Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

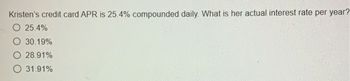

Transcribed Image Text:Kristen’s credit card APR is 25.4% compounded daily. What is her actual interest rate per year?

- 25.4%

- 30.19%

- 28.91%

- 31.91%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate the interest and total amount to be paid for each of the following. Pay attention to the term, sometimes people take out loans that do not equal a whole year. Total loan amount to be paid Loan Total Interest to be paid Princi Interest pal Name Total Total rate Interest Interest term (in per year per month months Johanna 4550 5.5% 24 Martin 7240 6.5% 36 Sonia 5000 7% 17 Ferdy 8500 3.5% Dave 950 8.5% Liz 11400 7.45% 9 Jermaine 12500 5.5% 24 Rudy 22600 3% 22 Nora 15400 6.5% 20 Nilliam 4800 4.75% 32arrow_forwardWould love the help. 11arrow_forwardFind the interest on a loan of $3300 at 7% if I borrow on April 7 and repay on June 2 using the following THREE time methods: Exact Time, Ordinary Time, AND Banker's Timearrow_forward

- Suppose Jorge Otero has set up an annuity due with a certain credit union. At the beginning of each month, $130 is electronically debited from his checking account and placed into a savings account earning 6% interest compounded monthly. What is the value (in $) of Jorge's account after 17 months? (Round your answer to the nearest cent.)arrow_forwardam. 111.arrow_forwardnarubhaiarrow_forward

- Yogesharrow_forwardOn March 24, 2014, Brendan and Madison borrow $18,000 each at a simple interest rate r = Brendan's bank calculates interest using exact 12%. interest, while Madison's bank uses the Banker's Rule (ordinary interest). Let X = amount Brendan pays back on September 24, 2014, and Y = amount Madison pays back on September 24, 2014. What is the value of X - Y?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education