FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

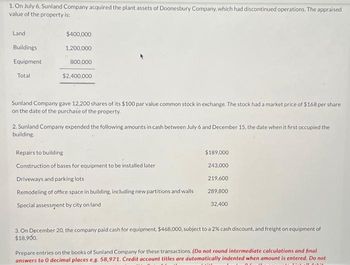

Transcribed Image Text:1. On July 6, Sunland Company acquired the plant assets of Doonesbury Company, which had discontinued operations. The appraised

value of the property is:

Land

Buildings

Equipment

Total

$400,000

1,200,000

800,000

$2,400,000

Sunland Company gave 12,200 shares of its $100 par value common stock in exchange. The stock had a market price of $168 per share

on the date of the purchase of the property.

2. Sunland Company expended the following amounts in cash between July 6 and December 15, the date when it first occupied the

building.

Repairs to building

Construction of bases for equipment to be installed later

Driveways and parking lots

Remodeling of office space in building, including new partitions and walls

Special assessment by city on land

$189,000

243,000

219,600

289,800

32,400

3. On December 20, the company paid cash for equipment, $468,000, subject to a 2% cash discount, and freight on equipment of

$18,900.

Prepare entries on the books of Sunland Company for these transactions. (Do not round intermediate calculations and final

answers to 0 decimal places e.g. 58,971. Credit account titles are automatically indented when amount is entered. Do not

TINTA

Transcribed Image Text:No. Account Titles and Explanation

1

2.

3.

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Rover, Inc. acquired a new machine: Invoice cost, 5%/10, n/30 Transportation cost Installation cost The new entity's main engineer spent two-thirds of his time on the new machine's trial run. The salary of the main engineer is P90,000 per month. P 1,940,000 P1,800,000 The cost of insurance of the the new machine for the first year was P10,000. P 1,980,000 50,000 What amount should be recorded as the cost of new machine? P 2,070,000 120,000 P 1,950,000arrow_forward1arrow_forwardImpact amount on sectionsarrow_forward

- 13 Joseph Company purchased equipment on March 31, 2025 for P800,000. The company spent P30,000 for its freight and P50,000 for taxes and other expenses incidental to acquisition. The equipment can be sold for P40,000 after 10 years. It is estimated to produce 336,000 units of product X. The equipment production of product X for the first 5 years follow: Year Units of product X 2025 2026 2027 2028 2029 36,000 34,500 32,500 31,000 28,500 Compute for the accumulated depreciation as of December 31, 2027 using Sum of the Year's Digit method. Round off your answer to the nearest peso. Write the absolute value. Answer should be numeric.arrow_forwardNonearrow_forward2. Mark Companyarrow_forward

- Subject: accountingarrow_forwardDirect material used $20,000 Depreciation- plant building $8,000 Indirect material (supplies) $2,500 Depreciation - sales building $6,000 Direct manufactured labor $7,000 Depreciation - plant tools $2.300 Indirect manufactured labor (annually salaries) $3,500 Production 40,000 units The total of "ixed costs" is: Question 3/20o 1.22300, 2 17300. 3.16300. 4.10,300. 5. None of the abovearrow_forwardDetermine the difference between the capitalized cost of the timber and steel penstock for a hydroelectric plant with interest of 10%: Timber Steel First Cost Php50,000 Php80,000 Estimated Life 10 years 30 years Scrap Value Php2,000 None Annual Maintenance Php1,200 Php200 Show calculations for the capitalized cost of each item separately.arrow_forward

- D, Earrow_forwardSales 10,000,000 6,000,000 1,000,000 100,000 180,000 100,000 Cost of Sales General Business Expenses Interest income on time deposit(gross) Depreciation Expense Charitable Contributions to the Government for Public Purpose (Priority project) If JMC is an individual, and she would use itemized deduction in her annual income tax return, how much is the total allowable deduction?arrow_forwardCost of new equipment: $200,000 Installation: $20,000 Change in Net Operating Working Capital: $50,000 New sales per year: $115,000 New operating costs per year: $50,000 Economic life: 4 years Depreciable life: MACRS 3-year class (33%, 45%, 15%, 7%) Salvage value: $20,000 Tax Rate: 25% WACC: 9% What is the total initial investment outlay (FCF0)? What is the operating cash flow for year 2, or FCF2? (SHOW ALL WORK/STEPS) What are the planned non-operating cash flows in year 4 (i.e. terminal cash flows)? (SHOW ALL WORK/STEPS) What is the book value of the equipment after three years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education