FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

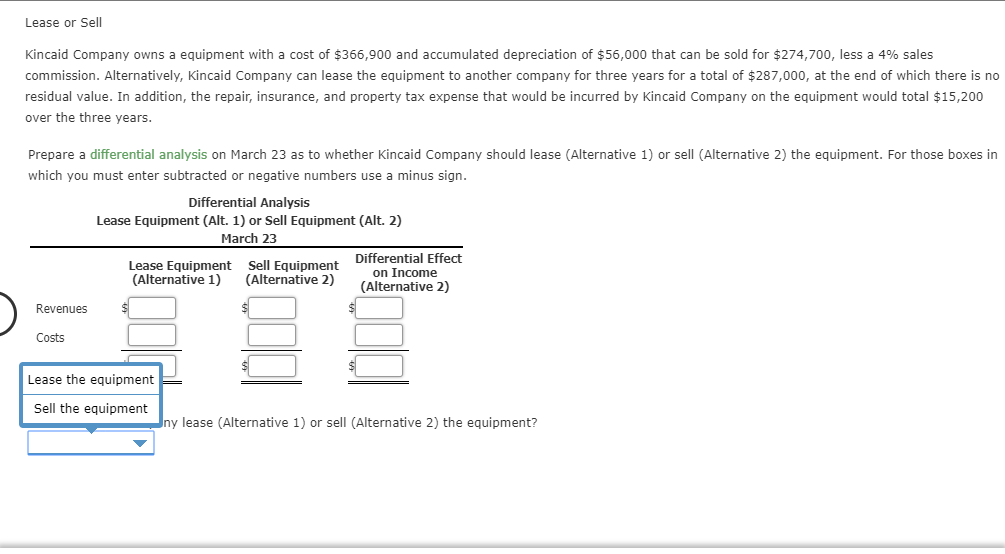

Transcribed Image Text:Lease or Sell

Kincaid Company owns a equipment with a cost of $366,900 and accumulated depreciation of $56,000 that can be sold for $274,700, less a 4% sales

commission. Alternatively, Kincaid Company can lease the equipment to another company for three years for a total of $287,000, at the end of which there is no

residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Kincaid Company on the equipment would total $15,200

over the three years.

Prepare a differential analysis on March 23 as to whether Kincaid Company should lease (Alternative 1) or sell (Alternative 2) the equipment. For those boxes in

which you must enter subtracted or negative numbers use a minus sign.

Differential Analysis

Lease Equipment (Alt. 1) or Sell Equipment (Alt. 2)

March 23

Differential Effect

on Income

(Alternative 2)

Lease Equipment

(Alternative 1)

Sell Equipment

(Alternative 2)

Revenues

Costs

$1

Lease the equipment

Sell the equipment

ny lease (Alternative 1) or sell (Alternative 2) the equipment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Kincaid Company owns equipment with a cost of $364,100 and accumulated depreciation of $53,600 that can be sold for $273,400, less a 4% sales commission. Alternatively, Kincaid Company can lease the equipment for 3 years for a total of $287,600, at the end of which there is no residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Kincaid Company on the equipment would total $14,900 over the 3-year lease. a. Prepare a differential analysis on October 29 as to whether Kincaid Company should lease (Alternative 1) or sell (Alternative 2) the equipment. If required, use a minus sign to indicate a loss. Differential Analysis Lease Equipment (Alt. 1) or Sell Equipment (Alt. 2) October 29 Lease Sell Differential Line Item Description Equipment Equipment (Alternative 1) (Alternative 2) Effects (Alternative 2) < Revenues Costs 287,600 $ 273,400 $14,200 14,900 Profit (Loss) 272,700 X Feedback Check My Work Subtract the lease costs from the lease…arrow_forwardBlossom, Inc. leases a piece of equipment to Wildhorse Company on January 1, 2025. The contract stipulates a lease term of 5 years, with equal annual rental payments of $8,880 at the end of each year. Ownership does not transfer at the end of the lease term, there is no bargain purchase option, and the asset is not of a specialized nature. The asset has a fair value of $48,000, a book value of $43,000, and a useful life of 8 years. At the end of the lease term, Blossom expects the residual value of the asset to be $12,000, and this amount is guaranteed by a third party. Assuming Blossom wants to earn a 5% return on the lease and collectibility of the lease payments is probable, record its journal entry at the commencement of the lease on January 1, 2025. (List all debit entries before credit entries. Credit account titles are automaticallyarrow_forwardPlymouth Company owns equipment with a cost of $600,000 and accumulated depreciation of $375,000 that can be sold for $300,000, less a 4% sales commission. Alternatively, Plymouth Company can lease the equipment for four years for a total of $320,000, at the end of which there is no residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Plymouth Company on the equipment would total $40,000 over the four-year lease. a. Prepare a differential analysis on August 7 as to whether Plymouth Company should lease (Alternative 1) or sell (Alternative 2) the equipment. Differential Analysis Lease Equipment (Alt. 1) or Sell Equipment (Alt. 2) August 7 LeaseEquipment(Alternative 1) SellEquipment (Alternative 2) DifferentialEffects (Alternative 2) Revenues $ $ $ Costs Profit (Loss) $ $ $ b. Should Plymouth Company lease (Alternative 1) or sell (Alternative 2) the equipment?arrow_forward

- answer in text form please (without image)arrow_forwardYokoyama Company owns a machine with a cost of $92,000 and accumulated depreciation of $18,500 that can be sold for $66,000 less a 5% sales commission. Alternatively, Yokoyama Company can lease the machine to another company for 3 years for a total of $74,000, at the end of which there is no residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Yokoyama Company on the machine would total $10,500 over the 3 years. Prepare a differential analysis on February 21 as to whether Yokoyama Company should lease (Alternative 1) or sell (Alternative 2) the machine. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Lease Machine (Alt. 1) or Sell Machine (Alt. 2) February 21 Differential Effect Lease Sell Machine Machine (Alternative 2) (Alternative 1) (Alternative 2) Revenues Costs Profit (loss) Should Yokoyama Company lease (Alternative 1) or sell (Alternative 2) the machine?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education