ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

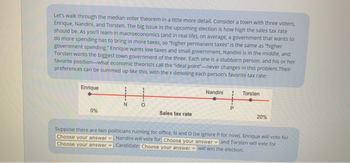

Transcribed Image Text:Let's walk through the median voter theorem in a little more detail. Consider a town with three voters,

Enrique, Nandini, and Torsten. The big issue in the upcoming election is how high the sales tax rate

should be. As you'll learn in macroeconomics (and in real life), on average, a government that wants to

do more spending has to bring in more taxes, so "higher permanent taxes" is the same as "higher

government spending." Enrique wants low taxes and small government, Nandini is in the middle, and

Torsten wants the biggest town government of the three. Each one is a stubborn person, and his or her

favorite position-what economic theorists call the "ideal point-never changes in this problem. Their

preferences can be summed up like this, with the x denoting each person's favorite tax rate:

Enrique

0%

N

O

Sales tax rate

Nandini

P

Torsten

20%

Suppose there are two politicians running for office, N and O (so ignore P for now). Enrique will vote for

Choose your answer. Nandini will vote for Choose your answer and Torsten will vote for

Choose your answer. Candidate Choose your answer will win the election.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The Nobel prize winning economist Milton Friedman liked to tell this story: There once was a town where thanks to expansive fiscal policy in Washington, the town had more money to fix roads and build bridges. The construction workers on those projects splurged on steak dinners every Friday, the meat for which they bought at the local butcher shop. The butcher was thrilled by increased sales of meat, as was the butcher's wholesale supplier. In fact, the butcher's supplier tried to put in bigger orders but it wasn't possible to buy more because the slaughterhouses were caught short, too. The result? Higher prices for meat got passed up from the slaughterhouse to the wholesaler to the butcher to the construction workers. With the possible exception of the owners of cattle, nobody was happy. Now a news reporter heard about surging steak prices in the town and decided to write a story about what was happening. Since the initial increase in meat prices was seen in the price of meat sold by…arrow_forwardsuppose Lena makes $50000 per year and Mariah makes $65000 per year. If each pays $5000 in taxes: What would their individual tax rates be? Would you describe this tax system as proportional, progressive, or regressive?arrow_forwardA government collects $175 billion quarterly in tax revenue. Each year it allocates $70 billion to the justice system and $130 billion for its own administrative costs. What percentage of annual tax revenue is allocated to these two categories of government spending? Group of answer choices 37.15% 28.57% 17.51% 27.58%arrow_forward

- Which one of the following statements about our federal, state and local tax systems is true? All of our taxes are highly regressive Our Federal taxes tend to be more progressive than our State and local taxes. Our Federal taxes tend to be less progressive than our State and local taxes. Our Federal taxes tend to be less progressive than our State taxes,but, our local taxes are the most progressive of all taxes.arrow_forwardNot sure if what I have is correct and confused on how to solve the restarrow_forwardHow can tax incidences have a positive and negative impact on the economy?arrow_forward

- explain step by step, how is it like to graph?arrow_forwardSuppose there are five voters. Their preferences for the amount the federal government should spend to stimulate the economy are shown in the figure to the right. According to the median voter theorem, in a vote, how much will the federal government spend to stimulate the economy? The federal government will spend S billion. (Enter your response as an integer.) 1200 1100 1000- 900- 800- 700- 600 2500- 400- 300- 200- 100- Greg kelly Christina Luisarrow_forwardIs the fiscal policy in South Africa sufficiently geared towards combating poverty?Discuss critically in an essay by using graphs in the answer as wellarrow_forward

- How does a "progressive tax system" differ from a "regressive tax system" in terms of income distribution? A) A progressive tax system imposes higher tax rates on higher incomes, while a regressive tax system imposes higher tax rates on lower incomes. B) A progressive tax system imposes a uniform tax rate on all incomes, while a regressive tax system adjusts rates based on economic cycles. C) A progressive tax system reduces income inequality by taxing higher incomes at higher rates, while a regressive tax system can increase inequality by placing a heavier burden on lower incomes. D) A progressive tax system exempts lower incomes from taxation, while a regressive tax system taxes all incomes at the same rate.arrow_forwardExplain the rationale behind the prevalence of electoral cycles in the world in macroeconomicsarrow_forwardIn the classical budgeting era from WWII to the early 70s, most citizens agreed on public policy and where to spend tax dollars? True or Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education