ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Inflation- induced tax distortions

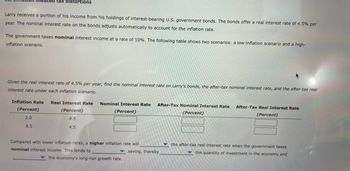

Transcribed Image Text:Larry receives a portion of his income from his holdings of interest-bearing U.S. government bonds. The bonds offer a real interest rate of 4.5% per

year. The nominal interest rate on the bonds adjusts automatically to account for the inflation rate.

tax distortions

The government taxes nominal interest income at a rate of 10%. The following table shows two scenarios: a low-inflation scenario and a high-

inflation scenario.

Given the real interest rate of 4.5% per year, find the nominal interest rate on Larry's bonds, the after-tax nominal interest rate, and the after-tax real

interest rate under each inflation scenario.

Inflation Rate Real Interest Rate Nominal Interest Rate After-Tax Nominal Interest Rate After-Tax Real Interest Rate

(Percent)

(Percent)

(Percent)

(Percent)

4.5

4.5

(Percent)

2.0

8.5

Compared with lower inflation rates, a higher inflation rate will

nominal interest income. This tends to

the economy's long-run growth rate.

saving, thereby

the after-tax real interest rate when the government taxes

the quantity of investment in the economy and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Inflation trend in Nigeria from 2000 to 2020arrow_forwardThe real interest rate is the percentage of the amount borrowed that must be paid to the lender in addition to the repayment of the principal. The money interest rate reflects the actual burden to borrowers and the payoff to lenders after accounting for the impact of inflation. True or Falsearrow_forwardIs inflation a progressive or regressive tax?arrow_forward

- Select the term that completes the missing information for the blank in the text. Compared to nominal returns, real returns are adjusted for taxes Select One taxes credit income inflationarrow_forwardlarge or persistent inflation is almost always caused byarrow_forwardLast year a movie ticket cost $10. Now a movie ticket cost $12. Which of the following best describes this economic condition? deflation inflation stagflation hyper-inflationarrow_forward

- Give an example of a good or service that has increased in price since the time when you were young. Describe the good or service and tell us what price the good cost when you were young compared to today. Calculate the percentage change in price (the inflation rate for the good in question) over the time period you are describing.arrow_forwardThe president is impeached and removed from office: a)Inflation stays the same b)Inflation increases c)Inflation decreases d)Can't tellarrow_forwardHow do we obtain the general inflation rate?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education