FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

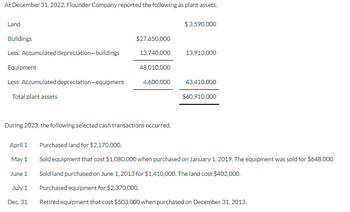

Transcribed Image Text:At December 31, 2022, Flounder Company reported the following as plant assets.

Land

Buildings

Less: Accumulated depreciation-buildings

Equipment

Less: Accumulated depreciation-equipment

Total plant assets

April 1

May 1

June 1

$27,650,000

13,740,000

During 2023, the following selected cash transactions occurred.

July 1

Dec. 31

48,010,000

4,600,000

$3,590,000

13,910,000

43,410,000

$60,910,000

Purchased land for $2,170,000.

Sold equipment that cost $1,080,000 when purchased on January 1, 2019. The equipment was sold for $648,000.

Sold land purchased on June 1, 2013 for $1,410,000. The land cost $402,000.

Purchased equipment for $2,370,000.

Retired equipment that cost $503,000 when purchased on December 31, 2013.

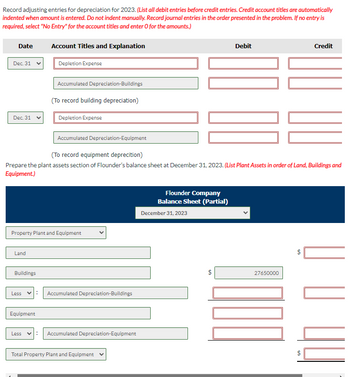

Transcribed Image Text:Record adjusting entries for depreciation for 2023. (List all debit entries before credit entries. Credit account titles are automatically

indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is

required, select "No Entry" for the account titles and enter O for the amounts.)

Date

Dec. 31

Dec. 31

Land

Buildings

Account Titles and Explanation

Less

Depletion Expense

Equipment

Accumulated Depreciation-Buildings

(To record building depreciation)

Property Plant and Equipment

Depletion Expense

Accumulated Depreciation-Equipment

(To record equipment deprecition)

Prepare the plant assets section of Flounder's balance sheet at December 31, 2023. (List Plant Assets in order of Land, Buildings and

Equipment.)

Accumulated Depreciation-Buildings

Less V: Accumulated Depreciation-Equipment

Total Property Plant and Equipment

10 00

Flounder Company

Balance Sheet (Partial)

December 31, 2023

Debit

LA

LOCO

27650000

Credit

tA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 5arrow_forwardFrom page 7-2 of the VLN, intangible assets are long term assets and would NOT include: Group of answer choices A. Goodwill B. Natural gas C. Patents D. Copyrightsarrow_forwardQuestion 11 A cash-generating unit comprises the following assets: £000 700 200 90 20 1,010 Building Plant and equipment Goodwill Current assets Following an impairment review it was discovered that an item of plant carried at £40,000 is damaged and will have to be scrapped. The recoverable amount of the cash-generating unit is estimated at £750,000. Required: What will be the carrying amount of the building after the impairment loss has been recognised (to the nearest £000).arrow_forward

- 17 Equipment that cost 412000 and on which 191000 of accumulated depreciation has been recorded was disposed of for 181000 cash. The entry to record this event would include a ?arrow_forwardMini-Exercise 6-3 (Static) Capitalizing versus expensing LO 6-2 Stucki Holdings Corporation incurred the following expenditures: $5,700 cost to replace the transmission in a company-owned vehicle; $19,300 cost of annual property insurance on the company's production facilities; $15,100 cost to develop and register a design patent; $25,400 cost to add a security and monitoring system to the company's distribution center; $700 cost to repair paint damage on a company-owned vehicle caused by normal wear and tear. Required: Which, if any, of these expenditures should be capitalized? Note: Select all that apply. Check All That Apply $5,700 $15,100 $25,400 $19,300arrow_forwardA cash-generating unit comprises the following assets: £000 Goodwill 440 Land 2,560 Plant and equipment 800 3,800 One of the pieces of equipment, carried at £160,000, is damaged and will have to be scrapped. The recoverable amount of the cash-generating unit is estimated at £3,000,000. What will be the carrying amount of the land after the impairment loss has been recognised? a. £2,111,472 b. £2,285,716 c. £2,021,052 d. £2,400,000 e. £300,000arrow_forward

- The following schedule reflects the incremental costs and revenues for acapital project. The company uses straight-line depreciation. The interestexpense reflects an allocation of interest on the amount of this investment,based on the company’s weighted average cost capital:Revenues $650,000Direct costs $270,000Variable overhead 50,000Fixed overhead 20,000Depreciation 70,000General & administrative 40,000Interest expense 8,000458,000Net profit before taxes $192,000══════The annual cash flow from this investment, before tax considerations, would be:arrow_forwardonly need d and e , thanksarrow_forwardRequired information Problem 10-6A (Algo) Disposal of plant assets LO C1, P1, P2 [The following information applies to the questions displayed below.] Onslow Company purchased a used machine for $192,000 cash on January 2. On January 3, Onslow paid $8,000 to wire electricity to the machine. Onslow paid an additional $1,600 on January 4 to secure the machine for operation. The machine will be used for six years and have a $23,040 salvage value. Straight-line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of. Problem 10-6A (Algo) Part 1 Required: 1. Prepare journal entries to record the machine's purchase and the costs to ready it for use. Cash is paid for all costs incurred. View transaction list Journal entry worksheetarrow_forward

- Sagararrow_forwardMachinery Purchased for $ 800000 Accumulated depreciation value is $ 600000 Sold for $400000 Determine the gain or loss on Disposalarrow_forwardImpairment is defined as a reduction in the value of a company asset, whether fixed or intangible which decline the asset's quality, quantity, or market value. (a) The carrying amount of a machinery is RM525,000. This consists of goodwill of RM75,000, development costs of RM150,000 and machinery of RM300,000. The machinery has a recoverable amount of RM330,000. Calculate the carrying amount of the machinery after the impairment loss has been allocated.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education