FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

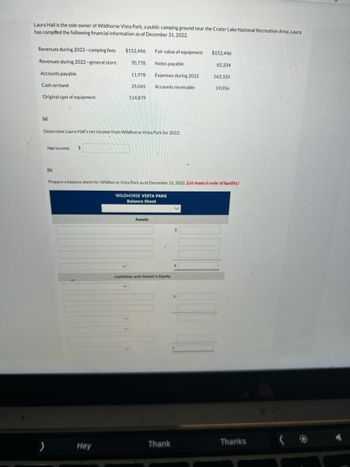

Transcribed Image Text:Laura Hall is the sole owner of Wildhorse Vista Park, a public camping ground near the Crater Lake National Recreation Area. Laura has compiled the following financial information as of December 31, 2022.

### Financial Information:

- **Revenues during 2022 – Camping Fees:** $152,446

- **Revenues during 2022 – General Store:** $70,778

- **Accounts Payable:** $11,978

- **Cash on Hand:** $25,045

- **Original Cost of Equipment:** $114,879

- **Fair Value of Equipment:** $152,446

- **Notes Payable:** $65,334

- **Expenses during 2022:** $163,335

- **Accounts Receivable:** $19,056

### Tasks:

#### (a) Determine Laura Hall’s Net Income from Wildhorse Vista Park for 2022.

- **Net Income:** ___________

#### (b) Prepare a Balance Sheet for Wildhorse Vista Park as of December 31, 2022.

**Assets:**

- List assets in order of liquidity in the provided fields.

**Liabilities and Owner’s Equity:**

- Complete the corresponding fields to balance the sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- .arrow_forwardRequired information [The following information applies to the questions displayed below.] Ryan is self-employed. This year Ryan used his personal auto for several long business trips. Ryan paid $2,080 for gasoline on these trips. His depreciation on the car if he was using it fully for business purposes would be $4,800. During the year, he drove his car a total of 12,600 miles (a combination of business and personal travel). Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. a. Ryan can provide written documentation of the business purpose for trips totaling 2,520 miles. What business expense amount can Ryan deduct (if any) for these trips? Maximum deductible amountarrow_forwardJustine Kofos purchased a house for $700,000 in Victoria for. The stamp duty payable is : Select one: a. $2,870 b. $44,870 c. $37,070 d. $26,990arrow_forward

- Required information [The following information applies to the questions displayed below.] Calvin reviewed his canceled checks and receipts this year (2023) for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Donee Hobbs Medical Center State Museum A needy family United Way Item IBM stock Antique painting Food and clothes Cash Cost $ 7,200 6,100 620 30,000 Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. Note: Leave no answer blank. Enter zero if applicable. Charitable contribution deduction Carryover FMV $ 44,000 3,660 370 30,000 d. Calvin's AGI is $210,000 and Hobbs is a private nonoperating foundation. Answer is complete but not entirely correct. $ 33,660 X 0arrow_forwardPlease help mearrow_forwardPlease don't answer in handwritten...thankuarrow_forward

- Yolanda is a cash basis taxpayer with the following tranasctions during the year: Cash received from sales of products $70,000 Cash paid for expenses (except rent and interest) $40,000 Rent prepaid on a leased building for 18 monts beginning December 1 $48,600 Prepaid interest on a bank loan, paid on December 31 for the next 3 months 5,000 Calculate Yolanda's income from her business for this calendar year.arrow_forward1. Label each item as Gross Income, (GI), Not Included, (NI) or Deductions for Adjusted Gross Income, (DAGI), and calculate adjusted gross income for Noelle Nelson. A gift from her mother Nia, $30,000 Noelle has a sole proprietorship, candy shop. The net income is $120,000 Salary $100,000. Bonus $40,000 Capital loss $20,000 Contribution to individual retirement account, $1,000 Child support received, $30,000 Alimony received $50,000. The divorce was signed on January 15, 2018. Noele won $20,000 in a national bowling tournament. Noelle received $20,000 from a legal settlement for a dog bite on her leg. Student loan interest paid $1,000. Noelle’s sister, Natasha, gave her $40,000, in repayment of a $35,000 loan from 2017. Workman’s compensation $30,000 Unemployment compensation $40,000 Interest from a City of Nashville Bond, $7,000 Treasury bill interest $10,000 Interest from CitiGroup Account $5,000 Penalty for early withdrawal from timed savings…arrow_forwardAlpesharrow_forward

- Please Do not Give Image format Otherwise rejected my questionarrow_forwardPaid 135,00 from the business funds for the repair and maintenance of his residence. Journal Entryarrow_forward3 During the current year 2021, Nicanor, Jr. who resides in R. Papa Street, Sampaloc Manila and with Tin 135-567-890-006. Made the following gifts: Date Donee Amount of donation June 1, 2018 Junior, his son, on account of his marriage celebrated June 1, 2018 P 150,000 cash July 10, 2018 His friend Aprot P 400,000 a second hand motor vehicle September 30, 2018 His daughter Julia P 450,000 cash dowry, on account of her scheduled marriage on October 25, 2018 November 23,2018 His father, Nicanor, Sr. A parcel of land worth P 180,000, subject to the condition that his father would assume the mortgage indebtedness of Jose in the amount of P 40,000; On November 23, 2018 gift, using the Donor’s Tax Return (BIR Form No. 1800), how much will be reflected on line 18(Tax Payable/(Overpayment)) ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education