ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

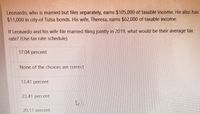

Transcribed Image Text:Leonardo, who is married but files separately, earns $105,000 of taxable income. He also has

$11,000 in city of Tulsa bonds. His wife, Theresa, earns $62,000 of taxable income.

If Leonardo and his wife file married filing jointly in 2019, what would be their average tax

rate? (Use tax rate schedule)

17.04 percent

None of the choices are correct

13.41 percent

23.41 percent

20.11 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In your current job, you earn $55,000. You take the standard deduction of $12,200. You have an offer of a new job working for a different employer. Your salary would go up by $5,000. Given your current taxable income, what is your marginal tax rate? For taxable income over... $0 $9,700 $39,475 $84,200 $160,725 $204,100 $510,300 22% O 12% O 10% O 24% ... but not over... $9,700 $39,475 $84,200 $160,725 $204,100 $510,300 ...the marginal tax rate is: 10% 12% 22% 24% 32% 35% 37%arrow_forwardFirms A and B are identical except for their capital structure. A carries no debt, whereas B carries £60m of debt on which it pays a 5% interest rate. Assume no transaction costs, no taxes and risk-free debt. The relevant numbers are provided in the following table (in £ m): A B Value of Firm 100 120 Debt 0 60 Equity 100 60 Projected earnings before interest 12 12 Interest payment 0 3 Interest rate Not Applicable 5% Please answer the following questions a) "The situation described in the table is consistent with the absence of arbitrage opportunities". True or False (T/F)? b) Which one of the two firms is relatively overvalued (A/B)? c) "B's shares carry more risk than A's shares". True or False (T/F)? d) What is the return to an investor holding a 10% stake in B (in £ '000)? e) Consider an investor who wants to purchase a 20% stake in A. If he wished to replicate B's capital structure through homemade leverage,…arrow_forwardCalculate Your Taxes To find your net pay, you'll need to first calculate your taxes. Start period 02 | 01|2019 End period 02 | 15| 2019 Find the tax percentages for each type of tax on your pay stub and insert them here. Then, press the calculate button when you're ready. Gross Pay $1,837.00 Earnings Taxes Deductions FEDERAL % of $1,837.00 $1,837.00 Federal (8.24%) FICA Medicare (1.45%) FICA MEDICARE % of $1,837.00 FICA Social Security (6.20%) FICA SOCIAL SECURITY % of $1,837.00 State - OK (3.86%) STATE % of $1,837.00 Total Disclaimer: Tax numbers are for illustrative purposes only. Net Pay Calculatearrow_forward

- What are the key taxes levied which can be collected by state, territory, and local government in Australia? How is GST revenue shared with the states and territories?arrow_forwardWhich of the following accounts allows investors to contribute before-tax dollars, and once the assets are in the account allows for tax-deferred growth of assets? A. Bank savings account B. Roth 401(k)/Roth 403(b) C. 401(k)/403(b)arrow_forwardThe government implements a negative income tax plan with a guaranteed minimum income of $5,000 and a phase-out rate for payments of 50%. Complete the following table by calculating the negative tax and total after-tax income for each family income given. (Note: Suppose that any income above $10,600 would pay a positive tax.) Family Income (Dollars) Negative Tax Total After-Tax Income (Dollars) (Dollars) 0 2,600 4,600 6,600 8,600 10,600arrow_forward

- Leno (married) had the following at the time of his death: What is the net taxable estate?arrow_forwardWhich is smaller in value, a $7,500 tax deduction or a $7,500 tax credit? Explain why. Please No more than three sentence. keep it simple.arrow_forwardDiscuss whether any of the following individuals are entitled to an office-in-home deduction: a. Maggie is a self-employed management consultant who maintains an office in her home exclusively used for client meetings and other business-related activities. Maggie has no other place of business and her office is the most significant place for her business. She has substantial income from the consulting practice. b. C. Marty is a college professor who writes research papers for academic journals in his office at home which is used exclusively for this purpose. Although Marty has an office at his place of employment, he finds it very convenient to maintain an office at home to avoid distractions from students and colleagues. Marty receives no income from the publication of the research articles for the year in question. Bobby operates his own sole proprietorship as an electrician. He maintains an office at home where he keeps his books, takes phone calls from customers, and does the…arrow_forward

- The homestead exemption is a legal regime that protects the equity that homeowners have in their principal residences from general liens and property taxes. The protection varies by state. What is the maximum equity that a general lienholder could attach for a property valued at $200,000 and a mortgage balance of $145,397 in a state with a $25,000 homestead exemption? (Input your answer rounded to the nearest whole dollar and without the $ sign, e.g., 1000)arrow_forwardRoberto Clemente's marginal federal income tax rate is 20%. How much money will Roberto save in federal income taxes if he deposits the $13,675 in a tax-deferred retirement account instead of depositing it in a taxable account? Taxes round to the dollararrow_forward1. What is is the taxable equivalent yield (TEY) on the following muni bonds, given a 30% tax rate? Price Semi-annual coupon rate 104.25 Price 6% Annual coupon rate 100 Face value Face value Maturity 10 Maturity TEY TEY 100 Price 5% Semi-annual coupon rate 100 Face value 7 Maturity TEY 900 Price 4% Zero 1000 Face 3 coupon value Maturity TEY 896.65 1000 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education