Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

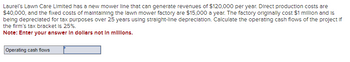

Transcribed Image Text:**Title:** Understanding Operating Cash Flows: A Case Study

**Scenario:**

Laurel's Lawn Care Limited has launched a new mower line with the potential to generate annual revenues of $120,000. The project involves several costs and considerations:

- **Direct Production Costs:** $40,000 per year

- **Fixed Maintenance Costs:** $15,000 per year for the factory

- **Initial Factory Cost:** $1 million

- **Depreciation:** The factory is depreciated over 25 years using straight-line depreciation.

**Financial Task:**

Calculate the operating cash flows for the project, considering the firm's tax bracket is 25%.

**Note:** Enter your answer in dollars, not in millions.

**Interactive Element:**

- A text box is provided for entering the calculated operating cash flows.

This case study provides a practical example for understanding how to compute operating cash flows by incorporating revenue, costs, depreciation, and tax considerations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- coparrow_forwardAn investment of $120,000 with a service life of 12 years is being considered. The expected revenues are provided in the cash flow diagram below. The company would like to perform an after-tax calculation to see if the investment is a good one. The company uses an after tax MARR of 8% and has a tax rate of 45%. The CCA depreciation rate for this type of investment is 20% and there would be a salvage value of $14,400 at the end of the 12 years. 0 i = 8% 35,000 Salvage = 14,400 25,000 Years 8 12 ▼ 120,000 What is the after tax annual worth of the investment? Do you recommend investing?arrow_forwardThe Wet Corp. has an investment project that will reduce expenses by $30,000 per year for 3 years. The project's cost is $35,000. If the asset is part of the 3-year MACRS category (33.33% first year depreciation) and the company's combined tax rate is 33%, what is the cash flow from the project in year 1? (Do not round intermediate calculations. Round your answer to the nearest dollar amount.) Multiple Choice $23,400 $24,730 $23,950 $25,410arrow_forward

- Gluon Incorporated is considering the purchase of a new high pressure glueball. It can purchase the glueball for $150,000 and sell its old low-pressure glueball, which is fully depreciated, for $26,000 The new equipment has a 10-year useful life and will save $34,000 a year in expenses before tax. The opportunity cost of capital is 11%, and the firm's tax rate is 21%. What is the equivalent annual saving from the purchase if Gluon can depreciate 100% of the investment immediately. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Answer is complete but not entirely correct. Equivalent annual savings $ 16,934.51arrow_forwardWhich of the following is TRUE? O An American call option on a stock should never be exercised early O An American call option on a stock should be exercised early when dividends are expected O It can sometimes be optimal to exercise early an American call option on a stock even when no dividends are expected and there is no liquidity or portfolio rebalancing need. O An American call option on a stock should never be exercised early when no dividends are expected << Previous Next ▸arrow_forwardfirm is considering purchasing a machine that costs $77,000. It will be used for six years, and the salvage value at that time is expected to be zero. The machine will save $41,000 per year in labor, but it will incur $16,000 in operating and maintenance costs each year. The machine will be depreciated according to five-year MACRS. The firm's tax rate is 35%, and its after-tax MARR is 18%. What is the present worth of the project?arrow_forward

- Laurel’s Lawn Care Limited has a new mower line that can generate revenues of $132,000 per year. Direct production costs are $44,000, and the fixed costs of maintaining the lawn mower factory are $17,000 a year. The factory originally cost $1.10 million and is being depreciated for tax purposes over 25 years using straight-line depreciation. Calculate the operating cash flows of the project if the firm’s tax bracket is 25%. Operating Cash Flow = _________arrow_forwardMunch N' Crunch Snack Company is considering two possible investments: a delivery truck or a bagging machine. The delivery truck would cost $43,056 and could be used to deliver an additional 95,000 bags of pretzels per year. Each bag of pretzels can be sold for a contribution margin of $0.45. The delivery truck operating expenses, excluding depreciation, are $1.35 per mile for 24,000 miles per year. The bagging machine would replace an old bagging machine, and its net investment cost would be $61,614. The new machine would require three fewer hours of direct labor per day. Direct labor is $18 per hour. There are 250 operating days in the year. Both the truck and the bagging machine are estimated to have 7-year lives. The minimum rate of return is 13%. However, Munch N' Crunch has funds to invest in only one of the projects. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 0.943 0.909 0.893 0.870 0.833 1.833 1.736 1.690 1.626 1.528 2.673 2.487 2.402 2.283…arrow_forwardThe Sip & Dip Donut company is considering the acquisition of a new automatic donut dropper for $600,000. The machine will have a six-year life and will produce before tax cash savings of $200,000 each year. The asset is to be depreciated using the straight-line method with no salvage value. The company's tax rate is 40 percent. What is the after-tax net cash inflow on the investment?arrow_forward

- Laurel’s Lawn Care Limited has a new mower line that can generate revenues of $120,000 per year. Direct production costs are $40,000, and the fixed costs of maintaining the lawn mower factory are $15,000 a year. The factory originally cost $1 million and is being depreciated for tax purposes over 25 years using straight-line depreciation. Calculate the operating cash flows of the project if the firm’s tax bracket is 25%.arrow_forwardThe Wet Corporation has an investment project that will reduce expenses by $20,000 per year for 3 years. The project's cost is $25,000. If the asset is part of the 3-year MACRS category (33.33% first year depreciation) and the company's combined tax rate is 35%, what is the cash flow from the project in year 1 ?arrow_forwardA project requires the purchase of machinery for $40.000 The machinery belongs in a 20% CCA class and will have a salvage value of $4,000 at the end of the 4 year project. It will require a net working capital investment of $2,000 up-front, and the net working capital is recovered at the end of the project. The firm has a tax rate of 35% and a required return of 10%. The project generates annual before-tax sales less cash costs equal to $15,000 in each of years 1 to 4. What is the project's NPV? Multiple Choice O O O O $2124 $8.272 $881 $1169arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education