Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Valuation of the target

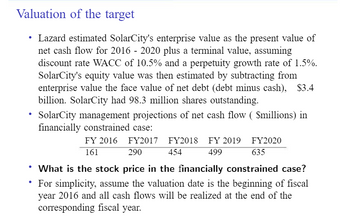

Lazard estimated SolarCity's enterprise value as the present value of

net cash flow for 2016 - 2020 plus a terminal value, assuming

discount rate WACC of 10.5% and a perpetuity growth rate of 1.5%.

SolarCity's equity value was then estimated by subtracting from

enterprise value the face value of net debt (debt minus cash), $3.4

billion. SolarCity had 98.3 million shares outstanding.

●

SolarCity management projections of net cash flow ($millions) in

financially constrained case:

FY 2016 FY2017 FY2018 FY 2019

161

290

454

499

FY2020

635

• What is the stock price in the financially constrained case?

• For simplicity, assume the valuation date is the beginning of fiscal

year 2016 and all cash flows will be realized at the end of the

corresponding fiscal year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Estimate a reasonable intrinsic stock price per share as of 01/01/2023 for private Manufacturing Company A given the information in the table below. Also assume that the company has a 10.50% weighted average cost of capital, $5,542 million excess cash holdings, $25,000 million market value of debt, 1,000 million shares outstanding, and 2.0% FCF terminal growth rate starting at the end of 2027. Assume that the cash flows depicted in the table below occur at the end of each year (i.e., -600 is FCF1 and 16,500 is FCF5).arrow_forwardOn January 1, 2009 the total assets of the Shipley Company were $ 180 million. During the year, the company plans to raise and invest $ 90 million. The firm's present capital structure is considered optimal.Assume that there is no short term debt. Long term debt 90,000,000 Common Equity 90, 000, 000 Total Liabilities and Equity 180,000,000 Project B Cash flow (2000) New bonds will have a coupon rate of 10% and will sell at par. Common stock, currently selling at $ 40 a share can be sold to net the company at$36 a share. Stockholders' required rate of return is 12%. (The next expected dividend is $1.60). Retained earnings are estimated to be $9 million. The tax rate is 40%. a. To maintain the present capital structure, how much of the capital budget must Shipley finance by equity? b. How much of the new equity funds needed must be generated internally?Externally? c. Calculate the cost of each of the equity components. d. Calculate the weighted average cost of capital.arrow_forwardWhite Lion Homebuilders has a current stock price of $27 per share, and is expected to pay a per-share dividend of $4.60 at the end of next year. The company’s earnings and dividends growth rate are expected to grow at a constant rate of 5.10% into the foreseeable future. If Alpha Moose expects to incur flotation costs of 3.90% of the value of its newly-raised equity funds, then the flotation-adjusted (net) cost of its new common stock (rounded to two decimal places) should be _____? (22.83%, 21.69%, 18.26%, or 26.25%) Please answer fast I give you like.arrow_forward

- Notes for 2024: Sales are estimated to be $85,000 in 2024 Assume the following: COGS are Variable $2000 of the Operating Expenses are Fixed Depreciation and the Remainder of the Operating Expenses are Fixed The firm will maintain its dividend payout ratio this year Cash, Accounts Receivable, Inventories, Net Plant, Accounts Payable and Accrued Payables are Spontaneous Market Securities, Bonds Payable and Common Stock are Discretionary $500 of Bonds Payable are Current and Will be Repaid at the Beginning of the Year Below is the 2023 Income Statement and Balance Sheet data you will be using to complete your forecast. Income Statement For the Year Ended December 31, 2023 Sales 70,000 COGS 45,000 Gross Profit 25,000 Operating Expenses 8,000 Depreciation 5,000 13,000 EBIT 12, 000 Interest Expense 1,300 EBT 10, 700 Tax Expense 2, 247 Earning After Taxes 8, 453 Dividends 3,000 Addition to Retained Earnings 5, 453 Balance Sheet December 31, 2023 Cash 8, 100 Marketable Securities 2,000…arrow_forwardDyrdek Enterprises has equity with a market value of $12.6 million and the market value of debt is $4.45 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.9 percent. The new project will cost $2.56 million today and provide annual cash flows of $666,000 for the next 6 years. The company's cost of equity is 11.79 percent and the pretax cost of debt is 5.06 percent. The tax rate is 24 percent. What is the project's NPV? Multiple Choice $208,195 $194,561 $536,049 $183,363 $364,858arrow_forwardReynolds Construction's current value of operations is $750 million based on the free cash flow valuation model. Its balance sheet shows $50 million of short-term investments that are unrelated to operations, and $300 million of total debt. What is the best estimate for the firm's value of equity, in millions?.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education