FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

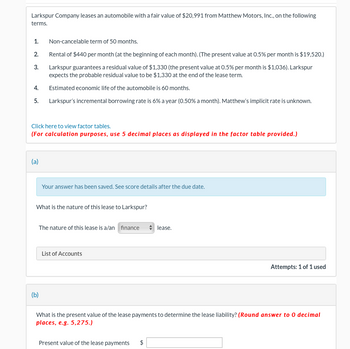

Transcribed Image Text:Larkspur Company leases an automobile with a fair value of $20,991 from Matthew Motors, Inc., on the following

terms.

1.

2.

3.

Non-cancelable term of 50 months.

Rental of $440 per month (at the beginning of each month). (The present value at 0.5% per month is $19,520.)

Larkspur guarantees a residual value of $1,330 (the present value at 0.5% per month is $1,036). Larkspur

expects the probable residual value to be $1,330 at the end of the lease term.

Estimated economic life of the automobile is 60 months.

5. Larkspur's incremental borrowing rate is 6% a year (0.50% a month). Matthew's implicit rate is unknown.

4.

Click here to view factor tables.

(For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

(a)

Your answer has been saved. See score details after the due date.

What is the nature of this lease to Larkspur?

The nature of this lease is a/an finance ◆ lease.

(b)

List of Accounts

Attempts: 1 of 1 used

What is the present value of the lease payments to determine the lease liability? (Round answer to 0 decimal

places, e.g. 5,275.)

Present value of the lease payments $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of its fiscal year, Lakeside Incorporated leased office space to LTT Corporation under a seven-year operating lease agreement. The contract calls for quarterly rent payments of $25,000 each. The office building was acquired by Lakeside at a cost of $2 million and was expected to have a useful life of 25 years with no residual value. What will be the effect of the lease on Lakeside’s earnings for the first year (ignore taxes)? Note: Enter your answer rounded to the nearest whole dollar.arrow_forwardSchrute Company leases an automobile with a fair value of $15,005 from Rainn, Inc., on the following terms: 1. Non-cancelable term of 50 months. 2. Rental of $300 per month (at the beginning of each month). 3. Schrute guarantees a residual value of $1,800 (the present value at 0.5% per month is $1,403). The expected residual value is estimated to be $1,800 at the end of the lease term. 4. Estimated economic life of the automobile is 60 months. 5. Schrute’s incremental borrowing rate is 6% a year (0.5% a month). Rainn’s implicit rate is unknown. Present Value of an Annuity Due with 0.5% and 60 periods: 51.98419 Present Value of an Ordinary Annuity at 0.5% and 60 periods: 48.17337352 Present Value of an Annuity Due with 0.5% and 50 periods: 44.36350 Present Value of an Ordinary Annuity with 0.5% and 50 Periods:41.56644707 The entry to record the first month’s lease payment (at commencement of the lease) would include: a) a debit to interest expense in the amount of $300.…arrow_forwardOn January 1, Lessee Company leases equipment with a useful life of 5 years for a 6-year lease term. Payments of $88,000 are due at the beginning of each year. The incremental borrowing rate is 4%. The present value of the payments is $407,440. Which of the following is true? Interest expense at the end of the first year is $407,440 x .04 Amortization expense at the end of the first year is $407,440 divided by 6. Lease expense at the end of the first year is $88,000. Interest expense at the end of the first year is $319,440 x .04arrow_forward

- Splish Brothers Company leases an automobile with a fair value of $13,924 from John Simon Motors, Inc., on the following terms: 1. Non-cancelable term of 50 months. 2. Rental of $280 per month (at the beginning of each month). (The present value at 0.5% per month is $8,873.) 3. Splish Brothers guarantees a residual value of $1,580 (the present value at 0.5% per month is $920). Delaney expects the probable residual value to be $1,580 at the end of the lease term. 4. Estimated economic life of the automobile is 60 months. 5. Splish Brothers’s incremental borrowing rate is 6% a year (0.5% a month). Simon’s implicit rate is unknown. Click here to view factor tables.(For calculation purposes, use 5 decimal places as displayed in the factor table provided.) What is the nature of this lease to Splish Brothers? The nature of this lease is a/an select a nature of the lease…arrow_forwardYK Incorporated leased road building equipment from Bajan Leasing on January 1, 2021. Bajan purchased the equipment from International Machines at a cost of $148,930. Related Information: Lease term 2 years (4 semi-annual periods) Quarterly rental payments $40,000 at the beginning of each period Economic life of asset 2 years Fair value of asset $148,930 Implicit interest rate 10% (Also lessee’s incremental borrowing rate) Required:Prepare a lease amortization schedule and appropriate entries for Manufacturers Southern from the beginning of the lease through January 2022. Amortization of the right-of-use asset is recorded at the end of each fiscal year (December 31) on a straight-line basis.arrow_forwardOn 1/1/21, Sargento leased equipment under a two-year operating lease agreement from Great American Leasing, which typically finances equipment for other companies at an annual interest rate of 4%. The lease documentation calls for four rent payments of $15,500 each, payable semiannually on June 30 and December 31 each year. The equipment was acquired by Great Amerian Leasing at a cost of $101,000 and were expected to have a useful life of five years with no residual value. Both firms record amortization and depreciation semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)Required:1. Prepare appropriate journal entries recorded by Great American Leasing for the first year of the lease.arrow_forward

- At the beginning of its fiscal year, Lakeside Incorporated leased office space to LTT Corporation under a eight-year operating lease agreement. The contract calls for quarterly rent payments of $29,000 each. The office building was acquired by Lakeside at a cost of $2.4 million and was expected to have a useful life of 30 years with no residual value. What will be the effect of the lease on LTT’s earnings for the first year (ignore taxes)? Note: Enter your answer rounded to the nearest whole dollar.arrow_forwardSplish Brothers Company leases an automobile with a fair value of $13,924 from John Simon Motors, Inc., on the following terms: 1. Non-cancelable term of 50 months.2. Rental of $280 per month (at the beginning of each month). (The present value at 0.5% per month is $8,873.)3. Splish Brothers guarantees a residual value of $1,580 (the present value at 0.5% per month is $920). Delaney expects the probable residual value to be $1,580 at the end of the lease term.4. Estimated economic life of the automobile is 60 months.5. Splish Brothers’s incremental borrowing rate is 6% a year (0.5% a month). Simon’s implicit rate is unknown. Click here to view factor tables.(For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Collapse question part(a) What is the nature of this lease to Splish Brothers? The nature of this lease is a/an select a nature of the leasefinancelease. Collapse question part(b) What is the present value of the lease payments to determine…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education