FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

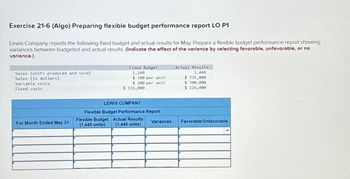

Exercise 21-6 (Algo) Preparing flexible budget performance report LO P1 Lewis Company reports the following fixed budget and actual results for May. Prepare a flexible budget performance report showing variances between budgeted and actual results. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance.) \table[[,Fixed Budget,Actual Results],[Sales (units produced and sold),1,240,1,440],[Sales (in dollars),$500 per unit,$735,000

Transcribed Image Text:Exercise 21-6 (Algo) Preparing flexible budget performance report LO P1

Lewis Company reports the following fixed budget and actual results for May. Prepare a flexible budget performance report showing

variances between budgeted and actual results. (Indicate the effect of the variance by selecting favorable, unfavorable, or no

variance.)

Sales (units produced and sold)

Sales (in dollars)

Variable costs

Fixed costs

Fixed Budget

1,240

Actual Results

1,440

$ 500 per unit

$200 per unit

$ 735,000

$ 300,000

$ 131,000

$ 126,000

LEWIS COMPANY

Flexible Budget Performance Report

For Month Ended May 31

Flexible Budget Actual Results

(1,440 units) (1,440 units)

Variances

Favorable/Unfavorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 4- Variance Analysis Required: The owners can see that the company sold a different amount of units than budgeted. They have asked vou to determine the flexible budget amounts and calculate the variances when comparing the flexible budget to the actual results S marksl. Flexible Budget Report Variance (show Static Flexible or Budget Budget Actual as positive Unfavorable Amount Amount Results amount) (U) Sales in Linits 6,500 6,200 Sales $ 650,000 650,000 Variable Cost 260,000 275,500 Foed Cost 26,000 25,000 Jet Operating Income 364 000 349,500arrow_forwardPlease do not give solution in image format thankuarrow_forwardExercise 21-4 (Algo) Preparing flexible budget performance report LO P1 Complete the following partial flexible budget performance report, and indicate whether each variance is favorable or unfavorable. The company budgets a selling price of $81 per unit and variable costs of $34 per unit. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) For Month Ended June 30 Sales Variable costs Contribution margin Fixed costs Income Flexible Budget Performance Report Flexible Budget Actual Results Variances Favorable/Unfavorable (11,800 units) (11,800 units) $ 29,200 Favorable 361,000 Favorable 554,600 280,000 295,000 Favorable Unfavorable No variancearrow_forward

- Chapter 9 Canvas Homework - SHOW YOUR WORK FOR CREDII Multiple Cost Drivers: Salamone's Pizza is a neighborhood pizzeria that has an area for in-store dining as well as offering take-out and free home delivery services. The pizzeria's owner has determined that the shop has two major cost drivers the number of pizzas sold and the number of deliveries made. The pizzeria's cost formulas appear below. Flxed Coat per Month Cost per Piza Cost per Dellvery $ 4.00 Plzza Ingredlente Kitchen staff $ 6,050 S 880 Utilitles $ 1.00 Dellvery person Dellvery vehicile $2.80 $2.20 S 700 S 456 $ 2,010 $ 800 Equipment depreclation Rent Mlscellaneous $0.20 In November, the pizzeria budgeted for 1,770 pizzas at an average selling price of $14 per pizza and for 210 deliveries. Data conceming the pizzeria's actual results in November were as follows: Actual Resulte 1,870 190 Plzzas Dellverles $ 28,800 $ 8,470 $ 5,990 $ 920 $ 532 $ 1,000 $ 458 $ 2,010 $ 832 Revenue Plzza Ingredlents Kitchen ataff Utilities…arrow_forwardRequired 1 Required 2 Calculate the activity variances for March. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Utilities Maintenance Supplies Indirect labor Depreciation Total FAB Corporation Activity Variances For the Month Ended March 31 Show Transcribed Text Required 1 Required 2 FAB Corporation Spending Variances For the Month Ended March 31arrow_forwardpoints The "spending variance" is the difference between actual costs and planning budget costs. True False 8 5 points A company has the following information: Revenues - Planning Budget $50,000 Costs - Planning Budget $45,000 Revenues - Flexible Budget $55,000 Costs - Flexible Budget $50,000 Revenues - Actual $52,000 Costs - Actual I $48,000 The revenue variance is $2,000 favorable $2,000 unfavorable $3,000 favorable $3,000 unfavorablearrow_forward

- Self-Study Problem 14-1 Sales Volume and Flexible-Budget (FB) Variances/JIT Manufacturing [The following information applies to the questions displayed below.] Solid Box Fabrications manufactures boxes for workstations. The firm’s standard cost sheet prior to October of the current year and actual results for October are as follows: Budget Information Standard Price and Variable Costs per Unit Fixed Costs Actual Results October Units 9,700 Sales$50.00 $563,000 Variable costs: Direct materials 5 pounds at $2.50 per pound$12.40 51,400 lb*× $3 =$154,200 Direct labor 0.50 hour at $14.40 per hour 7.20 5,300 hr × $17.20 = 91,160 Manufacturing overhead 2.00 19,000 Selling and administrative 5.00 45,000 Total variable costs$26.60 $309,360 Contribution margin$23.40 $253,640 Fixed costs: Manufacturing (factory) overhead $50,000 $55,000 Selling and administrative 20,000 24,000 Total fixed costs $70,000 $79,000 Operating income $174,640 *Assume that pounds purchased = pounds issued to production…arrow_forwardExercise 21-4 (Algo) Preparing flexible budget performance report LO P1 Complete the following partial flexible budget performance report, and indicate whether each variance is favorable or unfavorable. The company budgets a selling price of $85 per unit and variable costs of $34 per unit. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) For Month Ended June 30 Sales Variable costs Contribution margin Fixed costs Income Flexible Budget Performance Report Flexible Budget Actual Results (12,300 units) (12,300 units) 627,300 285,000 366,000 300,000 Variances Favorable/Unfavorable $ 44,500 Favorablearrow_forwardStatic and Flexible Budgets Graham Corporation used the following data to evaluate its current operating system. The company sells items for $10 each and used a budgeted selling price of $10 per unit. Units sold Variable costs Fixed costs a. Prepare the actual income statement, flexible budget, and static budget. Do not use negative signs with any of your answers below. Actual Budgeted 1,180,000 1,200,000 2,200,000 2,400,000 1,875,000 1,837,000 Units sold Revenues Variable costs Contribution margin Fixed costs Operating income $ $0 $0 Actual Results Flexible Budget Static Budget $ 0 $ For questions b., c., and d., do not use negative signs with your answers. Select either U for Unfavorable or F for Favorable using the drop down box next to each of your variance answers. b. What is the static-budget variance of revenues? C. What is the flexible budget variance for variable costs? <¶► 0 0 $ 0 0 0 0 $ ◆ 0 0 $ 0 0 0 0 $ d. What is the flexible budget variance for fixed costs? 0 0 0 0 0 0arrow_forward

- Mailings Review View Help Tell me what you want to do AB-T A. G II M Paragraph 5 Styles Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: cost formulas Direct labor AaBbCcDd AaBbCcDd AaBbC AaBbCct AaB AaBbCcD AaBbCcDd Ac 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Subtle Em... E $16.20q Indirect labor $4,600+ $1.50q Utilities $5,200 + $0.40q Supplies Equipment depreciation Factory rent $8,400 Property taxes $2,800 Factory administration $13,300 + $0.60q The Production Department planned to work 4,000 labor-hours in March; however, it actually worked 3,800 labor-hours during the month. Its actual costs incurred in March are listed below: Actual Cost Incurred in March Direct labor $ 63,120 Indirect labor $9,780…arrow_forwardNonearrow_forwardProblem 16-75 (Algo) Comprehensive Variance Problem (LO 16-5, 6) Robinwood Fixtures manufactures two products, K4 and X7. The company prepares its master budget on the basis of standard costs. The following data are for September: Standards Direct naterials Direct labor Variable overhead (per direct labor-hour), Fixed overhead (per month) Expected activity (direct labor-hours)) Actual results Direct material (purchased and used) Direct labor Variable overhead Fixed overhead Units produced (actual) Direct materials Direct labor Variable overhead Fleed overhead Price Variance K4 0.75 pounds at $7.00 per pound 1.25 hours at $25.00 per hour $.20.20 $ 415,200 17,300 Efficiency Variance 9,880 pounds at $6.40 per pound 14,750 hours at $25.30 per hour $ 311,060 $ 381,740 Required: a. Prepare a variance analysis for each variable cost for each product. b. Prepare a fixed overhead variance analysis for each product Note: For all requirements, Do not round intermediate calculations. Indicate the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education