ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

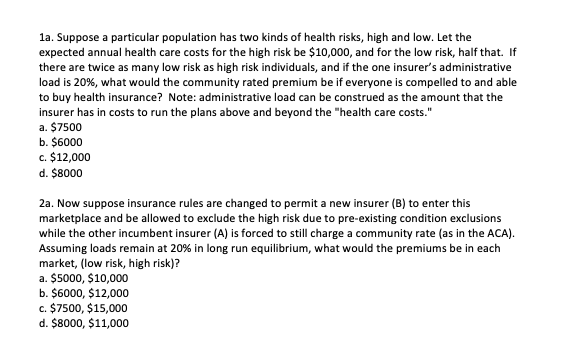

Transcribed Image Text:la. Suppose a particular population has two kinds of health risks, high and low. Let the

expected annual health care costs for the high risk be $10,000, and for the low risk, half that. If

there are twice as many low risk as high risk individuals, and if the one insurer's administrative

load is 20%, what would the community rated premium be if everyone is compelled to and able

to buy health insurance? Note: administrative load can be construed as the amount that the

insurer has in costs to run the plans above and beyond the "health care costs."

a. $7500

b. $6000

c. $12,000

d. $8000

2a. Now suppose insurance rules are changed to permit a new insurer (B) to enter this

marketplace and be allowed to exclude the high risk due to pre-existing condition exclusions

while the other incumbent insurer (A) is forced to still charge a community rate (as in the ACA).

Assuming loads remain at 20% in long run equilibrium, what would the premiums be in each

market, (low risk, high risk)?

a. $5000, $10,000

b. $6000, $12,000

c. $7500, $15,000

d. $8000, $11,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Beatrix Hoffman argues that the influential role of private profit-making companies in the US health care system has historically led to... O Lower costs O Higher costs but a more patient-friendly system O Better health outcomes relative to other wealthy nations O Higher costs and a more fragmented and complex systemarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardWeigh the pros and cons. How would changing Medicaid financing to a block grant or per capita cap be an advantage or disadvantage for millions of low-income children and adult participants?arrow_forward

- Sarah purchased an individual medical expense insurance policy that included a $250 deductible and an 80-20 coinsurance provision. She required medical care and the cost of the care provided was $40,750. How much of this amount must Sarah pay and how much will her insurer pay? How would your answer change if Sarah's policy included a $3,000 out-of- pocket limit that applied to coinsurance payments? . HINT (Coinsurance is calculated after you pay your deductible)arrow_forwardBN7.1 Explain the First Welfare Theorem & why it does not apply to Health Care Markets?arrow_forwardBriefly analyze & discuss the advantages and disadvantages of adopting a single-payer system for a National Health Insurance policy. (Please create a table to compare)arrow_forward

- Suppose consumers consume and gain utility from two types of goods and services – (1) health care and (2) all other goods & services. Using this information, derive the demand curve for health care.arrow_forwardi. i. Distinguish between the medical definition of heath and the economic definition of health. ii. Which definition you like better? Explain.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education