ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

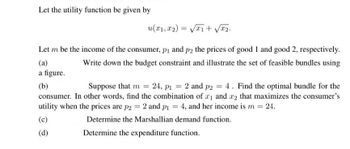

Transcribed Image Text:Let the utility function be given by

u(x1, x2) = √√x1 + √√x₂.

Let m be the income of the consumer, p₁ and p2 the prices of good 1 and good 2, respectively.

Write down the budget constraint and illustrate the set of feasible bundles using

(a)

a figure.

(b)

Suppose that m = 24, p₁ = 2 and p2 = 4. Find the optimal bundle for the

consumer. In other words, find the combination of ₁ and 2 that maximizes the consumer's

utility when the prices are p2 = 2 and p₁ = 4, and her income is m = 24.

(c)

Determine the Marshallian demand function.

(d)

Determine the expenditure function.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Help!arrow_forwardA consumer’s utility only depends on the consumption of goods A and B according to the following Cobb-Douglass utility function: U(A, B) = A1/4 B 3/4. The price of goods A and B are $20 and $40, respectively. The consumer has a budget of $1200 that he can use to consume the two goods. a. Write down the budget constraint and plot it. b. Calculate the optimal bundle and maximized utility for the consumer. c. A new tax of $10 is imposed on the price of good B. Compute the new optimal bundle of good A and B for the same consumer. What is the utility loss due to the tax? d. Show that the consumer would prefer a lump sum income tax that raises the same revenue as the tax on good B. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardSuppose the utility function of U(x1, x2) = x11/2x21/2 and the budget constraint of p1x1+p2x2=m. Let’s assume that p1=$1.5, p2=$2, and m=$60. Find the optimal bundle. Also, specify the optimal bundle.arrow_forward

- 2) Which of the following utility functions represent the same preferences? Explain. a) U (x₁, x₂) = X₁ X₂ b) W (x₁, x₂) = 5lnx₁ +5lnx₂ c) V (x₁, x₂) = x₁¹/3x₂ ¹/3 - 0.8 d) Z(x₁, x₂) = 0.5x₁ + 0.5x₂arrow_forwardA consumer’s preferences over pizza (x) and steak (y) are given by u(x,y) = x2y (HINT: MUx = 2xy and MUy = x2) and his income is I = $120 and py = $1. (a) Calculate his optimal bundle when pX = $8 (call this bundle A) and separately when pX = $1 (call this point C). (b) Finding the decomposition bundle B, calculate the income and substitution effects on the amount of pizza of a decrease in the price of pizza from pX = $8 down to pX = $1. (c) Forget about the decomposition bundle and the two effects. In (a), the price of pizza decreases, hence the agent ends up better off. Let’s quantify how much “better off” the agent becomes after this price drop, in dollars. For this, instead of the price drop, suppose the agent is given some money $m and he optimize utility with this additional gift included to his budget. What should m be, so that his optimal utility with his expanded budget is exactly equal to his utility at the bundle C (the bundle he chooses optimally when pizza price drops to…arrow_forwardA consumer has utility (see image) on ice creams (x) and cakes (y). (a) Are the indifference curves bowed towards the origin? (b) Derive his demand function (as a function of prices px, py and budget I) for ice cream (x). (c)(Looking at the demand function you found in (b), Is ice cream a normal good? Are ice cream and cakes substitutes or complements? Calculate the income elasticity of market demand at the point px = 2, py = 1 and I = 12.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education