FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

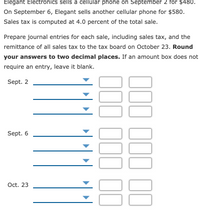

Elegant Electronics sells a cellular phone on September 2 for $480. On September 6, Elegant sells another cellular phone for $580. Sales tax is computed at 4.0 percent of the total sale.

Prepare

| Sept. 2 | fill in the blank 2 | fill in the blank 3 | |

| fill in the blank 5 | fill in the blank 6 | ||

| fill in the blank 8 | fill in the blank 9 | ||

| Sept. 6 | fill in the blank 11 | fill in the blank 12 | |

| fill in the blank 14 | fill in the blank 15 | ||

| fill in the blank 17 | fill in the blank 18 | ||

| Oct. 23 | fill in the blank 20 | fill in the blank 21 | |

| fill in the blank 23 | fill in the blank 24 |

Transcribed Image Text:Elegant Electronics sells a cellular phone on September 2 for $480.

On September 6, Elegant sells another cellular phone for $580.

Sales tax is computed at 4.0 percent of the total sale.

Prepare journal entries for each sale, including sales tax, and the

remittance of all sales tax to the tax board on October 23. Round

your answers to two decimal places. If an amount box does not

require an entry, leave it blank.

Sept. 2

Sept. 6

Oct. 23

000 100 11

000 1

00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1arrow_forwardElegant Electronics sells a cellular phone on September 2 for $393. On September 6, Elegant sells another cellular phone for $360. Sales tax is computed at 4.1% of the total sale. What is the total cash collected rounded to the nearest penny, two decimals?arrow_forwardElegant Electronics sells a cellular phone on September 2 for $460. On September 6, Elegant sells another cellular phone for $640. Sales tax is computed at 5.0 percent of the total sale. Prepare journal entries for each sale, including sales tax, and the remittance of all sales tax to the tax board on October 23. Round your answers to two decimal places. If an amount box does not require an entry, leave it blank. Sept. 2 fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 fill in the blank 8 fill in the blank 9 Sept. 6 fill in the blank 11 fill in the blank 12 fill in the blank 14 fill in the blank 15 fill in the blank 17 fill in the blank 18 Oct. 23 fill in the blank 20 fill in the blank 21arrow_forward

- Accounting Question: The following are independent situations: Record the sales transactions and related taxes for each client. Show steps please. 1. Max rang up $14,000 of sales, plus HST of 13%, on it's cash register on April 10. 2. Quince rang up $35,400 of sales, before sales taxes, on its cash register on April 21. The company charges 5% GST and No PST. 3. Jace charges 5% GST and 7% PST on all sales. On April 27, the company collected $23,200 sales in cash plus sales taxes.arrow_forwardElegant Electronics sells a cellular phone on September 2 for $491. On September 6, Elegant sells another cellular phone for $474. Sales tax is computed at 6.7% of the total sale. What is the total cash collected rounded to the nearest penny, two decimals?arrow_forwardHardevarrow_forward

- For the accounts receive and interest revenue I for march 20, I got 13, however its wrong, can you tell me what I am doing wrong? our answer is partially correct. Try again. On January 10, Molly Amise uses her Windsor, Inc. credit card to purchase merchandise from Windsor, Inc. for $1,500. On February 10, Molly is billed for the amount due of $1,500. On February 12, Molly pays $1,300 on the balance due. On March 10, Molly is billed for the amount due, including interest at 1% per month on the unpaid balance as of February 12.Prepare the entries on Windsor, Inc.’s books related to the transactions that occurred on January 10, February 12, and March 10. (Omit cost of goods sold entries.) (Round answers to 0 decimal places, e.g. 825. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit choose a transaction…arrow_forwardNov. 1 Dollar Store purchases merchandise for $1,300 on terms of 2/5, n/30, FOB shipping point, invoice dated November 1. 5 Dollar Store pays cash for the November 1 purchase. 7 Dollar Store discovers and returns $150 of defective merchandise purchased on November 1, and paid for on November 5, for a cash refund. 10 Dollar Store pays $65 cash for transportation costs for the November 1 purchase. 13 Dollar Store sells merchandise for $1,404 with terms n/30. The cost of the merchandise is $702. 16 Merchandise is returned to the Dollar Store from the November 13 transaction. The returned items are priced at $285 and cost $143; the items were not damaged and were returned to inventory.arrow_forwardPlease read the questions carefully the First question is asking for journal entry.arrow_forward

- On Deck Sports Memorabilia store sells a Babe Ruth rookie card for $3,100 on account. If the sales tax on the sale is 5%, the journal entry to record the sale would include: Multiple Choice a debit to Accounts Receivable for $3,255 a debit to Sales Tax Payable for $155 a debit to Sales for $3,100 a credit to Sales for $3,255arrow_forwardCheyenne Supply does not segregate sales and sales taxes at the time of sale. The register total for March 16 is $10,812. All sales are subject to a 6% sales tax. (a1) Compute sales taxes payable. Sales taxes payable $ eTextbook and Media List of Accounts Save for Later Attempts: unlimited Submit Answer (a2)arrow_forwardIvanhoe Auto Supply does not segregate sales and sales taxes at the time of sale. The register total for March 16 is $18,900. All sales are subject to a 5% sales tax.(a1) Compute sales taxes payable. Sales taxes payable (a2) Give the journal entry to record sales taxes payable and sales revenue. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit March 16arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education