FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

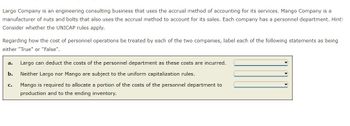

Transcribed Image Text:Largo Company is an engineering consulting business that uses the accrual method of accounting for its services. Mango Company is a

manufacturer of nuts and bolts that also uses the accrual method to account for its sales. Each company has a personnel department. Hint:

Consider whether the UNICAP rules apply.

Regarding how the cost of personnel operations be treated by each of the two companies, label each of the following statements as being

either "True" or "False".

a. Largo can deduct the costs of the personnel department as these costs are incurred.

b.

Neither Largo nor Mango are subject to the uniform capitalization rules.

Mango is required to allocate a portion of the costs of the personnel department to

production and to the ending inventory.

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Accounting: 3. Which of the following is an example of a fixed cost? A) Direct labor B) Utilities C) Sales commission D) Property taxes 4. Which of the following statements is true about managerial accounting? A) It is only used by smarrow_forwardWoodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: IT HR IT tickets 0 Employees 18 1,555 0 Publishing 2,488 27 Binding 2,177 45 Department direct costs $ 154,400 $ 248,490 $ 432,200 $ 395,500 Required: Allocate the service department costs using the reciprocal method. (Matrix algebra is not required because there are only two service departments.) Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations. From: Service department costs IT HR Total Cost Allocation To: IT HR Publishing Bindingarrow_forwardIndicate whether each of the following costs is a product cost or a period (selling and administrative) cost: Event a. b. C. Advertising costs. d. e. f. g. Goods purchased for resale. Salaries of salespersons. h. i. Transportation-out. Interest on a note payable. Salary of the company president. Transportation-in. Insurance on the office building. Office supplies.arrow_forward

- Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. Marley's ManufacturingIncome StatementMonth Ending August 31, 2018arrow_forwardLittle Things manufactures toys. For each item listed, identify whether it is a product cost, a period cost, or not an expense. A. internet provider services B. material expense C. raw materials inventory D. production equipment rental E. showroom rental F. factory employee salary G. Human Resource Director salaryarrow_forwarda. Road Warrior Motor is a company that manufactures and sells cars. Indicate whether each of the following should be considered a product cost or a period cost for the company. If you identify the item as a product cost, also indicate whether it is a direct material cost, direct labor cost, or overhead cost. Write “1” under the correct answer. For example, the answer to item 0 is “product cost” and “overhead cost.” 0. Property taxes on factory building. 1. Cost of buying the metal needed to manufacture cars. 2. Depreciation on the furniture used in the sales showroom. 3. Cost of electricity used in the factories. 4. Salaries of factory workers who manufacture cars. 5. Salaries of factory security guards. 6. Salaries of office workers in the financial department. 7. Depreciation on the warehouse used to store raw materials. 8. Income taxes paid to the government. b. The company manufactured 100 cars in January 2023 and has not sold any of them by the end of January. If the company…arrow_forward

- Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. Marley's ManufacturingIncome StatementMonth Ending August 31, 2018 Dept. A Dept. B Sales $23,000 $51,000 Cost of goods sold 11,040 26,520 Gross profit $11,960 $24,480 Expenses: Utility expenses $920 $2,550 Wages expense 5,980 10,710 Costs allocated from corporate 2,300 14,280 Total expenses $9,200 $27,540 Operating income/(loss) in dollars $fill in the blank 1 $fill in the blank 2 Operating income/(loss) in percentage fill in the blank 3 % fill in the blank 4 %arrow_forwardSuppose you are a partner in a cosmetics manufacturing company. What is required is as follows: a. Explain the nature of the company and the various costs involved in producing your business. Classification of all items into direct and indirect category along with the number of employees or workers in production departments and other departments. B. View details of all expenses under each category, Materials, Labor, Overhead (maximum 5 and minimum 3) C. Mention opening and closing ( raw materials, semi-finished and finished goods). Prepare a cost sheet using the information in Part A and calculate the profit.arrow_forward2. a) A company manufactures and retails tablet computers. You are required to group the costs which are listed below and numbered (1)-(10) into the following classifications i-v (each cost is intended to belong to only one classification): 1- Wiring for the tablet 2-The maintenance contract from the machines 3- Aftersales customer service 4- The Chief Executive Salary 5- Shipping costs from the warehouse to the retailer 6- Marketing Costs 7- Interest on bank overdraft 8- Staff Training costs 9- Electricity to run the production line 10- Warehouse storage rent for the tablets. i. ii. iii. iv. V. Direct materials 1 Indirect production overhead 2 Selling and distribution costs Administration costs Finance costsarrow_forward

- You have been employed as a cost accountant by Pared Inc. The president, I.M. Pared, is having a hard time understanding the flow of costs through the cost accounting system. Beginning with the purchase of material and ending with the transfer to cost of goods sold briefly flow chart (draw) and describe (write out) how the costs will travel through the cost accounting system explain this for me?arrow_forward[The following information applies to the questions displayed below.] The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone Company. Advertising expense Depreciation expense-Office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Raw materials purchases (all direct materials) Maintenance expense-Factory equipment Factory utilities Direct labor Indirect labor Office salaries expense Rent expense-Office space Rent expense-Selling space Rent expense-Factory building Sales salaries expense $ 28,750 7,250 8,600 49,325 925,000 35,400 33,000 675,480 159,475 63,000 22,000 26,100 76,800 392,560arrow_forwardWoodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: \table[[,IT,HR,Publishing,Binding],[,0,1,550,2,480,2,170],[IT tickets,16,0,24,40],[\table[[Employees],[Department direct costs]],$154,000,$248,400,$432,000,$395,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education