FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

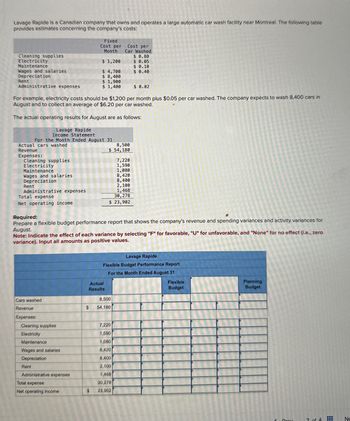

Transcribed Image Text:Lavage Rapide is a Canadian company that owns and operates a large automatic car wash facility near Montreal. The following table

provides estimates concerning the company's costs:

Fixed

Cost per

Month

Cost per

Car Washed

Cleaning supplies

$ 0.80

Electricity

$ 1,200

$ 0.05

Maintenance

$ 0.10

Wages and salaries

$ 4,700

$ 0.40

Depreciation

$ 8,400

Rent

$ 1,900

Administrative expenses

$ 1,400

$ 0.02

For example, electricity costs should be $1,200 per month plus $0.05 per car washed. The company expects to wash 8,400 cars in

August and to collect an average of $6.20 per car washed.

The actual operating results for August are as follows:

Lavage Rapide

Income Statement

For the Month Ended August 31

Actual cars washed

Revenue

Expenses:

Cleaning supplies

Electricity

Maintenance

Wages and salaries

Depreciation

Rent

Administrative expenses

Total expense

Net operating income

Required:

8,500

$ 54,180

7,220

1,590

1,080

8,420

8,400

2,100

1,468

30,278

$ 23,902

Prepare a flexible budget performance report that shows the company's revenue and spending variances and activity variances for

August.

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero

variance). Input all amounts as positive values.

Lavage Rapide

Flexible Budget Performance Report

For the Month Ended August 31

Cars washed

Revenue

Actual

Results

8,500

$

54,180

Expenses:

Cleaning supplies

7,220

Electricity

1,590

Maintenance

1,080

Wages and salaries

8,420

Depreciation

8,400

Rent

2,100

Administrative expenses

1,468

Total expense

30,278

Net operating income

$

23,902

Flexible

Planning

Budget

Budget

Prov

2 of 4

Ne

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education