FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

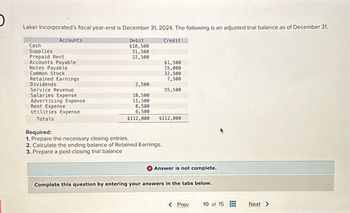

Transcribed Image Text:Laker Incorporated's fiscal year-end is December 31, 2024. The following is an adjusted trial balance as of December 31.

Accounts

Cash

Supplies

Prepaid Rent

Accounts Payable

Notes Payable

Common Stock

Retained Earnings

Dividends

Service Revenue

Salaries Expense

Advertising Expense

Rent Expense

Utilities Expense

Totals

Debit

$10,500

31,500

22,500

2,500

18,500

11,500

8,500

6,500

$112,000

Credit

Required:

1. Prepare the necessary closing entries.

2. Calculate the ending balance of Retained Earnings.

3. Prepare a post-closing trial balance

$1,500

15,000

32,500

7,500

55,500

$112,000

Answer is not complete.

Complete this question by entering your answers in the tabs below.

< Prev

******

10 of 15

‒‒‒

Next >

ant

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rasheed Company uses net method to record the sales made on credit. On June 30, 2019, it made sales of $45,000 with term 2/15, n/45. Prepare the required journal entries, if: On July 22 Rasheed company received full payment.arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) On December 31, a company has outstanding accounts receivable of $69,000, and it estimates that 3% of its receivables will be uncollectible. Prepare the adjusting journal entry at year-end to record bad debts expense if the Allowance for Doubtful Accounts has a: $1,173 credit balance before the adjustment. $345 debit balance before the adjustment.arrow_forwardSpring Garden Flowers had the following balances at December 31, 2024, before the year-end adjustments: E (Click the icon to view the balances.) The aging of accounts receivable yields the following data: E (Click the icon to view the accounts receivable aging schedule.) Requirements Journalize Spring's entry to record bad debts expense for 2024 using the aging-of-receivables method. 1. 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Requirement 1. Journalize Spring's entry to record bad debts expense for 2024 using the aging-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts Debit Credit Dec. 31 Data Table Accounts Receivable Allowance for Bad Debts 66,000 1,615 Requirement 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Allowance for Bad Debts Print Done Data Table Age of Accounts Receivable 0-60 Days Over 60 Days Total…arrow_forward

- Record the following transactions for Concord Co. in the general journal. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) 2020 May 1 Received a $33,000, 12 months, 10% note in exchange for Mark Chamber’s outstanding accounts receivable. Dec. 31 Accrued interest on the Chamber note. Dec. 31 Closed the interest revenue account. 2021 May 1 Received principal plus interest on the Chamber note. (No interest has been accrued in 2021.) Date Account Titles and Explanation Debit Credit May 1, 2020Dec. 31, 2020May 1, 2021 May 1, 2020Dec. 31, 2020May 1, 2021 (To record accrued interest on note.) May 1, 2020Dec. 31, 2020May 1, 2021 (To close the…arrow_forwardDO NOT GIVE SOLUTION IN IMAGEarrow_forwardWhat is the answer in D?arrow_forward

- DO NOT GIVE SOLUTION IN IMAGEarrow_forwardPrepare the journal entries, with appropriate journal entry descriptions, for 2020, including any required year-end adjusting entries.The company prepares annual adjusting entries.arrow_forwardOn January 1, 2022, Sunland Company had Accounts Receivable of $54,800 and Allowance for Doubtful Accounts of $3,800. Sunland Company prepares financial statements annually. During the year, the following selected transactions occurred: Jan. 5 Sold $4,700 of merchandise to Rian Company, terms n/30. Feb. 2 Accepted a $4,700, 4-month, 9% promissory note from Rian Company for balance due. 12 Sold $10,140 of merchandise to Cato Company and accepted Cato’s $10,140, 2-month, 10% note for the balance due. 26 Sold $5,300 of merchandise to Malcolm Co., terms n/10. Apr. 5 Accepted a $5,300, 3-month, 8% note from Malcolm Co. for balance due. 12 Collected Cato Company note in full. June 2 Collected Rian Company note in full. 15 Sold $1,800 of merchandise to Gerri Inc. and accepted a $1,800, 6-month, 11% note for the amount due. Journalize the transactions. (Omit cost of goods sold entries.) (Credit account titles are automatically indented when amount is…arrow_forward

- Required: (a) Prepare journal entries to record the impairment loss of receivable in 2021 under Statement of Financial Position approach. (b) Prepare partial Statement of Financial Positions to show the accounts receivables at 31 December 2021.arrow_forwardGuardian Carpets Incorporated provided the following accounts related to beginning balances in its accounts receivable and allowance accounts for the current year: Accounts Receivable Beginning Balance 6,000,000 Allowance for Uncollectible Accounts 2,000,000 Beginning Balance Question content area top right Part 1 Requirement Prepare the journal entries to record the following transactions that occurred during the current year. Prepare a schedule for both accounts receivable and the allowance for uncollectible accounts that shows the beginning balances, the various items that change the beginning balance, and the ending balance. Question content area bottom Part 1 Prepare the journal entries to record the following transactions that occurred during the current year. (Record debits first, then credits. Exclude explanations from any journal…arrow_forwardAt December 31, 2021, Blossom Company had a credit balance of $19,100 in Allowance for Doubtful Accounts. During 2022, Blossom wrote off accounts totaling $14,500. One of those accounts of $3,400 was later collected. At December 31, 2022, an aging schedule indicated that the balance in Allowance for Doubtful Accounts should be $24,700.Prepare journal entries to record the 2022 transactions of Blossom Company. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title to record amount written off enter a debit amount enter a credit amount enter an account title to record amount written off enter a debit amount enter a credit amount (To record amount written off) enter an account title to reverse write-off enter a debit amount enter a credit amount…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education