FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

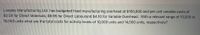

Transcribed Image Text:Langley Manufacturing Ltd. has budgeted fixed manufacturing overhead at $100,000 and per unit variable costs of

$3.50 for Direct Materials; $8.95 for Direct Labourand $4.10 for Variable Overhead. With a relevant range of 10,000 to

15,000 units what are the total costs for activity levels of 10,000 units and 14,000 units, respectively?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Myers Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows: Indirect labor Indirect materials Utilities Activity Level Depreciation Fixed overhead costs per month are Supervision $3,600, Depreciation $1,300, and Property Taxes $800. The company believes it will normally operate in a range of 7,100-11,000 direct labor hours per month. Direct Labor Hours Fixed Costs $1.20 Prepare a monthly manufacturing overhead flexible budget for 2020 for the expected range of activity, using increments of 1,300 direct labor hours. (List variable costs before fixed costs.) Indirect Labor Indirect Materials Property Taxes Supervision 0.70 Total Costs Total Fixed Costs Total Variable Costs Utilities Variable Costs 0.20 LA MYERS COMPANY Monthly Manufacturing Overhead Flexible Budget For the Year 2020 LA tA tAarrow_forwardNovak Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows: Indirect labor: $1.10, Indirect materials: 0.80, Utilities 0.50. Fbed overhead costs per month are Supervision $4,000, Depreciation $1, 200, and Property Taxes $800. The company believes it will normally operate in a range of 7, 000-10,000 direct labor hours per month. Prepare a monthly manufacturing overhead flexible budget for 2022 for the expected range of activity, using increments of 1, 000 direct labor hours. (List variable costs before fixed costs)arrow_forwardLane Company manufactures a single product that requires a great deal of hand labor. Overhead cost is applied on the basis of standard direct labor-hours. The budgeted variable manufacturing overhead is $5.00 per direct labor-hour and the budgeted fixed manufacturing overhead is $2,295,000 per year. The standard quantity of materials is 4 pounds per unit and the standard cost is $10.50 per pound. The standard direct labor-hours per unit is 1.5 hours and the standard labor rate is $13.50 per hour. The company planned to operate at a denominator activity level of 255,000 direct labor-hours and to produce 170,000 units of product during the most recent year. Actual activity and costs for the year were as follows: Actual number of units produced 204,000 Actual direct labor-hours worked 331,500 Actual variable manufacturing overhead cost incurred $ 961,350 Actual fixed manufacturing overhead cost incurred $ 2,652,000 Required: 1. Compute the predetermined overhead rate…arrow_forward

- < Deluxe, Inc. uses a standard cost system and provides the following information. (Click the icon to view the information.) Deluxe allocates manufacturing overhead to production based on standard direct labor hours. Deluxe reported the following actual results for 2024: actual number of units produced, 1,000, actual variable overhead, $5,000, actual fixed overhead, $3,200; actual direct labor hours, 1,400. Read the requirements Data table Static budget variable overhead Static budget fixed overhead Static budget direct labor hours Static budget number of units Standard direct labor hours Print The fixed overhead cost variance is The fixed overhead volume variance is $2,100 $2,800 1,400 hours 700 units 2 hours per unit Done Requirements 1. Compute the variable overhead cost and efficiency variances and fixed overhead cost and volume variances. 2. Explain why the variances are favorable or unfavorable irect labor hour was sed Print Done because the total fixed overhead cost was because…arrow_forwardA company has two products: A and B. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools: Activity Cost Pool Activity 1 3,000 2,800 Activity 2 4,500 5,500 Activity 3 2,500 5,250 Annual production and sales level of Product A is 34,300 units, and the annual production and sales level of Product B is 69,550 units. What is the approximate overhead cost per unit of Product B under activity-based costing? O $10.28 O $3.00 $2.33 $2.00 O $15.00 Budgeted Activity Budgeted Cost $87,000 $62,000 $93,000 Product A Product Barrow_forwardProvide the Correct answerarrow_forward

- Compute the predetermined variable overhead rate and the predetermined fixed overhead rate Stevens door mat. Stevens uses a standard cost system and determines that it should take one hour of direct labor to produce one door mat. The normal production capacity for this mat is 125,000 units per year. The total budgeted overhead at normal capacity is 1,062,500 comprised of 437,500 of variable costs and 625,000 of fixed costs. It applies overhead on the basis of direct labor hours. During the current year, produced 73,100 mats, worked 86,700 direct labor hours, and incurred variable overhead costs of 186,405 and fixed overhead costs of 562,350.arrow_forwardWhich one is the correct answer?arrow_forwardWhich one is the correct answer?arrow_forward

- Dineshbhaiarrow_forwardBoston Ltd makes a single product and provides the following detail for its activities and its product at the start of the period: Budgeted overhead = £400,000 Budgeted output in units = 25,000 units Bentley’s actual results at the end of the period were: Actual overhead = £380,000 Actual output = 24,500 units If Boston absorbs overheads based on the number of units produced, the business will have under/over-absorbed overheads by how much at the end of the period?arrow_forwardThe measure of activity in the standard costing system used at Esta GmbH is machining hours. The company's flexible manufacturing overhead budget and then data regarding the most recent period's operations are given below: Flexible Budget: Budgeted Level of Activity: 6,600 machining hours Overhead costs at the Budgeted activity level: Variable Overhead Cost: $17,226 Fixed Overhead Cost: $13,992 Most Recent period's operations: Actual level of activity: 7,200 machining hours Standard level of activity for output: 7,140 machining hours Actual total variable overhead cost: $17,856 Actual total fixed overhead cost: $14,256 PART A What is the variable overhead rate variance? (936 favorable, 481 unfavorable, 630 unfavorable, 779 favorable, OR 2,267 favorable) PART B What is the variable overhead efficiency variance? (157 unfavorable, 1409 unfavorable, 1566 unfavorable, 1488 unfavorable, OR 149 unfavorable) PART C What is the fixed overhead budget variance? (264 unfavorable, 1272…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education