FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:**Educational Website Transcription:**

---

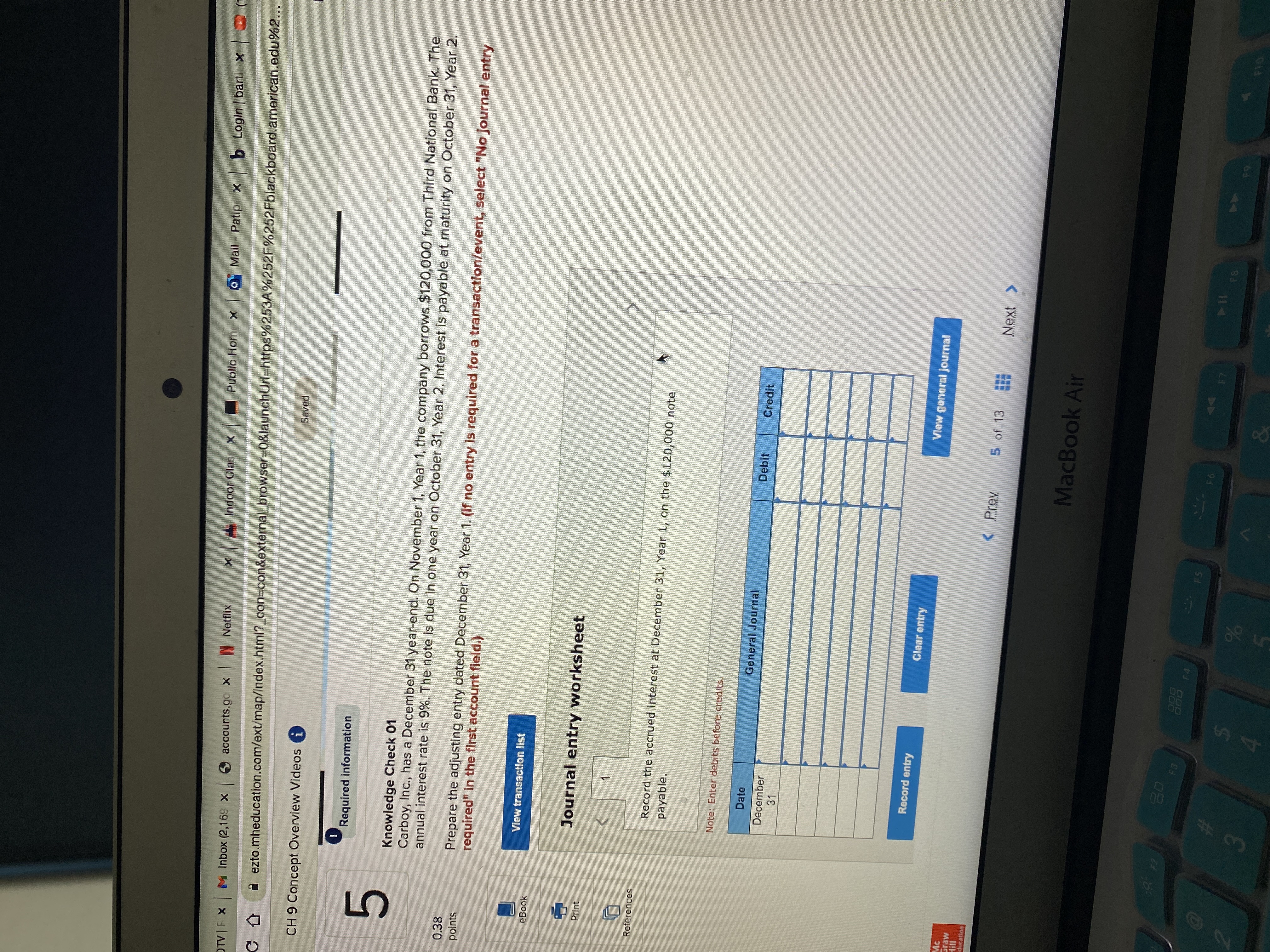

## Accounting Exercise: Adjusting Journal Entries

### Knowledge Check 01

Carboy, Inc. has a December 31 year-end. On November 1, Year 1, the company borrows $120,000 from Third National Bank. The annual interest rate is 9%. The note is due in one year on October 31, Year 2. Interest is payable at maturity on October 31, Year 2.

**Task:** Prepare the adjusting entry dated December 31, Year 1.

**Instruction:** If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

### Journal Entry Worksheet

**Requirement:** Record the accrued interest at December 31, Year 1, on the $120,000 note payable.

**Note:** Enter debits before credits.

#### Journal Entry Table

| Date | General Journal | Debit | Credit |

|------------|------------------------|-------|--------|

| December 31| | | |

**Buttons:**

- **Record entry**

- **Clear entry**

- **View general journal**

**Navigation:**

- Page 5 of 13

---

This exercise focuses on calculating and recording accrued interest in an accounting context. It emphasizes the importance of proper year-end adjustments in accurate financial reporting.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On August 1, 2021, Avonette, Inc., sold equipment and accepted a six-month, 9%, $50,000 note receivable. Avonette's year-end is December 31. Which of the following accounts will Avonette credit in the journal entry at maturity on February 1, 2022, assuming collection in full? O A. Interest Receivable B. Cash OC. Interest Payable O D. Note Payablearrow_forwardRequirement 4. Record the payment of the note payable (principal and interest) on its maturity date. (Record debits first, then credits. Exclude explanations from journal entries.) ss attached thanks 4y1 4arrow_forwardBramble Corp. lends Sheffield Corp. $50400 on April 1, accepting a four-month, 9% interest note. Bramble Corp. prepares financial statements on April 30. What adjusting entry should be made before the financial statements can be prepared? O Interest Receivable 378 Interest Revenue 378 Interest Revenue 80 Cash Note Receivable Cash Interest Receivable Interest Revenue Type here to search 378 50400 1134 S 378 50400 1134 17arrow_forward

- nces On 1 October 20X6, Halpern Co borrowed $180,000 from Canada Bank The note has a two-year term, and requires that interest of 9% be paid each 30 September, with the principal payable 30 September 20X8 Required: Provide all entries for the note from 20X6 to 20X8 (If no entry is required for a transaction/event. select "No journal entry required" in the first account field.) View transaction list 1 Record the borrowings from Canada Bank. 2 Record the accrual of intest for the period ending 31st December 20x6. a Record the interest payment on 30 September 20x7. 4 Record the accrual of interest for the period ending 31st December 20X7 5 Record the interest payment on 30 September 20X8. Record the repayment of borrowings to Canada Bank 6 Note: journal entry has been entered Record entry Clear entry EX - - 2 Credit View gener al journalarrow_forwardProblem: ABC Company issued a promissory note to RCBC Bank. Details from the promissory note are as follows: Date of note: November 1, 2020 Term of note: 180 days Principal: P120,000 Interest rate: 12% Determine the following: 1. What is the account to be credited on the adjusting entry on December 31, 2020? 2. How much is the amount to be credited on December 31, 2020? 3. How much is the total interest expense for the full term of the note.arrow_forward< Entries for discounted note payable A business issued a 60-day note for $39,000 to a bank. The note was discounted at 6%. Assume a 360 days in a year. a. Journalize the entry to record the issuance of the note. If an amount box does not require an entry, leave it blank. If necessary, round your answers to one decimal place. 000 000 b. Journalize the entry to record the payment of the note at maturity. If an amount box does not require an entry, leave it blank. E A Aarrow_forward

- Entries for Notes Payable Laughlin Enterprises issues a $130,000, 45-day, 6% note to Morrison Industries for merchandise inventory. Assume a 360-day year. If an amount box does not require an entry, leave it blank. a. Journalize Laughlin Enterprises’ entries to record: the issuance of the note. the payment of the note at maturity. 1. fill in the blank 64677a0a8f9b073_2 fill in the blank 64677a0a8f9b073_3 fill in the blank 64677a0a8f9b073_5 fill in the blank 64677a0a8f9b073_6 2. fill in the blank 64677a0a8f9b073_8 fill in the blank 64677a0a8f9b073_9 fill in the blank 64677a0a8f9b073_11 fill in the blank 64677a0a8f9b073_12 fill in the blank 64677a0a8f9b073_14 fill in the blank 64677a0a8f9b073_15 b. Journalize Morrison Industries’ entries to record: the receipt of the note. the receipt of the payment of the note at maturity. 1. fill in the blank 9616b40e100d004_2 fill in the blank 9616b40e100d004_3 fill in the blank…arrow_forwardJournalize the following, assuming a 360-day year is used for interest computations: Apr. 30 Issued a $1,080,000, 120-day, 9% note dated April 30 to Misner Co. on account. Paid Misner Co. the amount owed on the note dated April 30. Aug. 30 If an amount box does not require an entry, leave it blank. Apr. 30 Aug. 30arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education