SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Subject - account

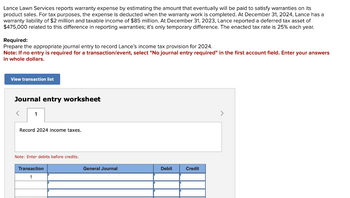

Transcribed Image Text:Lance Lawn Services reports warranty expense by estimating the amount that eventually will be paid to satisfy warranties on its

product sales. For tax purposes, the expense is deducted when the warranty work is completed. At December 31, 2024, Lance has a

warranty liability of $2 million and taxable income of $85 million. At December 31, 2023, Lance reported a deferred tax asset of

$475,000 related to this difference in reporting warranties; it's only temporary difference. The enacted tax rate is 25% each year.

Required:

Prepare the appropriate journal entry to record Lance's income tax provision for 2024.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers

in whole dollars.

View transaction list

Journal entry worksheet

< 1

Record 2024 income taxes.

Note: Enter debits before credits.

Transaction

1

General Journal

Debit

Credit

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Prior to and during 2019, Shadrach Company reported tax depreciation at an amount higher than the amount of financial depreciation, resulting in a book value of the depreciable assets of 24,500 for financial reporting purposes and of 20,000 for tax purposes at the end of 2019. In addition, Shadrach recognized a 3,500 estimated liability for legal expenses in the financial statements during 2019; it expects to pay this liability (and deduct it for tax purposes) in 2023. The current tax rate is 30%, no change in the tax rate has been enacted, and the company expects to be profitable in future years. What is the amount of the net deferred tax liability at the end of 2019? a. 300 b. 450 c. 1,050 d. 1,350arrow_forwardHow do the all events and economic performance requirements apply to the following transactions by an accrual basis taxpayer? a. The company guarantees its products for six months. At the end of 2019, customers had made valid claims for 600,000 that were not paid until 2020. Also, the company estimates that another 400,000 in claims from 2019 sales will be filed and paid in 2020. b. The accrual basis taxpayer reported 200,000 in corporate taxable income for 2019. The state income tax rate was 6%. The corporation paid 7,000 in estimated state income taxes in 2019 and paid 2,000 on 2018 state income taxes when it filed its 2018 state income tax return in March 2019. The company filed its 2019 state income tax return in March 2020 and paid the remaining 5,000 of its 2019 state income tax liability. c. An employee was involved in an accident while making a sales call. The company paid the injured victim 15,000 in 2019 and agreed to pay the victim 15,000 a year for the next nine years.arrow_forwardIn the current year, Madison Corporation had 50,000 of taxable income at a tax rate of 25%. During the year, Madison began offering warranties on its products and has a Warranty liability for financial reporting purposes of 5,000 at the end of the year. Warranty expenses are not deductible until paid for income tax purposes. Prepare the journal entry to record Madisons income taxes at the end of the year.arrow_forward

- Lance Lawn Services reports warranty expense by estimating the amount that eventually will be paid to satisfy warranties on its product sales. For tax purposes, the expense is deducted when the warranty work is completed. At December 31, 2021, Lance has a warranty liability of $2 million and taxable income of $75 million. At December 31, 2020, Lance reported a deferred tax asset of $471,000 related to this difference in reporting warranties, its only temporary difference. The enacted tax rate is 25% each year. Required: Prepare the appropriate journal entry to record Lance's income tax provision for 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet > Record 2021 income taxes. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journalarrow_forwardLance Lawn Services reports warranty expense by estimating the amount that eventually will be paid to satisfy warranties on its product sales. For tax purposes, the expense is deducted when the warranty work is completed. At December 31, 2021, Lance has a warranty liability of $2 million and taxable income of $80 million. At December 31, 2020, Lance reported a deferred tax asset of $461,000 related to this difference in reporting warranties, its only temporary difference. The enacted tax rate is 25% each year. Required:Prepare the appropriate journal entry to record Lance’s income tax provision for 2021.arrow_forwardLance Lawn Services reports warranty expense by estimating the amount that eventually will be paid to satisfy warranties on its product sales. For tax purposes, the expense is deducted when the warranty work is completed. At December 31, 2021, Lance has a warranty liability of $2 million and taxable income of $75 million. At December 31, 2020, Lance reported a deferred tax asset of $435,000 related to this difference in reporting warranties, its only temporary difference. The enacted tax rate is 25% each year.Required:Prepare the appropriate journal entry to record Lance’s income tax provision for 2021.arrow_forward

- At December 31, 2025, Suffolk Corporation had an estimated warranty liability of $105,000 for accounting purposes and $0 for tax purposes. (The warranty costs are not deductible until paid.) The effective tax rate is 20%. Compute the amount Suffolk should report as a deferred tax asset at December 31, 2025.arrow_forwardPurple Corp. reported under GAAP for the year ended 12/31/2024 depreciation expense $45,000 and warranty expense $25,000. During 2024, $5,000 in warranties were serviced, and the remainder is estimated to be serviced over the following 4 years. Under the tax code, depreciation for 2024 would be $60,000. Assuming these are the only differences between GAAP and the tax code, how much would be reported as a deferred tax expense or deferred tax benefit on the income statement for the year ended 12/31/2024 if the future tax rate will be 30%? A A deferred tax expense of $4,500 B A deferred tax benefit of $6,000 C A deferred tax expense of $1,500 D A deferred tax benefit of $1,500arrow_forwardPrepare the income tax expense section of the income statement for 2025, beginning with the line "Income before income taxes." (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) SHERIDAN COMPANY Income Statement (Partial) For the Year Ended December 31, 2025 $arrow_forward

- Sheridan Company reports pretax financial income of $73,500 for 2025. The following items cause taxable income to be different than pretax financial income. Depreciation on the tax return is greater than depreciation on the income statement by $17,600. 1. 2. Rent collected on the tax return is greater than rent recognized on the income statement by $19,900. 3. Fines for pollution appear as an expense of $10,500 on the income statement. Sheridan's tax rate is 30% for all years, and the company expects to report taxable income in all future years. There are no deferred taxes at the beginning of 2025. (a) Your answer is correct. Compute taxable income and income taxes payable for 2025. (b) Taxable income 86300 Income taxes payable 25890 eTextbook and Media Solution Pretax financial income for 2025 $73,500 Excess depreciation per tax return (17,600) Excess rent collected over rent earned 19,900 Nondeductible fines 10,500 Taxable income $86,300 Taxable income $86,300 Enacted tax rate 30%…arrow_forwardJ-Matt, Inc., had pretax accounting income of $329,000 and taxable income of $372,000 in 2021. The only difference between accounting and taxable income is estimated product warranty costs of $43,000 for sales in 2021. Warranty payments are expected to be in equal amounts over the next three years (2022-2024) and will be tax deductible at that time. Recent tax legislation will change the tax rate from the current 25% to 20% in 2023. Determine the amounts necessary to record J-Matt's income taxes for 2021 and prepare the appropriate journal entry.arrow_forwardFor the year ended December 31, 2023, Crane Ltd. reported income before income taxes of $82,000.In 2023, Crane Ltd. paid $45,000 for rent; of this amount, $15,000 was expensed in 2023. The remaining $30,000 was treated as a prepaid expense for accounting purposes and would be expensed equally over the 2024-2025 period. The full $45,000 was deductible for tax purposes in 2023.The company paid $66,000 in 2023 for membership in a local golf club (which was not deductible for tax purposes).In 2023 Crane Ltd. began offering a 1-year warranty on all merchandise sold. Warranty expenses for 2023 were $32,000, of which $26,000 was actual repairs for 2023 and the remaining $6,000 was estimated repairs to be completed in 2024.Meal and entertainment expenses totalled $16,000 in 2023, only half of which were deductible for income tax purposes.Depreciation expense for 2023 was $160,000. Capital Cost Allowance (CCA) claimed for the year was $181,000.Crane was subject to a 20% income tax rate for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT