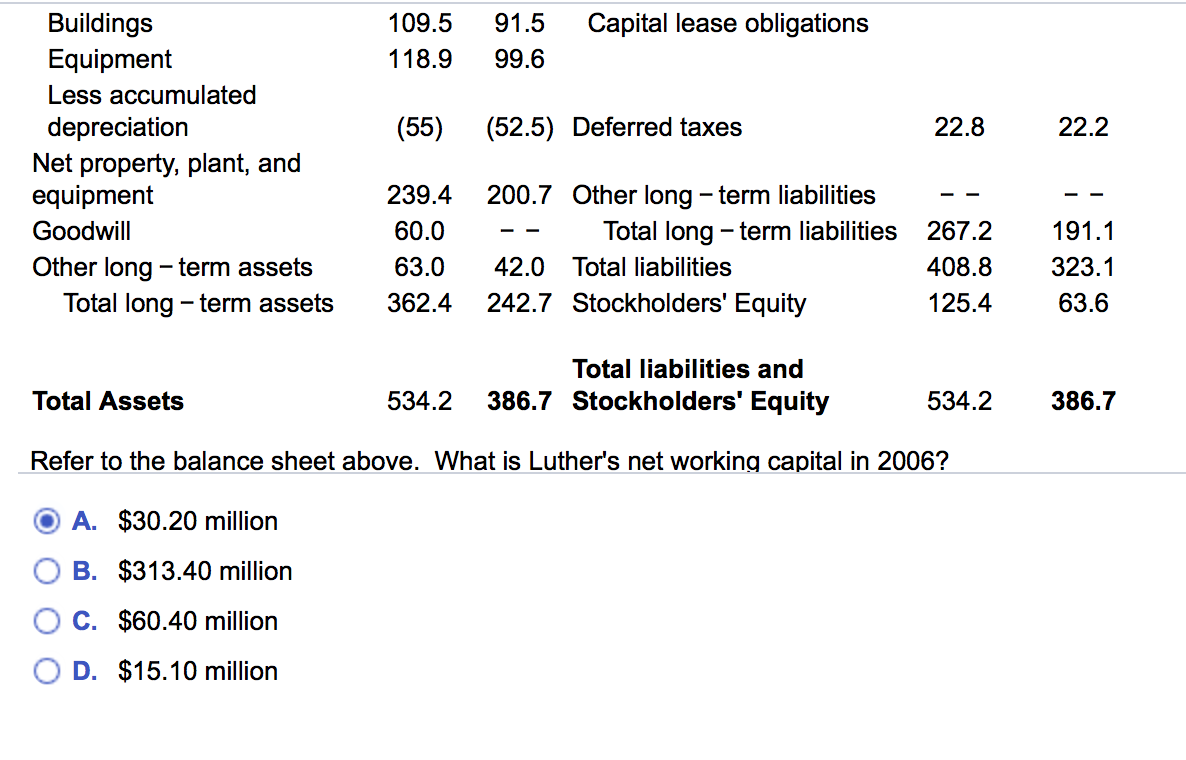

Transcribed Image Text:Buildings

Equipment

109.5

91.5

Capital lease obligations

118.9

99.6

Less accumulated

depreciation

(55)

(52.5) Deferred taxes

22.8

22.2

Net property, plant, and

equipment

239.4

200.7 Other long - term liabilities

Goodwill

60.0

Total long - term liabilities

267.2

191.1

Other long - term assets

63.0

42.0 Total liabilities

408.8

323.1

242.7 Stockholders' Equity

Total long - term assets

362.4

125.4

63.6

Total liabilities and

386.7 Stockholders' Equity

Total Assets

534.2

534.2

386.7

Refer to the balance sheet above. What is Luther's net working capital in 2006?

A. $30.20 million

B. $313.40 million

C. $60.40 million

O D. $15.10 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- E10.2arrow_forwardbarrow_forwardWalmart Stores, Inc. Property and Equipment ($ in millions) Land Buildings and improvements Fixtures and equipment Transportation equipment Property under capital lease Property and equipment Accumulated depreciation Property and equipment, net January 31, 2015 $ 26,261 97,496 January 31, 2014 $ 26,184 95,488 45,044 42,971 2,807 2,785 5,787 5,661 177,395 173,089 (63,115) (57,725) $114,280 $115,364arrow_forward

- Calculate the assessed value of the piece of property: Assessment rate Market value Assessed value 80% $210,000arrow_forward$100,000 x 4.79079* = Lease Payments $479,079 Right-of-Use Asset *Present value of an annuity due of $1: n = 6,i = 10%arrow_forward8.15 Analyzing Disclosures Regarding Fixed Assets. Exhibit 8.21 presents selected financial statement data for three chemical companies: Monsanto Company, Olin Corporation, and NewMarket Corporation. (NewMarket was formed from a merger of Ethyl Corporation and Afton Chemical Corporation.) Exhibit 8.21 Three Chemical Companies' Selected Financial Statement Data on Depreciable Assets (amounts in millions) (Problem 8.15) New Market Corporation Monsanto Olin Company Q Q Depreciable assets at cost: Beginning of year End of year Accumulated depreciation: Beginning of year $752 $4,611 $1,796 777 4,604 1,826 584 2,331 1,301 End of year 611 2,517 1,348 Net income 33 267 55 Depreciation expense 27 328 72 Deferred tax liability relating to depreciable assets: Beginning of year 13 267 83 End of year 9 256 96 Income tax rate 35% 35% 35% Depreciation method for financial reporting Straight-line Straight-line Straight-line Depreciation method for tax reporting Accelerated Accelerated Acceleratedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education