FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:K

Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the Mini Mochi Munch.

Kokomochi plans to spend $5.4 million on TV, radio, and print advertising this year for the campaign. The ads are

expected to boost sales of the Mini Mochi Munch by $9.3 million this year and $7.3 million next year. In addition, the

company expects that new consumers who try the Mini Mochi Munch will be more likely to try Kokomochi's other

products. As a result, sales of other products are expected to rise by $1.7 million each year.

Kokomochi's gross profit margin for the Mini Mochi Munch is 36%, and its gross profit margin averages 24% for all

other products. The company's marginal corporate tax rate is 21% both this year and next year. What are the

incremental earnings associated with the advertising campaign?

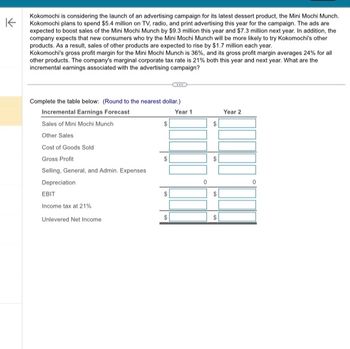

Complete the table below: (Round to the nearest dollar.)

Incremental Earnings Forecast

Year 1

Sales of Mini Mochi Munch

Other Sales

Cost of Goods Sold

Gross Profit

Selling, General, and Admin. Expenses

Depreciation

EBIT

Income tax at 21%

Unlevered Net Income

$

$

$

$

0

$

$

$

Year 2

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bubbly Waters currently sells 440 Class A spas, 590 Class spas, and 340 deluxe modeſ spas each year. The firm is considering adding a mid-class spa and expects that if it does, it can sell 515 units per year. However, the new spa is added, Class A sales are expected to decline to 295 units while the Class C sales are expected to increase to 615. The sales of the deluxe model will not be affected. Class A spas sell for an average of $14,700 each. Class C spas are priced at $7,400 and the deluxe models sell for $18,400 each. The new mid-range spa sell for $9,400. What annual sales figure should you use in your analysis?arrow_forwardPhil’s is a sit-down restaurant that specializes in home-cooked meals. Theresa’s is a walk-in deli that specializes in speciality soups and sandwiches. Both firms are currently considering expanding their operations during the summer months by offering pre-wrapped doughnuts, sandwiches, and wraps at a local beach. Phil’s currently has a WACC of 14% while Theresa’s WACC is 10%. The expansion project has a projected net present value of £12,600 at a 10% discount rate and a net present value of -£2,080 at a 14% discount rate. Theresa’s belongs to Harvester, which has expected earnings before interest and tax (EBIT) of £45,000 in perpetuity and a tax rate of 30%. Harvester has £60,000 in outstanding debt at an interest rate of 8%. The unlevered cost of capital is 12. 1. What is the value of Harvester according to Modigliani and Miller Proposition I with taxes? 2. Should Harvester change its debt-equity ratio if the goal is to maximize the value of the firm? Why?arrow_forwardIn the coming year, Concord, Inc. will be introducing its first product, a wrist brace that protects serious video gamers from repetitive- motion injuries. The brace will be sold for $13.00 to retailers throughout the country. All sales will be made on account. An expected 65% of sales will be collected within the quarter of the sale, and another 30% in the quarter following the sale. The remaining 5% of credit sales are expected to be uncollectible. The sales budget for the coming year is as follows: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Budgeted sales units 29,000 41,000 57,000 77,000 Prepare Concord, Inc's cash receipts budget for the coming year. (Enter answers in necessary fields only. Leave other fields blank. Do not enter 0. Round "Budgeted sale price" and "Cash Receipts Budgets" answers to 2 decimal places, eg. 52.75 and all other answers to 0 decimal places, e.g. 5,275.)arrow_forward

- Bliss Bar is a company that sells deluxe chocolate and candy bars based in Illinois. The company is considering launching a new product line featuring protein bars coated with their deluxe chocolate flavors. Bliss Bar has spent $75,000 developing a new protein bar line as a part of the company’s product diversification plan. It also spent another $40,000 for market research on flavors to produce. Based on market research, Bliss Bar expects first year sales of 1,200,000 protein bars at a price of $2.45 per unit with an expected annual growth of 3% in sales volume each year of the six-year project. The variable costs per unit are $0.80, and the annual fixed costs are $30,000. Bliss Bar estimates that the net working capital will be 8% of next year’s sales. The launch of this new product line is expected to cannibalize the sales of an existing candy bar, Choco-O! by 10,000 units per year. Choco-O! is sold at a price of $2 per unit and has variable costs of $0.50 per unit. To expand…arrow_forwardWith the growing popularity of casual surf print clothing, two recent MBA graduates decided to broaden this casual surf concept to encompass a “surf lifestyle for the home.” With limited capital, they decided to focus on surf print table and floor lamps to accent people’s homes. They projected unit sales of these lamps to be 11,500 in the first year, with growth of 8 percent each year for the next five years. Production of these lamps will require $75,000 in net working capital to start. Total fixed costs are $170,000 per year, variable production costs are $21 per unit, and the units are priced at $66 each. The equipment needed to begin production will cost $650,000. The equipment will be depreciated using the straight-line method over a 5-year life and is not expected to have a salvage value. The tax rate is 25 percent and the required rate of return is 18 percent. What is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places,…arrow_forwardK Pisa Pizza, a seller of frozen pizza, is considering introducing a healthier version of its pizza that will be low in cholesterol and contain no trans fats. The firm expects that sales of the new pizza will be $24 million per year. While many of these sales will be to new customers, Pisa Pizza estimates that 30% will come from customers who switch to the new, healthier pizza instead of buying the original version. a. Assume customers will spend the same amount on either version. What level of incremental sales is associated with introducing the new pizza? b. Suppose that 40% of the customers who will switch from Pisa Pizza's original pizza to its healthier pizza will switch to another brand if Pisa Pizza does not introduce a healthier pizza. What level of incremental sales is associated with introducing the new pizza in this case? a. Assume customers will spend the same amount on either version. What level of incremental sales is associated with introducing the new pizza? The…arrow_forward

- Winnebagel Corporation currently sells 33,000 motor homes per year at $71,000 each, and 13,500 luxury motor coaches per year at $108,000 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 28,000 of these campers per year at $15,500 each. An independent consultant has determined that if Winnebagel introduces the new campers, it should boost the sales of its existing motor homes by 2,400 units per year and reduce the sales of its motor coaches by 1,100 units per year. What is the amount to use as the annual sales figure when evaluating this project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) Annual salesarrow_forwardCoronado Enterprises is a boutique guitar manufacturer. The company produces both acoustic and electric guitars for rising and established professional musicians. Sharon Lee, the company’s sales manager, prepared the following sales forecast for 2022. The forecasted sales prices include a 5% increase in the acoustic guitar price and a 10% increase in the electric guitar price, to cover anticipated increases in raw materials prices. Sales Price 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Acoustic guitar sales $1,250 240 270 310 340 Electric guitar sales $2,100 400 350 320 360 On December 31, 2021, Coronado had 30 acoustic guitars in stock—fewer than the desired inventory level of 96 guitars, based on the following quarter’s sales. The company has budgeted for sales of 240 acoustic guitars in the first quarter of 2023. Prepare the 2022 production budget for acoustic guitars. Production…arrow_forwardKk.421.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education