FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Intermediate Accoungting ll ch 16

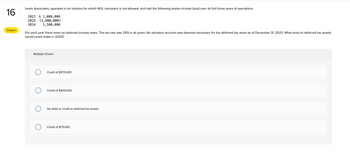

Transcribed Image Text:16

Skipped

Lewis Associates. operates in an industry for which NOL carryback is not allowed, and had the following pretax income (loss) over its first three years of operations

2022 $1,000,000

2023 (1,800,000)

2024 1,500,000

For each year there were no deferred income taxes. The tax rate was 25% in all years. No valuation account was deemed necessary for the deferred tax asset as of December 31, 2023. What entry to deferred tax assets

would Lewis make in 2024?

Multiple Choice

O

O

Credit of $375,000

Credit of $300,000

No debit or credit to deferred tax assets

Credit of $75,000

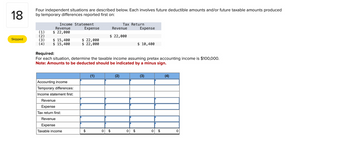

Transcribed Image Text:18

Skipped

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced

by temporary differences reported first on:

(1)

(2)

(3)

(4)

Income Statement

Revenue

$ 22,000

$ 15,400

$ 15,400

Accounting income

Temporary differences:

Income statement first:

Expense

Revenue

Expense

Tax return first:

Revenue

Expense

Taxable income

$ 22,000

$ 22,000

Required:

For each situation, determine the taxable income assuming pretax accounting income is $100,000.

Note: Amounts to be deducted should be indicated by a minus sign.

$

Tax Return

Revenue

$ 22,000

(1)

0 $

(2)

Expense

0 $

$ 10,400

(3)

0 $

(4)

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Explain consignment arrangement with example.arrow_forwardQuestion 3: When is an employer NOT required to file a quarterly Form 941? Answer: А. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,000 В. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,500 С. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $2,500 D. When annual tax liability for federal income, Social Security, and Medicare tax is less than $100,000arrow_forwardPrior (Past) service cost is expensed immediately using a. U.S. GAAP. b. IFRS. c. Both U.S. GAAP and IFRS. d. Neither U.S. GAAP nor IFRS.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education