FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Can you show me step by step how you got the number of outstanding shares and the total paid in capital

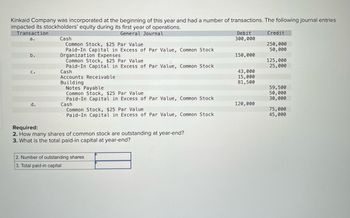

Transcribed Image Text:**Kinkaid Company: Stockholders' Equity Transactions in the First Year**

Kinkaid Company was incorporated at the beginning of this year and had several transactions affecting its stockholders' equity during the first year of operations. Below are the journal entries that recorded these transactions.

**Journal Entries:**

| Transaction | General Journal | Debit | Credit |

|-------------|---------------------------------------------|-----------|-----------|

| a. | Cash | 300,000 | |

| | Common Stock, $25 Par Value | | 250,000 |

| | Paid-In Capital in Excess of Par Value, Common Stock | | 50,000 |

| b. | Organization Expenses | 150,000 | |

| | Common Stock, $25 Par Value | | 125,000 |

| | Paid-In Capital in Excess of Par Value, Common Stock | | 25,000 |

| c. | Cash | 43,000 | |

| | Accounts Receivable | 15,000 | |

| | Building | 81,500 | |

| | Notes Payable | | 59,500 |

| | Common Stock, $25 Par Value | | 50,000 |

| | Paid-In Capital in Excess of Par Value, Common Stock | | 30,000 |

| d. | Cash | 120,000 | |

| | Common Stock, $25 Par Value | | 75,000 |

| | Paid-In Capital in Excess of Par Value, Common Stock | | 45,000 |

**Required:**

Based on the journal entries, answer the following questions.

2. How many shares of common stock are outstanding at year-end?

3. What is the total paid-in capital at year-end?

**Answers:**

| 2. Number of outstanding shares | _______________ |

| 3. Total paid-in capital | _______________ |

**Analysis Diagram:**

The table above records the financial transactions involving common stock issuance and the additional paid-in capital. Each entry depicts resources received (debit) against the issuance of stock and the additional paid-in capital (credit).

- **Transaction a:** Issuance of 10,000 shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The declaration of a stock dividend will * increase paid-in capital. change the total of stockholders' equity. increase total liabilities. increase total assets.arrow_forwardIn calculating earnings per share, a company uses the treasury stock method when a. it recognizes the assumed impact of exercising outstanding warrants. b. it develops a methodology to handle the premium paid on exercised share options. c. it needs to value the cash received for a convertible bond. d. it needs to value treasury stock repurchased during the year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education