FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

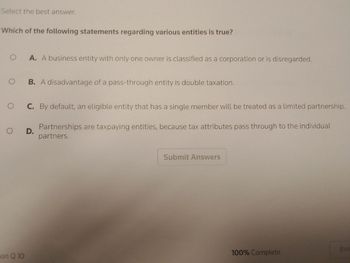

Transcribed Image Text:Select the best answer.

Which of the following statements regarding various entities is true?

O

O

O

A. A business entity with only one owner is classified as a corporation or is disregarded.

ion Q 10

B. A disadvantage of a pass-through entity is double taxation.

C. By default, an eligible entity that has a single member will be treated as a limited partnership.

Partnerships are taxpaying entities, because tax attributes pass through to the individual

partners.

O D.

Submit Answers

100% Complete

Exit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Select the best answer. Which of the following statements regarding various entities is true? O A. A business entity with only one owner is classified as a corporation or is disregarded. O B. A disadvantage of a pass-through entity is double taxation. O C. By default, an eligible entity that has a single member will be treated as a limited partnership Partnerships are taxpaying entities, because tax attributes pass through to the individual partners. O D. Submit Answers 100% Completearrow_forwardwhich of the following statements regarding entities is true ? (a) c corporation is an incorporated entity chartered under federal law (b)an s corporation is a creature of state tax law (c)in a limited liability company none of the members bear personal liability for the debts and obligations of the entity (d)in a limited partnership the partners bear personal liability for the debts and obligations of the partnershiparrow_forwardWho is eligible to take the Section 199A qualified business income deduction? 1. C corporation on Form 1120 II. S corporation on Form 1120S III. Partnership on Form 1065 IV. Sole proprietorship on Schedule C V. Individual taxpayer on Form 1040 1 I, II, III II, III, IV Varrow_forward

- Which of the following entities is subject to double taxation? A) S Corporation B) Sole Proprietorship CI C Corporation D) Limited Liability Partnership (LLP)arrow_forwardWhich of the following legal entities are generally classified as C corporations for tax purposes? Multiple Choice Limited liability companies. S corporations. Limited partnerships. Sole proprietorships. None of the choices is correct.arrow_forwardPartnerships: a.Are not taxable entities. b.Are taxed in the same manner as individuals. c.File tax returns on Form 1041. d.File tax returns on Form 1120.arrow_forward

- Nonearrow_forwardWhich statement is true? In computing the net taxable income of a corporation availing of the optional standard deduction, the OSD shall be deducted from the total sales or revenue. A corporate taxpayer is not qualified to avail of NOLCO as this is only applicable to individual taxpayers. The income of a business partnership shall be taxed with the regular corporate income tax and the share of each partner from the income of the partnership shall be subject to the regular income tax as well. Generally, government owned or controlled corporations are taxable.arrow_forwardCheck my answer. Can a sole proprietor form as a single-member limited liability company (LLC)? If so, how would such an LLC be taxed? Under the check-the-box Regulations, an unincorporated entity with only one owner can file as an LLC and would be classified as a disregarded entity. LLC’s do not typically pay federal income taxes, but the LLC would need to report and pay employment and excise taxes.arrow_forward

- Which of the following is not true of a corporation? Oa. It may enter into binding legal contracts in its own name. Ob. It may sue and be sued. c. The acts of its owners bind the corporation. Od. It may buy, own, and sell property.arrow_forward26. The advantages of an LLC include all of the following except: A. Members are protected from personal liability for business decisions B. Sharing of profits C. Up to the members to decide who has earned what percentage of the profits or losses D. Entire net income of the LLC is subject to taxes E. Less record keeping compared to a Corporationarrow_forwardPlease do not give solution in image format ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education