FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

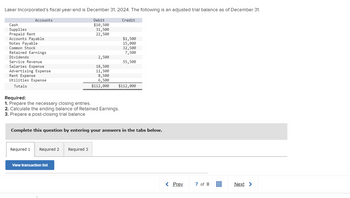

Question

Transcribed Image Text:Laker Incorporated's fiscal year-end is December 31, 2024. The following is an adjusted trial balance as of December 31.

Debit

$10,500

31,500

22,500

Accounts

Cash

Supplies

Prepaid Rent

Accounts Payable

Notes Payable

Common Stock

Retained Earnings

Dividends

Service Revenue

Salaries Expense

Advertising Expense

Rent Expense

Utilities Expense

Totals

2,500

18,500

11,500

Required 1 Required 2 Required 3

8,500

6,500

$112,000

Required:

1. Prepare the necessary closing entries.

2. Calculate the ending balance of Retained Earnings.

3. Prepare a post-closing trial balance

View transaction list

Credit

$1,500

15,000

32,500

7,500

55,500

$112,000

Complete this question by entering your answers in the tabs below.

< Prev

7 of 8

ww

#

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected accounts from Lue Co.'s adjusted trial balance for the year ended December 31 follow. Prepare a classified balance sheet. Total equity. .... .. $30,000 Employee federal income taxes payable $9,000 Equipment.... Salaries payable ... Accounts receivable. Cash ... Current portion of long-term debt Notes payable (due in 6 years) . 40,000 Federal unemployment taxes payable ... .00 . 34,000 FICA–Medicare taxes payable... 5,100 FICA–Social Security taxes payable ... 50,000 Employee medical insurance payable . . 4,000 State unemployment taxes payable . . 10,000 Sales tax payable (due in 2 weeks) . . 725 3,100 .2,000 1,800 ... .... .... ... •. 275arrow_forwardHanshabenarrow_forwardThe following transactions apply to Jova Company for Year 1, the first year of operation: Issued $13,500 of common stock for cash. Recognized $68,500 of service revenue earned on account. Collected $60,800 from accounts receivable. Paid operating expenses of $35,600. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account. The following transactions apply to Jova for Year 2: Recognized $76,000 of service revenue on account. Collected $68,800 from accounts receivable. Determined that $970 of the accounts receivable were uncollectible and wrote them off. Collected $200 of an account that had previously been written off. Paid $49,200 cash for operating expenses. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 1.0…arrow_forward

- The Trial Balance for Jaya Sentrycon at December 31, 2019 are as follows: Account Tittle Trial Balance Dr Cr Cash 45.000 Accounts Receivable 15.000 Roofing Supplies 12.000 Equipment 75.000 Accumulated Depreciation-Equipment 10.000 Accounts Payable 15.000 Unearned Revenue 4.500 Share Capital 87.500 Dividend 8.000 Service Revenue 55.000 Salaries Expense 12.300 Miscellaneous Expense 4.700 Total 172.000 172.000 Other data: 1. Physical counts remains only $ 3.600,- of roofing supplies on hand 2. Depreciations for December 31, 2019 is $ 1.200,- 3. Unearned revenue amounted to $ 900,- at December 31, 2019 4. Accrued salaries are $ 2.550,- 5. Account Receivable has not been recorded $ 3.950,- Instructions: a. Journalize the adjusting entries! b. Enter the trial balance on a worksheet and complete the worksheet! c. Prepare an Income Statement and Retained EarningStatement for the month of December 2019 and the Financial…arrow_forwardDhapaarrow_forwardThe general ledger of Jackrabbit Rentals at January 1, 2021, includes the following account balances: Accounts Debits Credits Cash $ 47,500 Accounts Receivable 31,700 Land 116,800 Accounts Payable 15,900 Notes Payable (due in 2 years) 36,000 Common Stock 106,000 Retained Earnings 38,100 Totals $ 196,000 $ 196,000 The following is a summary of the transactions for the year: 1. January 12 Provide services to customers on account, $68,400. 2. February 25 Provide services to customers for cash, $78,300. 3. March 19 Collect on accounts receivable, $46,300. 4. April 30 Issue shares of common stock in exchange for $36,000 cash. 5. June 16 Purchase supplies on account, $13,300. 6. July 7 Pay on accounts payable, $11,900. 7. September 30 Pay salaries for employee work in the current year, $70,200. 8. November 22…arrow_forward

- DO NOT GIVE SOLUTION IN IMAGEarrow_forwardWell Company paid Being Company for merchandise with a $4,500, 90-day, 10% note dated December 11. What is the financial statement effect to Being Company at the end of the accounting period on December 31? Select one: a. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash InterestReceivable Retained Earnings InterestIncome A) +25 +25 +25 b. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash NotesReceivable NotesPayable Retained Earnings InterestIncome InterestExpense B) +25 -25 c. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash NotesReceivable NotesPayable Retained Earnings InterestIncome InterestExpense C) -25 -25 -25 d. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY…arrow_forwardOn January 1, 2021, Displays Incorporated had the following account balances: Debit 41,000 38,000 44,000 77,000 246,000 Accounts Cash Accounts receivable Supplies Inventory Land Accounts payable Notes payable (5%, due next year) Common stock Retained earnings Totals $ Credit $ 56,000 39,000 205,000 146,000 $ 446,000 $ 446,000 From January 1 to December 31, the following summary transactions occurred: a. Purchased inventory on account for $349,000. b. Sold inventory on account for $665,000. The cost of the inventory sold was $329,000. c. Received $594,000 from customers on accounts receivable. d. Paid freight on inventory received, $43,000. e. Paid $339,000 to inventory suppliers on accounts payable of $347,000. The difference reflects purchase discounts of $8,000. f. Paid rent for the current year, $61,000. The payment was recorded to Rent Expense. g. Paid salaries for the current year, $169,000. The payment was recorded to Salaries Expense. Year-end adjusting entries: a. Supplies on…arrow_forward

- The following transactions apply to Jova Company for Year 1, the first year of operation: Issued $13,500 of common stock for cash. Recognized $68,500 of service revenue earned on account. Collected $60,800 from accounts receivable. Paid operating expenses of $35,600. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account. The following transactions apply to Jova for Year 2: Recognized $76,000 of service revenue on account. Collected $68,800 from accounts receivable. Determined that $970 of the accounts receivable were uncollectible and wrote them off. Collected $200 of an account that had previously been written off. Paid $49,200 cash for operating expenses. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 1.0…arrow_forwardThe general ledger of Jackrabbit Rentals at January 1, 2021, includes the following account balances: Accounts Debits Credits Cash $ 45,500 Accounts Receivable 29,700 Land 114,800 Accounts Payable 15,700 Notes Payable (due in 2 years) 34,000 Common Stock 104,000 Retained Earnings 36,300 Totals $ 190,000 $ 190,000 The following is a summary of the transactions for the year: 1. January 12 Provide services to customers on account, $66,400. 2. February 25 Provide services to customers for cash, $77,300. 3. March 19 Collect on accounts receivable, $46,100. 4. April 30 Issue shares of common stock in exchange for $34,000 cash. 5. June 16 Purchase supplies on account, $12,900. 6. July 7 Pay on accounts payable, $11,700. 7. September 30 Pay salaries for employee work in the current year, $68,200. 8. November 22…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education