FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

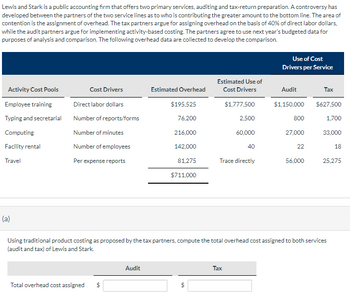

Transcribed Image Text:Lewis and Stark is a public accounting firm that offers two primary services, auditing and tax-return preparation. A controversy has

developed between the partners of the two service lines as to who is contributing the greater amount to the bottom line. The area of

contention is the assignment of overhead. The tax partners argue for assigning overhead on the basis of 40% of direct labor dollars,

while the audit partners argue for implementing activity-based costing. The partners agree to use next year's budgeted data for

purposes of analysis and comparison. The following overhead data are collected to develop the comparison.

Activity Cost Pools

Employee training

Typing and secretarial

Computing

Facility rental

Travel

(a)

Cost Drivers

Direct labor dollars

Number of reports/forms

Number of minutes

Number of employees

Per expense reports

Total overhead cost assigned $

Estimated Overhead

Audit

$195,525

76,200

216,000

142,000

81,275

$711,000

Estimated Use of

Cost Drivers

$1,777,500

2,500

60,000

40

Trace directly

Use of Cost

Drivers per Service

Tax

Audit

$1,150,000

800

27,000

22

56,000

Tax

Using traditional product costing as proposed by the tax partners, compute the total overhead cost assigned to both services

(audit and tax) of Lewis and Stark.

$627,500

1,700

33,000

18

25,275

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with coat accounting. thanks.arrow_forwardBanc Corporation Trust is considering either a bank-wide overhead rate or department overhead rates to allocate $396,000 of indirect costs. The bank-wide rate could be based on either direct labor-hours (DLH) or the number of loans processed. The departmental rates would be based on direct labor-hours for Consumer Loans and a dual rate based on direct labor-hours and the number of loans processed for Commercial Loans. The following information was gathered for the upcoming period: Department Consumer DLH 16,000 9,000 Loans Processed Direct Costs 700 300 $ 280,000 $ 180,000 Commercial If Banc Corporation Trust uses a bank-wide rate based on the number of loans processed, what would be the total costs for the Consumer Department? Multiple Choice О $254,000 О $280,000 O O $576,000 $557,200 G Aarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Chirko & Partners, a Quebec-based public accounting partnership, specializes in audit services. Its job-costing system has a single direct-cost category (professional labor) and a single indirect-cost pool (audit support, which contains all costs of the Audit Support Department). Audit support costs are allocated to individual jobs using actual professional labor-hours. Chirko & Partners employs 10 professionals to perform audit services. Budgeted and actual amounts for 2017 are as follows: Budget for 2017 Professional labor compensation $975,000 Audit support department costs $675,000 Professional labor-hours billed to clients 15,000 hours Actual results for 2017 Audit support department costs $775,000 Professional labor-hours billed to clients 15,500 hours Actual professional labor cost rate $54 per hour 1. Compute the direct-cost rate and the indirect-cost rate per professional labor-hour for 2017…arrow_forwardSelect Manufacturing Co. produces three joint products and one organic waste byproduct. Assuming the byproduct can be sold to an outside party, what is the correct accounting treatment of the byproduct proceeds received by the firm? a. Apply sale proceeds on a prorated basis to the joint products’ sales. b. Use the sale proceeds to reduce the common costs in the joint production process. c. Apply the sale proceeds to the firm’s miscellaneous income account. d. Either “b” or “c” can be usedarrow_forwardGarrison Co. produces three products - X, Y, and Z - from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow. Sales Value at If Processed Further Units Produced Product Split Off Sales Value Additional Costs 40,00 80,00 X 6,000 $ $ $1,200 0 0 15,00 40,00 y 3,000 3,000 0 0 16,00 30,00 Z 1,000 1,500 0 0 The amount of joint costs allocated to product Z using the net realizable value method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar):arrow_forward

- The Josh - Lester Corporation, manufacturer of tractors and other heavy farm equipment, is organized along decentralized product lines, with each manufacturing division operating as a separate profit center. Each division manager has been delegated full authority on all decisions involving the sale of that division's output both to outsiders and to other divisions of Josh - Lester. i(Click the icon to view the information on the divisions.) Begin by calculating the contribution margin from selling units to other customers. Then calculate the net benefit (cost) to the company as a whole. (Enter a net cost using parentheses or a minus sign.) Less: The company already completed an analysis to determine if it was in its best interest to have division C purchase 1,300 units from an external supplier for $125 per unit, assuming that there are no alternative uses for internal facilities of division A. (Click the icon to view the results of the analysis.) Now, assume that division A can sell…arrow_forwardMunabhaiarrow_forwardBradbo owned two adjoining restaurants, the Pork Palace and the Chicken Hut. Each restaurant was treated as a profit center for performance evaluation purposes. Although the restaurants had separate kitchens, they shared a central baking facility. The principal costs of the baking area included materials, supplies, labor, and depreciation and maintenance on the equipment. Bradbo allocated the monthly costs of the baking facility to the two restaurants based on the number of tables served in each restaurant during the month using dual allocation and equal sharing of fixed costs. In April, the costs were $39,000, of which $20,500 were fixed. The Pork Palace served 3,830 tables, while the Chicken Hut served 5,745 tables. 1. The amount of the joint cost that should have been allocated to the Chicken Hut in April is calculated to be 2. The amount of joint cost that should have been allocated to the Pork Palace in April is calculated to bearrow_forward

- Wonkies, Inc. is a large company that owns fast-food restaurants, has a soft drink division, and a snack division. Wonkies, Inc. corporate management gives its division managers considerable operating and investment autonomy in running their divisions. Wonkies, Inc. is considering how it should compensate Mark Hamm, the general manager of the snack division. ■ Proposal 1 calls for paying Hamm a fixed salary. ■ Proposal 2 calls for paying Hamm no salary and compensating him only on the basis of the division’s RI, calculated based on operating income before any bonus payments. ■ Proposal 3 calls for paying Hamm some salary and some bonus based on RI. Q. Wonkies, Inc. competes against Galaxy Industries in the snack business. Galaxy is approximately the same size as the Wonkies snack division and operates in a business environment that is similar to Wonkies. The top management of Wonkies, Inc. is considering evaluating Hamm on the basis of his snack division’s RI minus Galaxy’s RI. Hamm…arrow_forwardExpress Delivery Company (EDC) is considering outsourcing its Payroll Department to a payroll processing company for an annual fee of $223,200. An internally prepared report summarizes the Payroll Department’s annual operating costs as follows: Supplies $ 33,200 Payroll clerks’ salaries 123,200 Payroll supervisor’s salary 61,200 Payroll employee training expenses 13,200 Depreciation of equipment 23,200 Allocated share of common building operating costs 18,200 Allocated share of common administrative overhead 31,200 Total annual operating cost $ 303,400 EDC currently rents overflow office space for $39,200 per year. If the company closes its Payroll Department, the employees occupying the rented office space could be brought in-house and the lease agreement on the rented space could be terminated with no penalty. If the Payroll Department is outsourced the payroll clerks will not be retained; however, the supervisor would be transferred to the company’s Human…arrow_forwardGrael Technology has two divisions, Consumer and Commercial, and two corporate service departments, Tech Support and Purchasing. The corporate costs for the year ended December 31, 20Y7, are as follows: Tech Support Department $336,000 Purchasing Department 67,500 Other corporate administrative costs 448,000 Total corporate costs $851,500 The other corporate administrative costs include officers’ salaries and miscellaneous smaller costs required by the corporation. The Tech Support Department allocates the divisions for services rendered, based on the number of computers in the department, and the Purchasing Department allocates divisions for services, based on the number of purchase orders for each department. The usage of service by the two divisions is as follows: Tech Support Purchasing Consumer Division 300 computers 1,800 purchase orders Commercial Division 180 2,700 Total 480 computers 4,500 purchase orders The service department allocations…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education