FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

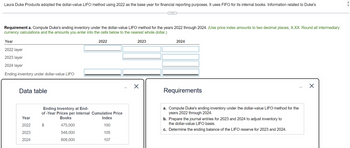

Transcribed Image Text:Laura Duke Products adopted the dollar-value LIFO method using 2022 as the base year for financial reporting purposes. It uses FIFO for its internal books. Information related to Duke's

Requirement a. Compute Duke's ending inventory under the dollar-value LIFO method for the years 2022 through 2024. (Use price index amounts to two decimal places, X.XX. Round all intermediary

currency calculations and the amounts you enter into the cells below to the nearest whole dollar.)

Year

2022 layer

2023 layer

2024 layer

Ending inventory under dollar-value LIFO

Data table

2022

2023

☑

2024

Requirements

Ending Inventory at End-

of-Year Prices per Internal Cumulative Price

Books

Year

Index

2022

475,000

100

2023

548,000

105

2024

609,000

107

a. Compute Duke's ending inventory under the dollar-value LIFO method for the

years 2022 through 2024.

b. Prepare the journal entries for 2023 and 2024 to adjust inventory to

the dollar-value LIFO basis.

c. Determine the ending balance of the LIFO reserve for 2023 and 2024.

✗

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Princeton's detailed age analysis of trade receivables at 31 December 2020 shows the following: Customername Totaloutstanding £ Creditlimit £ 0-30days £ 31-60days £ 61-90days £ Over 90days £ A. Ames 16200 15000 2000 8700 2500 3000 B.Bristow 18300 25000 18300 - - - C.Chen 4700 4800 - 2000 2700 - TOTAL 39200 - 20300 10700 5200 3000 Notes:• The company offers 30 days credit to its customers.• The credit is offered to the customers based on words of mouth• Ames is disputing the quality of some of the goods and refusing to pay, no decision hasbeen made yet (£3,000 over 90 days)• Chen has just put in an order for £5,000, he is a good friend of the directorRequired:What are the key points arising from the credit controller's review in respect of each tradereceivable balance and what suggestions can be made to improve the aged analysis report?arrow_forwardKA. On July 1, 2019, Great White North (GWN) Inc. purchased merchandise from a supplier in the U.S. for US$800,000 with terms requiring full payment by October 31, 2019. GWN has a July 31st year end. On October 31, 2019, GWN paid its supplier in full. Selected dates and spot rates are shown below: July 1, 2019 CDN $1.2150 July 31, 2019 CDN $1.2175 October 31, 2019 CDN $1.22 1) Prepare all journal entries on Settlement date. 2) Prepare all journal entries that would be prepared at year end.arrow_forwardOn January 1, 2024, the Brunswick Hat Company adopted the dollar-value LIFO retail method. The following data are available for 2024: Cost Retail Beginning inventory $ 72,900 $ 135,000 Net purchases 102,150 232,000 Net markups 5,000 Net markdowns 10,000 Net sales 200,000 Retail price index, 12/31/2024 1.08 Required: Calculate the estimated ending inventory and cost of goods sold for 2024 using the information provided. Ending inventory at retail:_________ Ending inventory at cost:__________ Cost of goods sold:_______________arrow_forward

- Hull Manufacturing Corp. (HMC), a Canadian company, manufactures instruments used to measure the moisture content of barley and wheat. The company sells primarily to the domestic market, but in Year 3, it developed a small market in Argentina. In Year 4, HMC began purchasing semi-finished components from a supplier in Romania. The management of HMC is concerned about the possible adverse effects of foreign exchange fluctuations. To deal with this matter, all of. HMC's foreign-currency-denominated receivables and payables are hedged with contracts with the company's bank. The year-end of HMC is December 31. The following transactions occurred late in Year 4: • On October 15, Year 4, HMC purchased components from its Romanian supplier for 807,000 Romanian leus (RL). On the same day, HMC entered into a forward contract for RON807,000 at the 60-day forward rate of RON1 = $0.415. The Romanian supplier was paid in full on December 15, Year 4. • On December 1, Year 4, HMC made a shipment to a…arrow_forwardCanova Corporation adopted the dollar-value LIFO retail method on January 1, 2024. On that date, the cost of the inventory on hand was $22,000 and its retail value was $27,500. Information for 2024 and 2025 is as follows: Date 12/31/2024 12/31/2025 Ending Inventory Retail Price at Retail $ 36,000 $ 39,000 Required: 1. What is the cost-to-retail percentage for the inventory on hand at 1/1/2024? 2. Calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO retail method. Required 1 Required 2 Index 1.25 1.30 Ending inventory Complete this question by entering your answers in the tabs below. 23,092 $ Cost-to-Retail Percentage 84% 854 Answer is complete but not entirely correct. Calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO retail method. Note: Round your answers to the nearest whole dollar amount. 2024 2025 24,112arrow_forwardYour answer is correct. Calculate Maple Leaf's receivables turnover and collection period for 2019 and 2018. (Round receivables turnover to 2 decimal places, e.g. 52.75 and collection period to 1 decimal place, e.g. 52.7. Use 365 days for calculation.) Receivables turnover Collection period 2019 33.75 times 2018 34.81 times 10.81 days 10.48 days (b) Has the company's liquid improved weakened? weakened Company's liquidity has Attempts: 1 of 1 usedarrow_forward

- Stuff Company is a subsidiary of Pland Corporation and is located in Madrid, Spain, where the currency is the euro (€). Data on Stuff's inventory and purchases are as follows: Inventory, January 1, 20X7 Purchases during 20x7 Inventory, December 31, 20x7 The beginning inventory was acquired during the fourth quarter of 20X6, and the ending inventory was acquired during the fourth quarter of 20X7. Purchases were made evenly over the year. Exchange rates were as follows: Fourth quarter of 20x6 January 1, 20X7 Average during 20x7 Fourth quarter of 20x7 December 31, 20x7 € 226,000 866,000 194,000 €1-$1.29015 €1$ 1.32030 € 1$ 1.39655 €1-$1.45000 € 1$ 1.47280 Required: a. Show the remeasurement of cost of goods sold for 20X7, assuming that the U.S. dollar is the functional currency. Note: Round your intermediate calculations and final answer to nearest dollar amount. a. Cost of goods sold b. Cost of goods sold b. Show the translation of cost of goods sold for 20X7, assuming that the euro is…arrow_forwardOn 15 December 2020; Saadah Company purchased goods at the amount of 42500 OMR and paid 12500, the balance is on account. Which of the following is the correct journal entry for this transaction? Select one: O A. Date Accounts Debit Credit (RO) (RO) Goods 42500 30000 15.12.2020 Payable Cash 12500 О в. Debit Credit (RO) (RO) Date Accounts Payable 30000 15.12.2020 Cash 12500 Goods 42500 Date Accounts Debit Credit (RO) (RO) Payable 30000 15.12.2020 Cash 12500 Goods 42500 D. Date Accounts Debit Credit (RO) (RO) Goods 42500 30000 15.12.2020 Cash Payable 12500arrow_forwardThe following information is available for Monty Corp. for 2023: Payment for goods during year $103200 Accounts Payable, beginning 14800 Inventory, beginning 30600 Accounts Payable, ending 12900 Inventory, ending 17800 Cost of goods sold for 2023 is a) $105100. b) $101300. c)$133800. d)$114100.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education