Concept explainers

Equivalent Units and Cost per Equivalent Unit—Weighted-Average Method

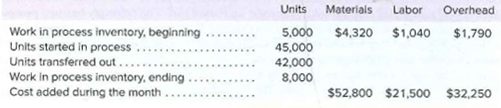

Pureform, Inc., uses the weighted-average method in its

The beginning work in process inventory was 80% complete with respect to materials and 60% complete with respect to labor and

Required:

1. Compute the first department’s equivalent units of production for materials, labor, and overhead for the month.

2. Determine the first department’s cost per equivalent unit for materials, labor, and overhead for the month.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Ansarrow_forward1. For a company that uses process costing, Processing Department C had the following information for the most recent month: Beginning inventory for the month contained 12,000 units that were 30 percent complete with respect to materials. During the month, 80,000 units were completed and transferred out. Ending inventory was 6,000 units, 60 percent complete with respect to materials. What would be the weighted average equivalent units of production for materials for the month? 2. For a company that uses process costing, Processing Department F had the following information for the most recent month: Units Beginning Work-in-Process Inventory (40 percent complete) 5,000 Units started during the month 18,000 Ending Work-in-Process Inventory (10 percent complete) 4,000 Materials and conversion are incurred uniformly throughout the process. What would be the equivalent units of production for conversion when using the weighted average costing method? 3. New Method Company uses a process…arrow_forwardPureform, Incorporated, uses the weighted-average method in its process costing system. It manufactures a product that passes through two departments. Data for a recent month for the first department follow. Units 76,000 Materials $ 68,400 Labor $ 30,200 Overhead $ 41,900 Work in process inventory, beginning Units started in process 719,000 Units transferred out 740,000 Work in process inventory, ending 55,000 Cost added during the month $ 984,725 $ 372,370 $ 517,225 The beginning work in process Inventory was 90% complete with respect to materials and 75% complete with respect to labor and overhead. The ending work in process inventory was 70% complete with respect to materials and 10% complete with respect to labor and overhead. Required: 1. Compute the first department's equivalent units of production for materials, labor, and overhead for the month. 2. Determine the first department's cost per equivalent unit for materials, labor, and overhead for the month. (Round your answers to…arrow_forward

- Question: Ebony Company uses the weighted-average method of process costing to assign production costs to the products. Information for April follows. Assume that all materials are added at the beginning of the production process, and that direct labor and factory overhead are added uniformly throughout the process. Complete a process cost summary using the following sections: Beginning WIP Units completed and transferred Units Material Conversion 5000 50000 100000 20000 250000 500000 Ending WIP 80% complete with 7000 respect to conversion and 100% for materials 1. Costs charged to production 2. Unit cost information 3. Equivalent units of production 4. Cost per Equivalent unit of productionarrow_forwardPureform, Incorporated, uses the weighted-average method of process costing. It manufactures a product passing through two departments. Data for a recent month for the first department follow: Work in process inventory, beginning Units started in process Units transferred out Work in process inventory, ending Cost added during the month Units 66,000 629,000 650,000 45,000 1. Equivalent units of production 2. Cost per equivalent unit Materials $ 54,800 Materials $ 725,300 $ 276,175 The beginning work in process inventory was 70% complete for materials and 55% complete for labor and overhead. The ending work in process inventory was 50% complete for materials and 30% complete for labor and overhead. Required: 1. Compute the first department's equivalent units of production for materials, labor, and overhead for the month. 2. Determine the first department's cost per equivalent unit for materials, labor, and overhead for the month. Note: Round your answers to 2 decimal places. Labor $…arrow_forwardAlpesharrow_forward

- Equivalent Units; Assigning Costs; Cost Reconciliation—Weighted-Average Method Superior Micro Products uses the weighted-average method in its process costing system. During January, the Delta Assembly Department completed its processing of 25,000 units and transferred them to the next department. The cost of beginning work in process inventory and the costs added during January amounted to 5599,780 in total. The ending work in process inventory in January consisted of 3,000 units, which were 80% complete with respect to materials and 60% complete with respect to labor and overhead. The costs per equivalent unit for the month were as follows: Required: 1. Compute the equivalent units of materials, labor, and overhead in the ending work in process inventory for the month. 2. Compute the cost of ending work in process inventory for materials, labor, overhead, and in total for January. 3. Compute the cost of the units transferred to the next department for materials, labor, overhead, and…arrow_forwardPureform, Incorporated, uses the weighted-average method in its process costing system. It manufactures a product that passes through two departments. Data for a recent month for the first department follow: Work in process inventory, beginning Units started in process Units transferred out Work in process inventory, ending Cost added during the month Units 57,000 539,000 560,000 36,000 1. Equivalent units of production 2. Cost per equivalent unit Materials $ 238,370 $ 344,290 The beginning work in process inventory was 75% complete with respect to materials and 60% complete with respect to labor and overhead. The ending work in process inventory was 55% complete with respect to materials and 35% complete with respect to labor and overhead. Materials $ 51,000 Labor Required: 1. Compute the first department's equivalent units of production for materials, labor, and overhead for the month. 2. Determine the first department's cost per equivalent unit for materials, labor, and overhead for…arrow_forwardThe Lakeside Company uses a weighted-average process costing system. The following data are available: Beginning inventory Units started in production Units finished during the period Units in process at the end of the period (complete as to materials, % complete as to labor and overhead) Cost of materials used Labor and overhead costs Total cost of the 16,400 units finished is: -0- 20,800 16,400 4,400 $39,780 $42,000arrow_forward

- Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Required: Using the FIFO method: a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory. d. Determine the cost of units transferred out of the department during the month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent…arrow_forwardDomesticarrow_forwardEasy Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's firs processing department for a recent month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Materials cost Conversion cost Work in process, ending: Units in process Percent complete with respect to materials Percent complete with respect to conversion Required: Using the FIFO method: Complete this question by entering your answers in the tabs below. Req A and B Req C and D $ $ a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory.…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education