FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Using the information from below make a statement of

Transcribed Image Text:KINGPIN COMPANY

INCOME STATEMENT

YEAR ENDED 12/31/20

Sales

$300,000

Cost of Goods Sold

-150,000

Gross Profi

$150,000

OPERATING EXPENSES:

Depreciation Expense

15,100

Other Expenses

92,000

TOTAL OPERATING EXPENSES

107,100

OPERATING INCOME

$42,900

Other Gains (Losses)

Gain on Sale of Equipment

1,200

INCOME BEFORE TAXES

$44,100

Income Tax Expense

-13,230

NET INCOME

$30,870

ADDITIONAL INFORMATION ON YEAR 2020

TRANSACTIONS:

(1) Sold equipment for $14,625.

(2) Purchased equipment costing $36,000 paying $10,000 cash and signing a long-term Note Payable

for $26,000.

(3) Paid $13,500 to reduce the long-term Notes

Payable

(4) Borrowed $2,000 by signing a short-term Notes

Payable

(5) Declared and Paid Cash Dividends of $20,000

(6) Issued 1,000 shares of Common Stock for $12 per

share.

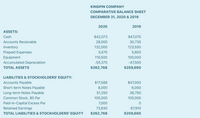

Transcribed Image Text:KINGPIN COMPANY

COMPARATIVE BALANCE SHEET

DECEMBER 31, 2020 & 2019

2020

2019

ASSETS:

Cash

$42,073

$47,075

Accounts Receivable

28,000

30,735

Inventory

132,000

123,550

Prepaid Expenses

5,570

5,800

Equipment

110,500

100,000

Accumulated Depreciation

-55,375

-47,500

TOTAL ASSETS

$262,768

$259,660

LIABILITIES & STOCKHOLDERS' EQUITY:

$17,588

$47,000

Accounts Payable

Short-term Notes Payable

8,000

6,000

Long-term Notes Payable

Common Stock, $5 Par

51,250

38,750

105,000

100,000

Paid-In-Capital Excess Par

7,000

Retained Earnings

73,930

67,910

TOTAL LIABILITIES & STOCKHOLDERS' EQUITY

$262,768

$259,660

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How would I input the formulas into excel to get those numbers for the statement of cash flowsarrow_forwardplease determine the rate of return of the cash flows shown in the table below. Year 0 1 2 3 4 Cash flow -3,000 1,000 900 900 900arrow_forwardWhat is Target’s balance of cash equivalents for the fiscal year ended January 30,2016?arrow_forward

- When using the indirect method of determining net cash flows from operating activities, how are revenues and expenses reported on the statement of cash flows if their cash effects are identical to the amounts reported in the income statement?arrow_forwardthere are 2 categories of cash flows: single cash flows, referred to as "lump sums," and annuities. based on your understanding of annuities, answer the following questions:arrow_forwardHow do you take the present value of a stream of cash flows. How does it work for annual payments, weekly payments, quarterly payments, and monthly payments? Provide examples of eacharrow_forward

- What accounts on the balance sheet must be evaluated when completing the financing activities section of the statement of cash flows?arrow_forwardPlease explain how to prepare a statement of cash flows (indirect method) including analyzing tables? Please provide an example. Thank you,arrow_forwardWhich of the following activities caused the greatest change in cash during the year? HINTS: You can find the breakdown of these activities on the Statements of Cash Flows. Multiple Choice O Operating activities Investing activities Financing activitiesarrow_forward

- Activity reported in the Financing Activities section of the statement of cash flows would include accounts classified as a.current assets and current liabilities. b.long-term assets and long-term liabilities. c.long-term liabilities and stockholders' equity. d.current liabilities and stockholders' equity.arrow_forwardDescribe the two formats for reporting operating activities on the statement of cash flows.arrow_forwardCan you please write the calculations step by step including the formulas. How did you calculate the Cash flow in order to calculate the cumulative cash flow after that?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education