FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

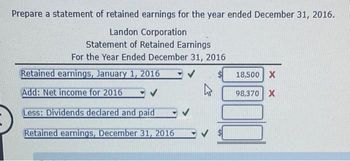

Transcribed Image Text:Prepare a statement of retained earnings for the year ended December 31, 2016.

Landon Corporation

Statement of Retained Earnings

For the Year Ended December 31, 2016

Retained earnings, January 1, 2016

Add: Net income for 2016

Less: Dividends declared and paid

Retained earnings, December 31, 2016

18,500 X

98,370 X

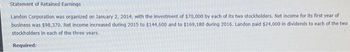

Transcribed Image Text:Statement of Retained Earnings

Landon Corporation was organized on January 2, 2014, with the investment of $70,000 by each of its two stockholders. Net income for its first year of

business was $98,370. Net income increased during 2015 to $144,600 and to $169,180 during 2016. Landon paid $24,000 in dividends to each of the two

stockholders in each of the three years.

Required:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Young Corporation has been operating successfully for several years. It is authorized to issue 24,000 shares of no-par common stock and 6,000 shares of 8%, $100 par preferred stock. The Contributed Capital section of its January 1, 2019, balance sheet is as follows: 1. Answer the questions in Part a. 2. Prepare journal entries to record the transactions in Part b. 3. Prepare the Cobtributed Capital section of Young’s December 31, 2016, balance sheet.arrow_forwardMechforce, Incorporated had net income of $150,000 for the year ended December 31, 2022. At the beginning of the year, 17,000 shares of common stock were outstanding. On April 1, an additional 19,000 shares were issued. On October 1, the company purchased 4,000 shares of its own common stock and held them as treasury stock until the end of the year. No other changes in common shares outstanding occurred during the year. During the year, Mechforce paid the annual dividend on the 8,000 shares of 4.60%, $100 par value preferred stock that were outstanding the entire year. Required: Calculate basic earnings per share of common stock for the year ended December 31, 2022. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Answer is complete but not entirely correct. Earnings per share $ 0.74 xarrow_forwardPlease show the solution in good accounting form. 8. How much is the total shareholders' equity at year-end?arrow_forward

- The articles of incorporation for Peahen Corp. authorize the company to issue 100,000 $6 preferred shares and 500,000 common shares. During first year of operations, Peahen Corp. completed the following selected transactions: (Click the icon to view the transactions.) Required 1. Record the transactions in the general journal. 2. Prepare the shareholders' equity section of the Peahen Corp. balance sheet at November 30, 2020. Requirement 1. Record the transactions in the journal. (Record debits first, then credits. Explanations are not required.) Dec. 4, 2019: Issued 6,000 common shares to the consultants who formed the corporation, receiving cash of $180,000. Date Dec. Journal Entry Accounts Debit Creditarrow_forwardThe following selected transactions occurred during Trio Networks Corporation’s first year of operations: 2020 Jan. 15 Issued 2,000 common shares to the corporation’s promoters in exchange for their efforts in creating it. Their efforts are estimated to be worth $32,000. Feb. 21 17,500 common shares were issued for cash of $13 per share. Mar. 9 6,000 preferred shares were issued for cash totalling $113,100. Aug. 15 55,000 common shares were issued in exchange for land, building, and equipment with appraised values of $320,000, $425,000, and $117,000, respectively. Required:Prepare journal entries.arrow_forwardMarutzky Corporation had a net income of $2,200,000 for the year 2018. On January 1, 2018, the corporation had 300,000 shares of common stock outstanding and issued an additional 250,000 shares of common stock on October 1, 2018. Calculate the earnings per shares using the weighted-average number of common shares outstanding.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education